Benchmark Study The State of Fraud and Financial Crime in the US 2023

"The State of Fraud and Financial Crime in the US 2023" was produced by PYMNTS in collaboration with Hawk AI. PYMNTS retains full editorial control over the following findings, methodology and data analysis.

Key Findings

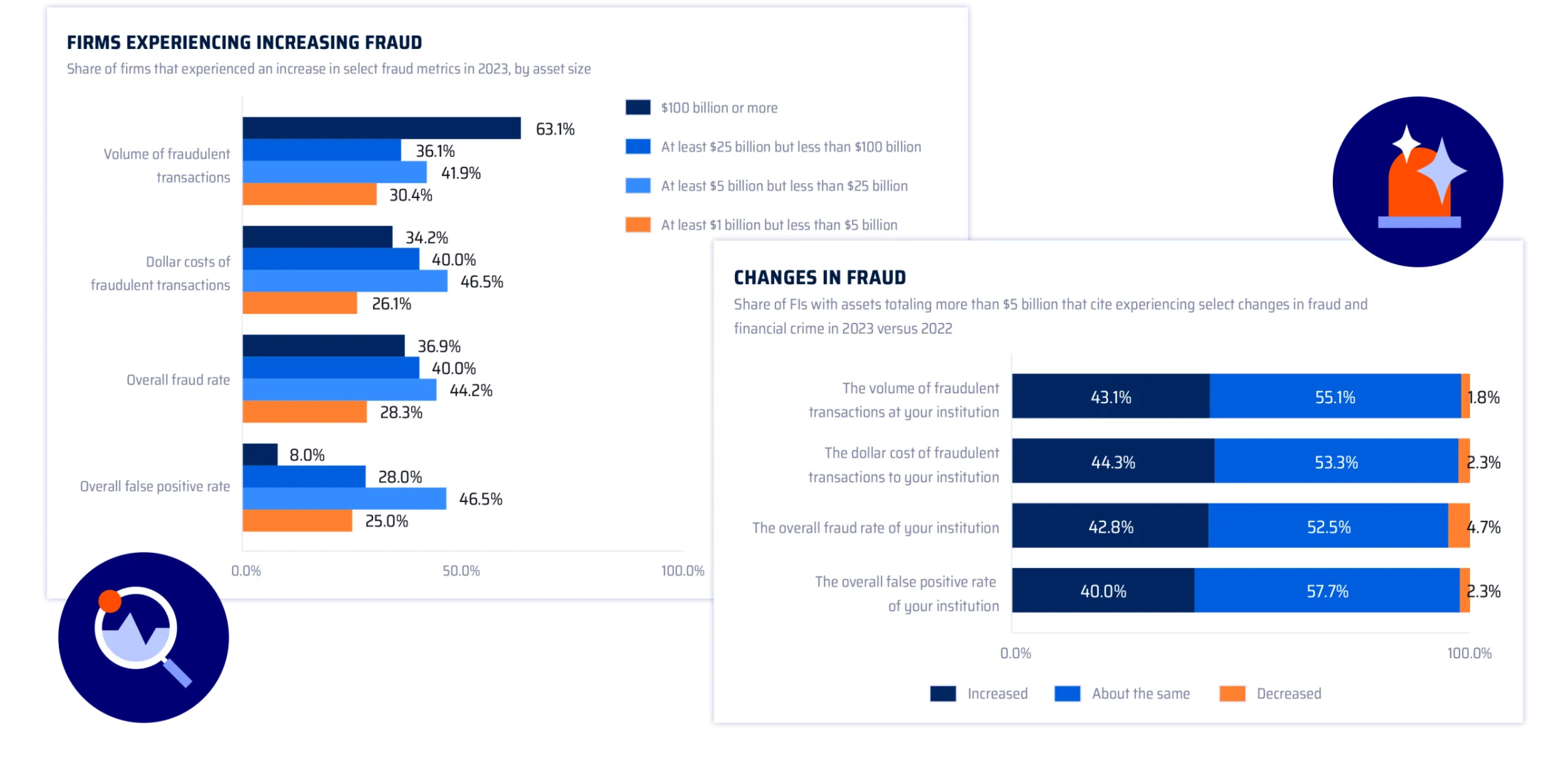

More than 40% of banks in the U.S. experienced an increase in fraud relative to 2022; fraud losses increasing by about 65%.

