Transaction Fraud Protect customers in real-time with AI-powered precision

Stop more fraudsters with less customer friction & full control

Stop suspicious transactions in true real-time (150 ms average)

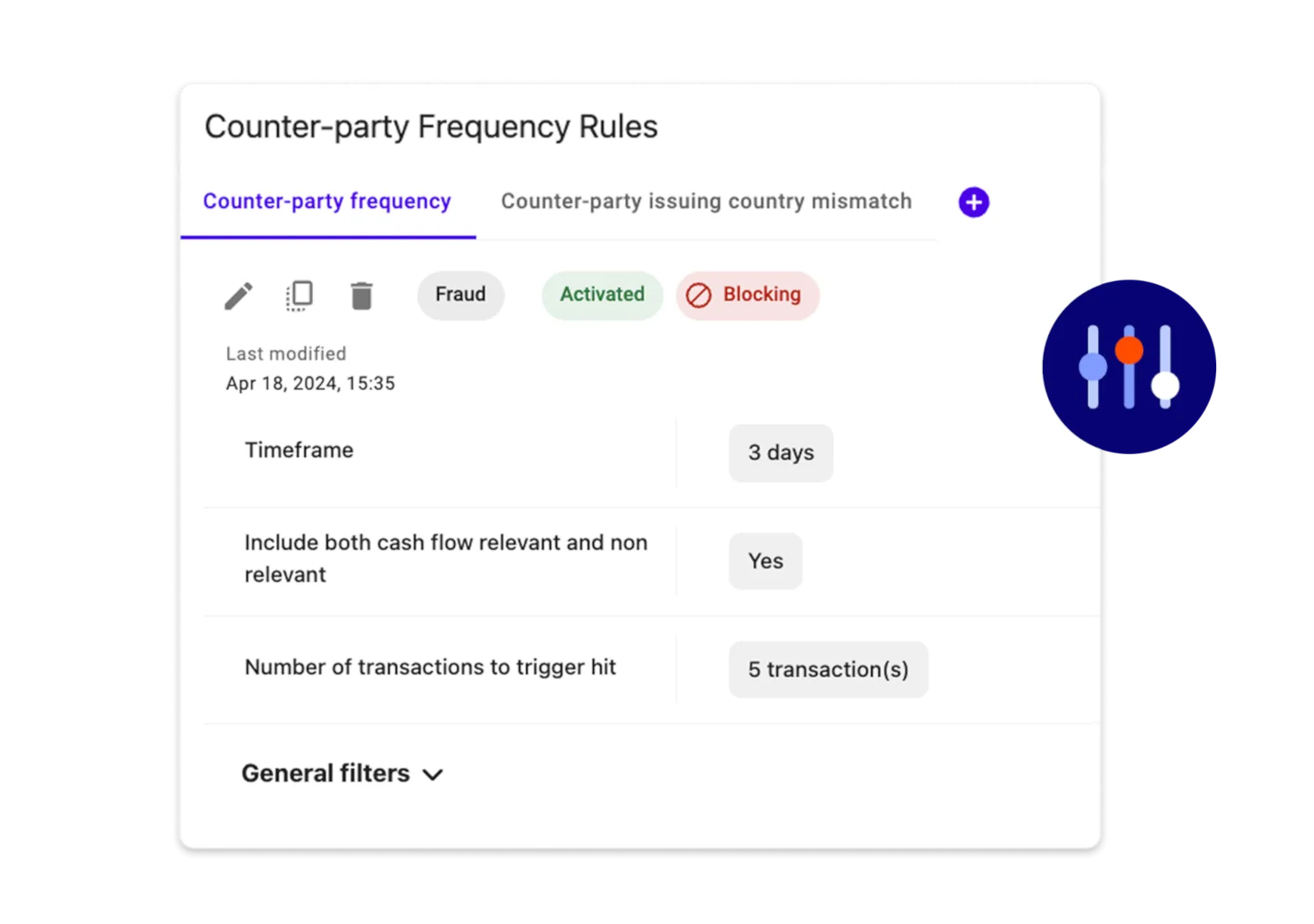

Block threats quickly with self-serve rule configuration and out-of-the-box rule guidance

Reduce false positives and uncover novel fraud patterns with explainable AI

Prevent losses across any payment rail, incl. card, ACH, real-time payments, and check

Pinpoint threats unique to your business

Cover every threat vector, from known, high-impact threats to new, emerging behaviors with Hawk’s library of AI models, complete with built-in model governance.

Day one defense models deliver fast, personalized protection, with typology-specific model blueprints tailored and ready within three days of initial solution deployment. Custom AI models further reduce false positives and find novel risk.

