AML Solutions for Neobanks Address Compliance With Technology, Not Headcount

The Challenge Keeping Neobank Compliance Teams Up at Night

You’re starting to feel the impact of your innovation and success. Your transaction count is growing and changing consumer behavior means your compliance team is under pressure from a mountain of false-positive alerts. You don’t have the correct processes in place to remain at peak efficiency, and previous neobank fines have you worried about how negative press might impact your customers and investors.

Compliance is too complicated to outsource your headcount to cost-effective regions, and the traditional banking experts keep recommending systems that have proven to be inefficient and ineffective.

You need industry experts who understand the modern fintech landscape and build effective systems with the latest AI, cloud and API technology. You’re building the bank of the future and need a partner who understands that journey.

Our AI-powered AML for Neobanks is:

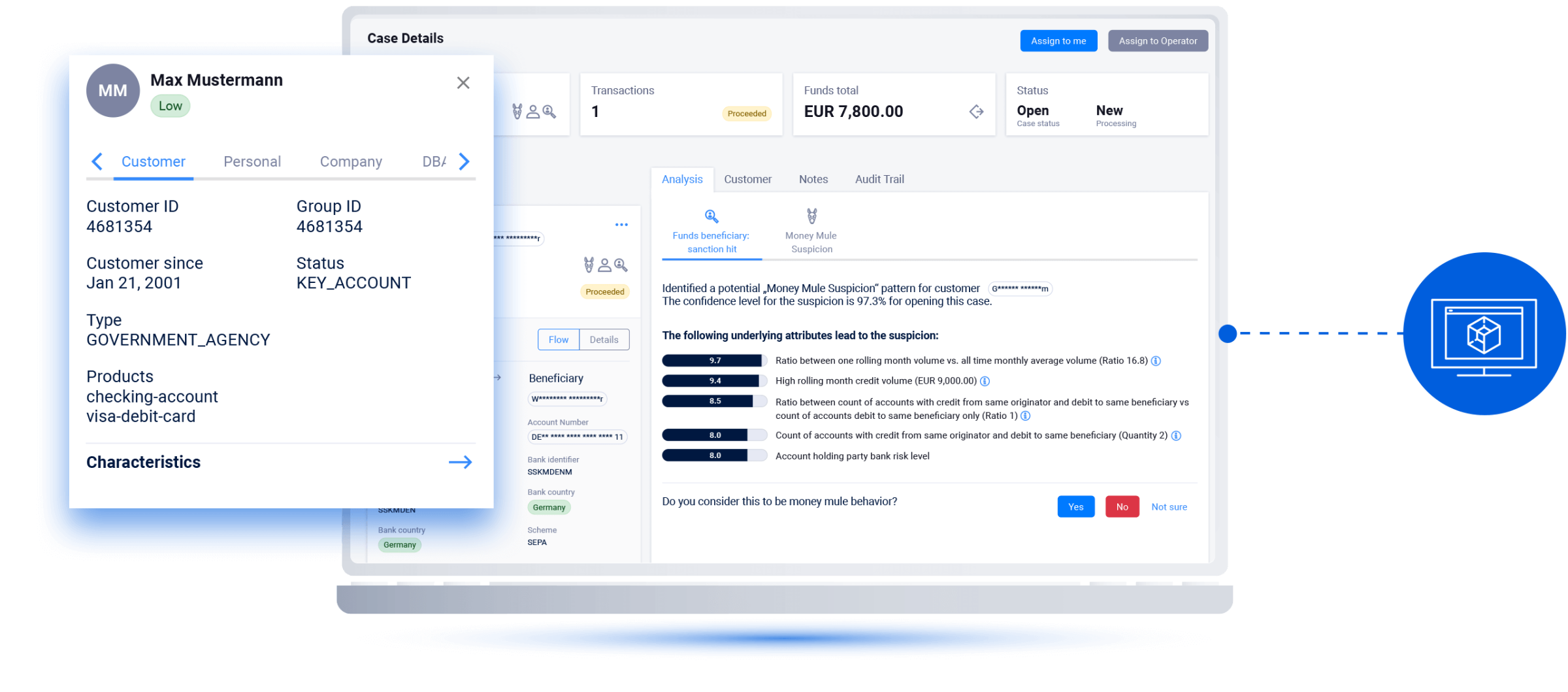

- Efficient - reduce false positives by over 70% to prevent increased compliance headcount

- Effective - spot anomalies and detect unknown crime patterns before they become common

- Explainable - all stakeholders, from frontline compliance officers through to your regulators understand and trust our results

The Key Considerations for Neobanks Looking for AML Solutions

HAWK:AI offers deep compliance experience, combined with modern technology using the latest cloud, AI and development principles to significantly reduce your manual overhead. Compliance is complex, but it doesn’t need to be inefficient and ineffective.

- A unified process with a streamlined user interface allows your teams to work effectively

- Regulatory scrutiny means you need to grow sustainably without stifling innovation

- You have a modern tech stack and need partners who build with AI and Cloud principles first

AML Transaction Monitoring for Neobanks

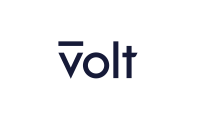

Monitor any transaction for red flags using a comprehensive set of rules in combination with Behavioral Analytics.

Sponsoring banks and regulators have an eye on your business, give them the confidence that your transaction monitoring is comprehensive and world-class.

Key benefits of AML Transaction Monitoring for Neobanks:

- Detect suspicion using rules, combined with AI

- Dramatically reduce false positives with artificial intelligence

- Detect unknown crime patterns before they become rampant

- Prepare for the information sharing future of anti-money laundering

- Reduce time per case with a centralized interface

AML Payment Screening for Neobanks

Screen customers and counterparties against Sanctions and country lists.