Account information misuse is still the leading type of fraud, average scam fraud losses were nearly half a million dollars

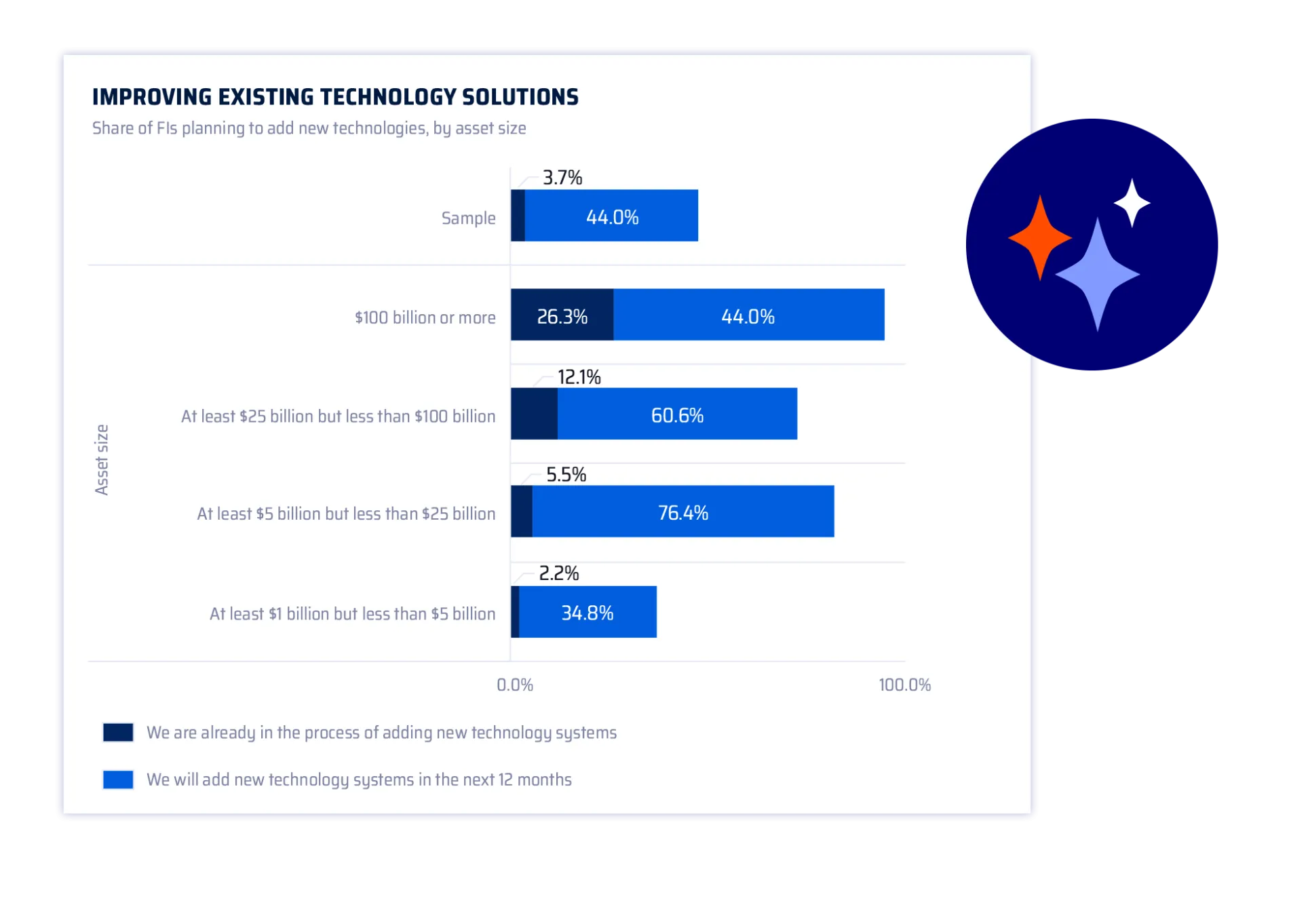

FIs have invested in ML and AI to address the increase in fraud, yet smaller FIs still lag in adoption.

Most FIs are already adding or will add ML and AI technologies to combat fraud in the next year

Growing threats Advanced fraud and financial crime

Financial institutions (FIs) continue to experience increasingly sophisticated fraud and financial crime. The rise of digital banking and ever-faster digital payment methods accelerates this phenomenon. As a result, banks have had to up their game to find ways to stem the growth in fraudulent transactions — and the resulting uptick in financial losses.

PYMNTS’ research finds that compared to 2022, 43% of FIs have experienced increased fraud. The average cost of fraud for FIs with assets of $5 billion or more also increased by 65%, from $2.3 million in 2022 to $3.8 million in 2023.

Source for all graphs on this page: PYMNTS Increasing Fraud Heightens Need for Newer, Better Technologies, September 2023 N = 200: Complete responses, fielded March 20, 2023 – June 16, 2023

"43% of U.S. financial institutions reported increases in fraudulent transactions this year."

