Resource Center Industry insights, news, and announcements

Articles sorted by actuality

Discover how Mitek and Hawk's AI-powered partnership is redefining check fraud prevention and why modernizing detection systems is essential to combat increasingly sophisticated, real-time threats.

Take part in Hawk's new webinar and discover how Hawk's Analytics Studio helps you optimize the full AI model lifecycle for AML and fraud—from building and governing models to ongoing performance monitoring.

Hawk has appointed world-renowned financial crime expert and former FATF delegate Dr. Shlomit Wagman as Strategic Advisor.

Learn how Nacha’s 2026 rule updates are shifting the standard and why it is critical for financial institutions to evolve their fraud detection systems.

Register for our webinar with ACAMS on how financial crime and compliance teams are managing the AI lifecycle—from model development and validation to ongoing monitoring.

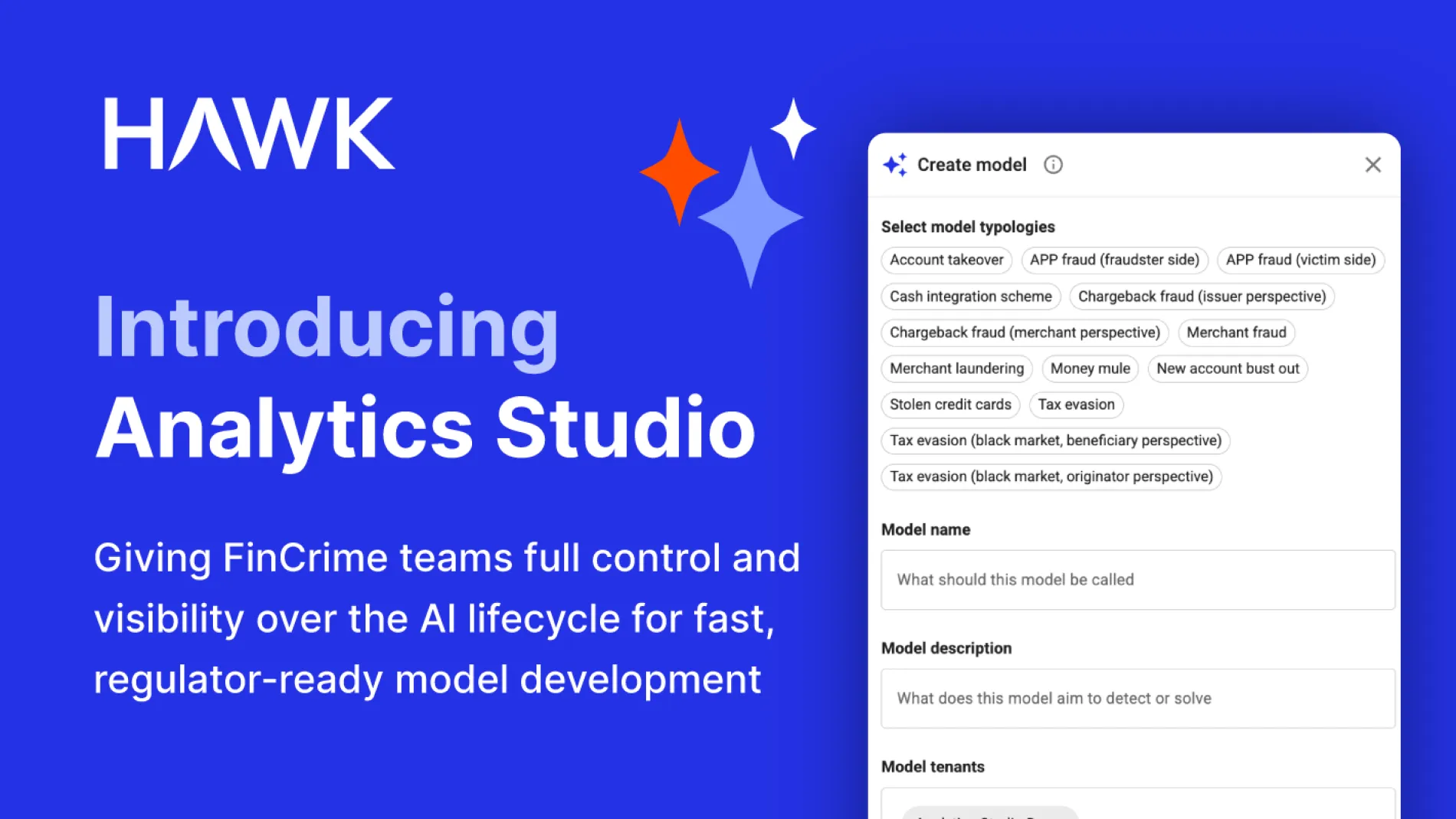

Hawk announces the launch of Analytics Studio, an AI lifecycle management solution for financial institutions to build and govern AI models using expert-designed templates.

Discover why 76% of compliance leaders expect Agentic AI to transform the FCC function and learn which activities will see the most impact.

Explore how AI enhances check fraud detection through image forensics, consortium data, and behavioral biometrics to identify complex patterns and alterations.

Read our latest report to see where banks are deploying AI across FCC functions, from mature fraud prevention to emerging use cases in regulatory reporting.

Explore why 82% of banking leaders are scaling AI investment and learn how GenAI and Agentic AI will transform compliance and risk management in 2026.

Hawk was featured in the 2026 RegTech100 by FinTech Global, a ranking that recognizes the companies shaping the next generation of regulatory and financial crime compliance globally.

Erica Brackman, Senior Product Marketing Manager at Hawk, shares six key findings from Chartis' latest reports on the state of AI adoption and maturity at banks and payment companies.