Address risks at speed

Misleading vendor “real-time” claims and reliance on external support for rule management let fraudulent transactions slip through.

With Hawk, you can stop suspicious transactions in true real-time (150 ms average) and optimize fast with self-serve rule configuration and sandbox testing.

Easily tailor your risk coverage for established fraud typologies using Hawk’s out-of-the-box rule guidance and day one defense models for rapid and effective protection from day one.

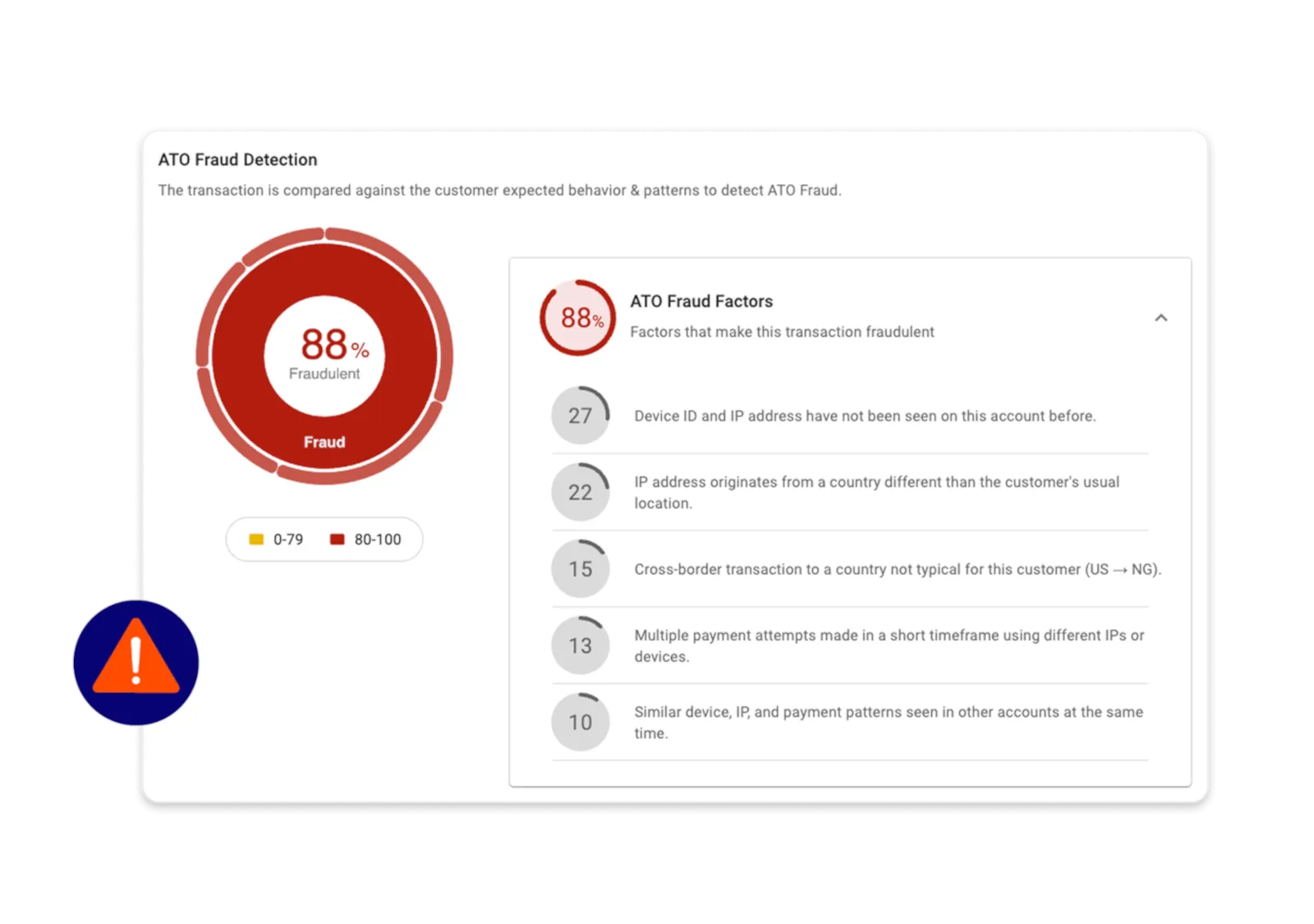

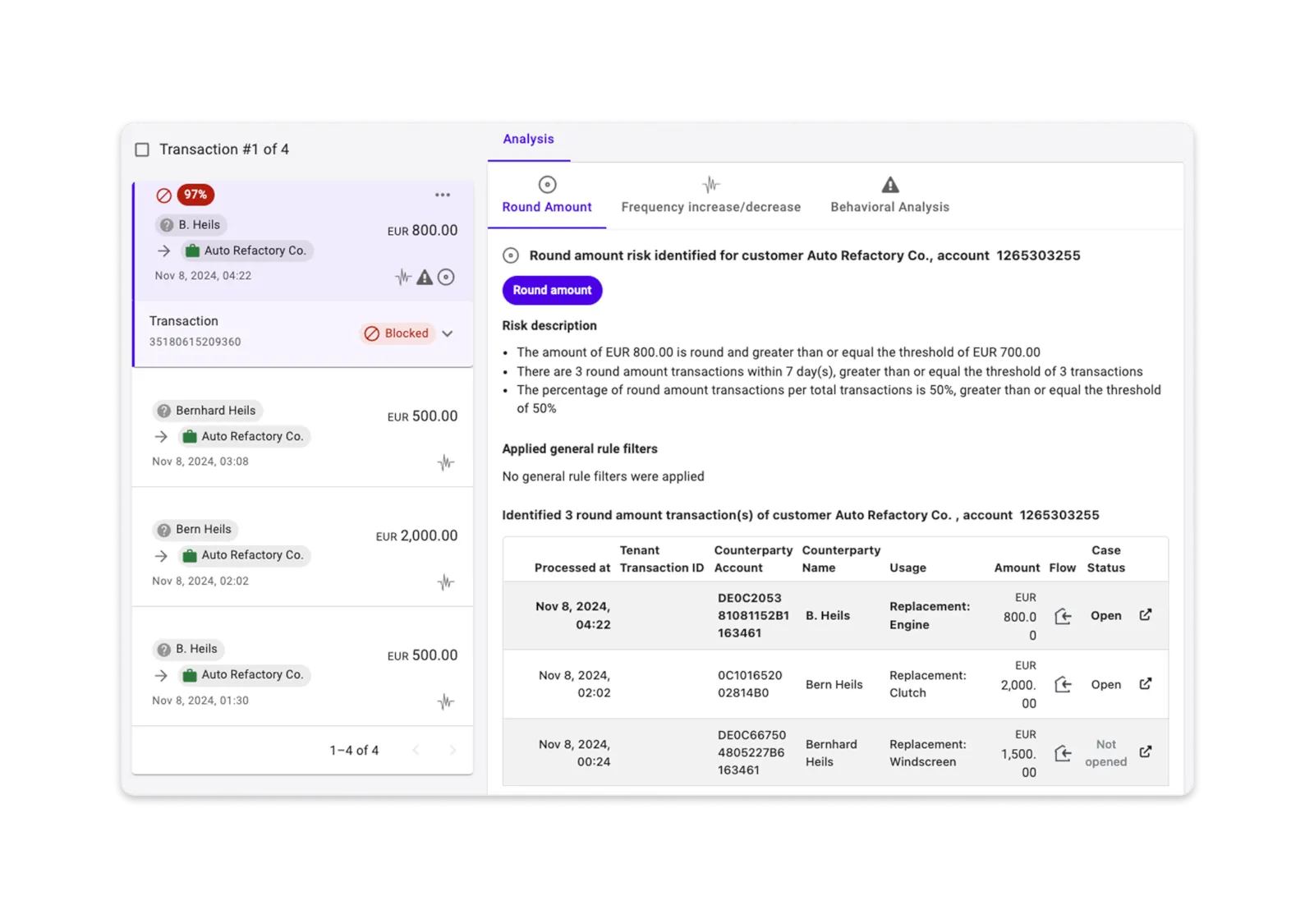

Understand the why behind every alert

Holding suspicious payments too long creates unnecessary delays for customers. Many AI models provide vague or no reasoning, which slows down alert review.

Hawk’s clear explanations provide context on why the risk was flagged, speeding up alert review. Fraud teams can make quick, confident decisions and release payments effortlessly through Hawk’s user-friendly platform.

Transaction Fraud Defenses Built for Speed & Control

✔️ True real-time fraud prevention (150 ms average)

✔️ Support for all payment rails with rail-agnostic API

✔️ Out-of-the-box rule guidance including advance fee fraud, check fraud, ATM fraud, investment scams, ACH fraud, card fraud, and more

✔️ Self-serve rule management and configuration

✔️ Payment interdiction that allows you to block, hold, and release transactions

✔️ Frictionless alerting and case management

✔️ Automatic AI model governance

✔️ Multi-tenant structure

✔️ Scalable data infrastructure

Fraud Strikes Fast and So Can You

Stop more fraudsters and reduce customer friction today with flexible fraud defense