Rising Scams Average scam losses of nearly $500K in 2023

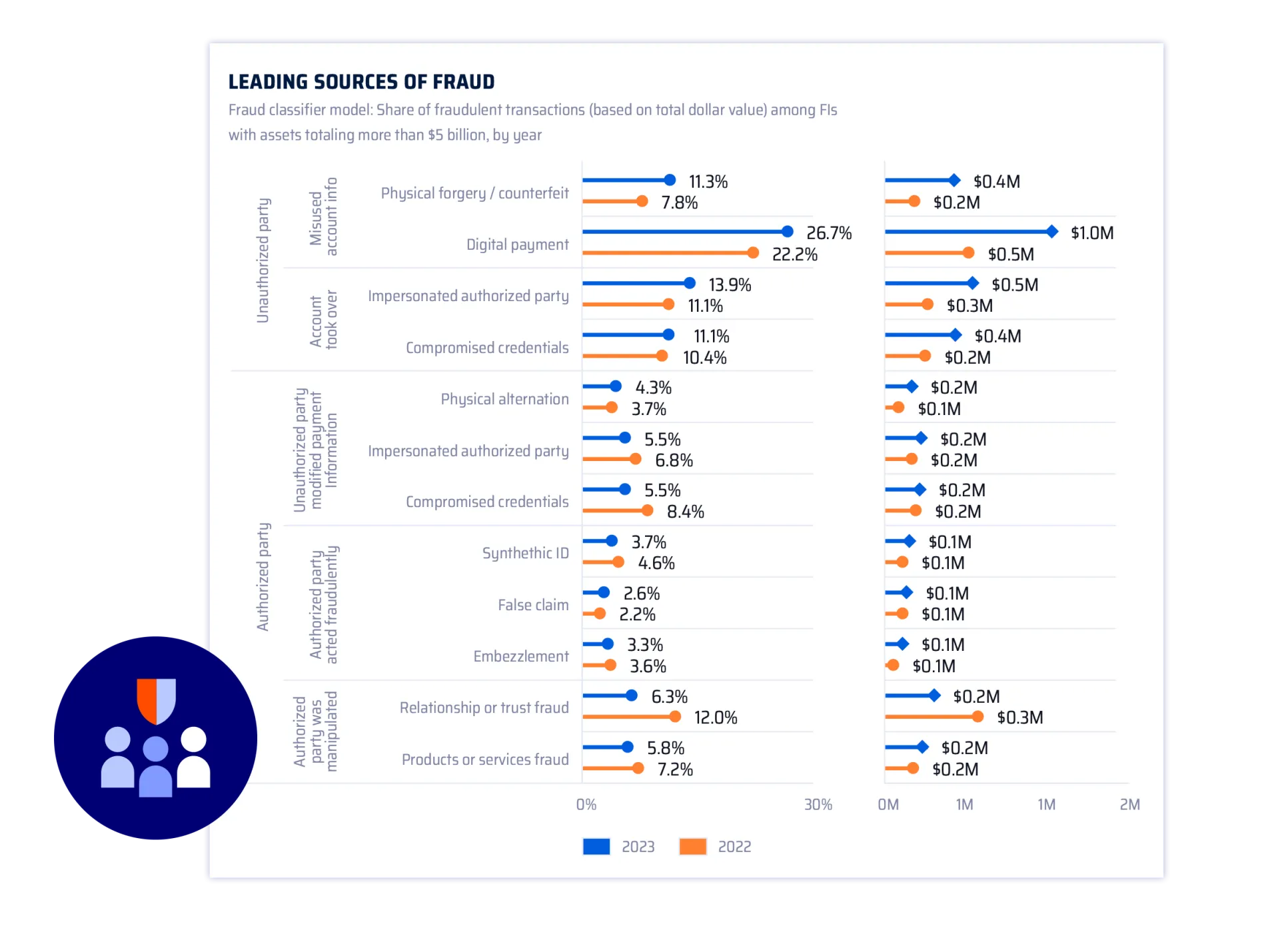

While account information misuse is still the leading type of fraud, each Financial Institution lost, on average, nearly half a million dollars to scams in 2023.

