Payment Companies AML and fraud prevention for payment providers

Improve regulatory compliance and reduce costs with AI-powered AML and fraud detection technology from Hawk.

Built with deep financial industry knowledge

AI helps your experts spot anomalies and detect unknown crime patterns

70% false positive reduction – your team can focus on priority tasks

All stakeholders can easily understand and trust our system's results

Built with deployment options that can be customized to your needs

AML solutions for payment companies The challenge keeping compliance managers up at night

Your transaction count is growing rapidly, putting the compliance team under pressure. You’re concerned about the potential impact of regulation or compliance demands from business partners on your continued growth. You know you don’t have the correct processes in place for AML compliance at peak efficiency.

Our AI-powered AML for payment companies is:

- Efficient — reduce false positives by over 70% to prevent increasing compliance headcount

- Effective — spot anomalies and detect crime patterns before they become common

- Explainable — all stakeholders, from frontline compliance officers through to your auditors understand and trust our results

Key considerations for payment companies looking for AML solutions

Hawk offers deep payment industry experience, combined with modern technology, to help you significantly increase your operational efficiency and improve your regulatory compliance. AML compliance is complex, but it doesn’t need to be inefficient and ineffective. What you need to consider:

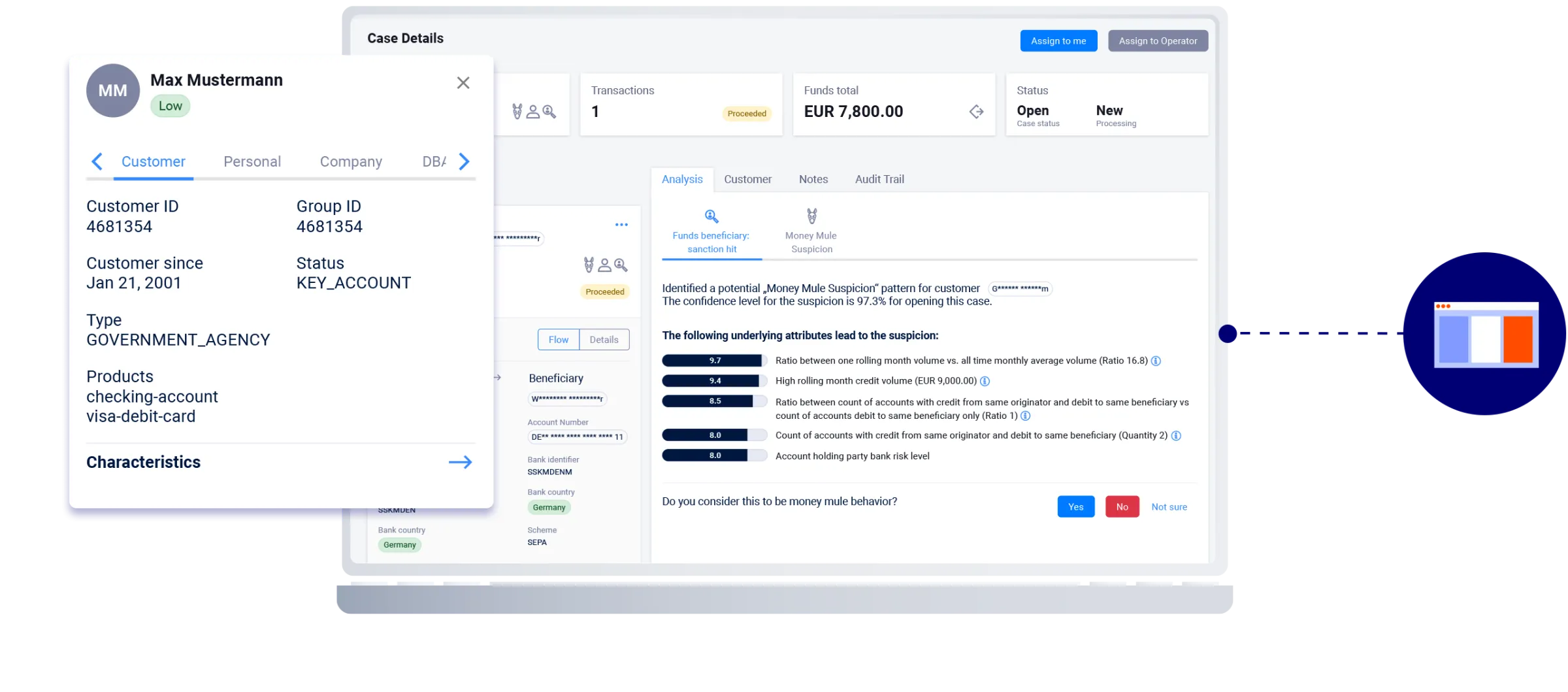

- Combine modules as per your risk management needs in one user interface – combine Transaction Monitoring, pKYC, Payment Screening, and Fraud Prevention

- Ready-to-go risk scenarios and no-code configuration, roles, and case management workflows allow you to flexibly adjust to your specific needs

- Ability to add AI & Machine Learning to traditional rules, both to minimize case workload and to identify unknown risk

Transaction Monitoring AML Transaction Monitoring for Payments

Auditors, regulators and business partners require you to monitor transactions for money laundering risk and AML/CFT compliance. Give them confidence that your transaction monitoring is addressing identified risks with precision and documenting every step of the way in the audit trail.

Key benefits for payment companies:

- Dramatically reduce false positives with artificial intelligence

- Detect unknown crime patterns

- Reduce time per case with a centralized interface

- Use explainable AI to ensure stakeholders understand and trust the system

- Access full audit trails

Customer Screening and Customer Risk Rating Continuously assess customer risk based on flexible scoring across multiple data points

Maintain a risk rating of each of your customers. Payment companies and other fintechs can now dynamically score customer risk using internal and external data, or add behavioral analytics for richer context. Key benefits include:

- Combine static and dynamic data to form your own risk rating

- Reduce time per case with an integrated interface

- Self-service, no code configuration

Work with a recognized industry leader