- A modular solution that you can adopt as your needs change, in a unified interface to boost efficiency

- Fight false positives with artificial intelligence in a transparent and auditable manner

- Reduce time per case with a centralized interface, augmenting streamlined manpower with automation

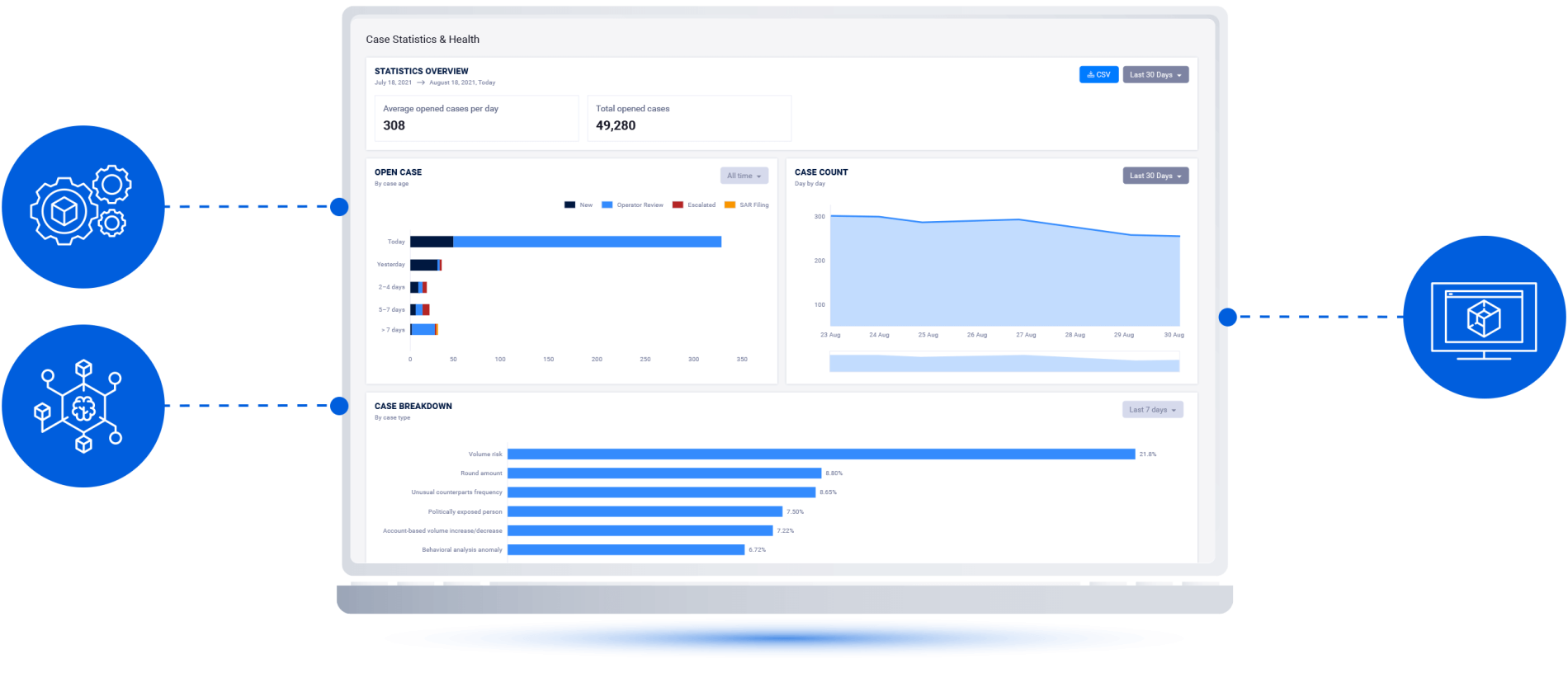

Continuously Assess Customer Risk Based on Flexible Scoring Across Multiple Data Points

Discover the risk rating of each of your clients in a clear and transparent manner. Neobanks and other fintechs can now dynamically score customer risk using internal and external data, or add behavioral analytics for richer context.

Screening customers as well as their transactions, whether during onboarding or thereafter, is vital to remain compliant with regulations.

Key benefits include:

- Combine static and dynamic data to form your own risk rating

- Reduce time per case with an integrated interface

- Self-service, no code configuration

Built in Germany With Deep Industry Knowledge

Effective

AI helps your experts spot anomalies and detect unknown crime patterns

Efficient

70% false positive reduction – your team can focus on priority tasks

Explainable

All stakeholders can easily understand and trust our system's results

Easy To Deploy

Built with deployment options that can be customized to your needs

Preparing for Growth – NAB Addresses AML Regulations With HAWK:AI’s Speed and Scalability

“We tested and benchmarked many different systems in the marketplace and found Hawk AI to be a clear technology leader. In the payment processing business, you need flexibility, speed, and the ability to scale. The Hawk AI system delivers all those things. Their team has built leading-edge technology and applies a balanced approach between rules and AI.”

– Jim Parkinson, Chief Experience Officer, North American Bancard

Don’t Fall Into the Legacy Banking Trap of Throwing Headcount at Your Compliance Problems, Set Some Time To Discuss With HAWK:AI Today.

Further Solutions

Transaction Monitoring

Monitor any transaction for red flags using a comprehensive set of rules in combination with Behavioral Analytics.

Customer Screening

Screen customers against Sanctions, PEP, watchlists, and adverse media during onboarding and thereafter.

Customer Risk Rating

Dynamically score customer risk using internal and external data. Add behavioral analytics for richer context.

Payment Screening

Screen counterparties against Sanctions and Country lists in real-time. Cleanse data and tune name-matching.