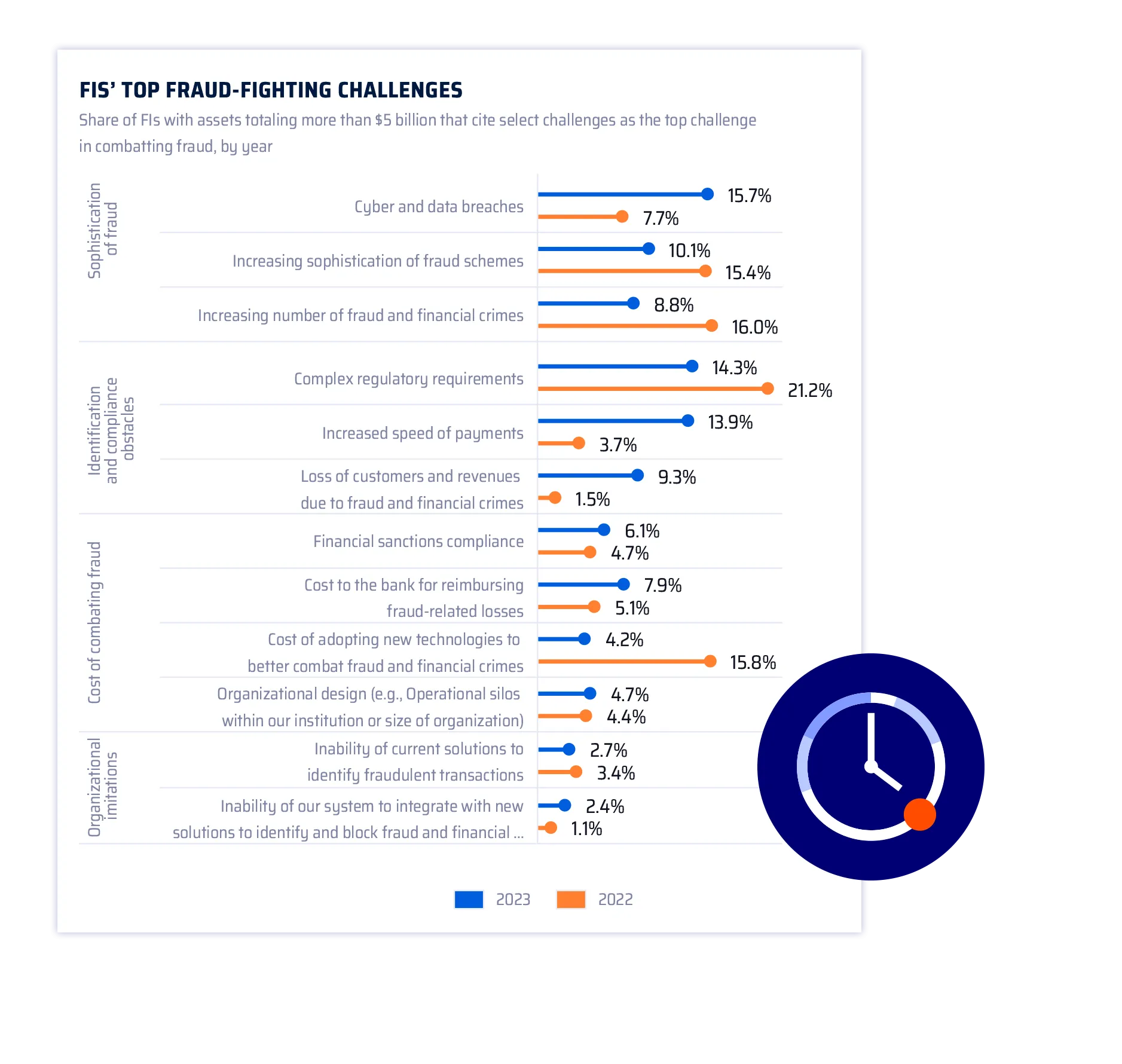

Changing Challenges Data breaches, faster payments, and complex regulations

Financial Institutions' top fraud-fighting challenges include sophisticated cyberattacks, faster payment rails, and an intricate regulatory environment.

Improving Technology Nearly half adding new solutions

Banks of all sizes need effective tools to win the fight against fraud. 48% of FIs are either in the process of adding or will add new technology systems in the next year.

Collaboration PYMNTS and Hawk AI

"The State of Fraud and Financial Crime in the U.S. 2023," a PYMNTS and Hawk AI collaboration, examines the state of fraud and financial crime FIs experienced in 2023 compared to 2022, including the rising costs of fraud and what actions they have taken to mitigate fraud.

We collected 200 responses from executives working at FIs with assets of at least $1 billion between March 29 and June 16. Respondents were also part of our 2022 survey on fraud experienced by FIs. In 2022, all sampled FIs had assets totaling more than $5 billion. In 2023, sampled FIs included 108 FIs with assets totaling more than $5 billion and 92 FIs with assets between $1 billion and $5 billion. Respondents were executives with deep knowledge and leadership responsibilities in the following areas: fraud and risk operations, fraud strategy or fraud analysis.

Get more details

For detailed information, see our report, "Increasing Fraud Heightens Need for Newer, Better Technologies." You can also find many other works in our White Paper Library.

Learn more about HAWK:AI Do you have a question, RFI/RFP or demo request?

Our teams are happy to assist with any questions you may have about our products, our mission or the AML surveillance industry.

To ensure a fast response by the most relevant team member, please fill in all the form fields and leave us a detailed message.