Banking AML and fraud prevention for banks

Increase risk coverage and reduce costs with AI-powered AML and fraud detection technology from Hawk. Fuse traditional rules with AI for an efficient, effective operation, with risk management tailored to suit your organization.

Built with deep financial industry knowledge

AI helps your experts spot anomalies and detect unknown crime patterns

70% false positive reduction – your team can focus on priority tasks

All stakeholders can easily understand and trust our system's results

Built with deployment options that can be customized to your needs

AML solutions for banks The challenge keeping banking compliance teams up at night

Your legacy AML systems have been inefficient and ineffective for some time, while throwing headcount at the problem so far was the only viable solution. But you know regulatory and technological change is coming, and that your current solution will no longer suffice.

Our AI-powered AML for banks is:

- Efficient — reduce false positives by over 70% to reduce operational costs

- Effective — spot anomalies and detect unknown crime patterns to find more criminal activity

- Explainable — all stakeholders, from frontline compliance officers through to your regulators, understand and trust our results

Key considerations for banks looking for modern AML solutions

- AI-powered anomaly detection can help your financial crime teams to identify emerging risks and discover unknown AML threats

- Unnecessary alerts and false positives can be significantly reduced using AI, enabling you to control operational costs

- Explainable AI provides human language insight into decisions, giving transparency to analysts and regulators

- Hawk enables you to introduce AI at your preferred pace

Transaction Monitoring AML Transaction Monitoring for Banks

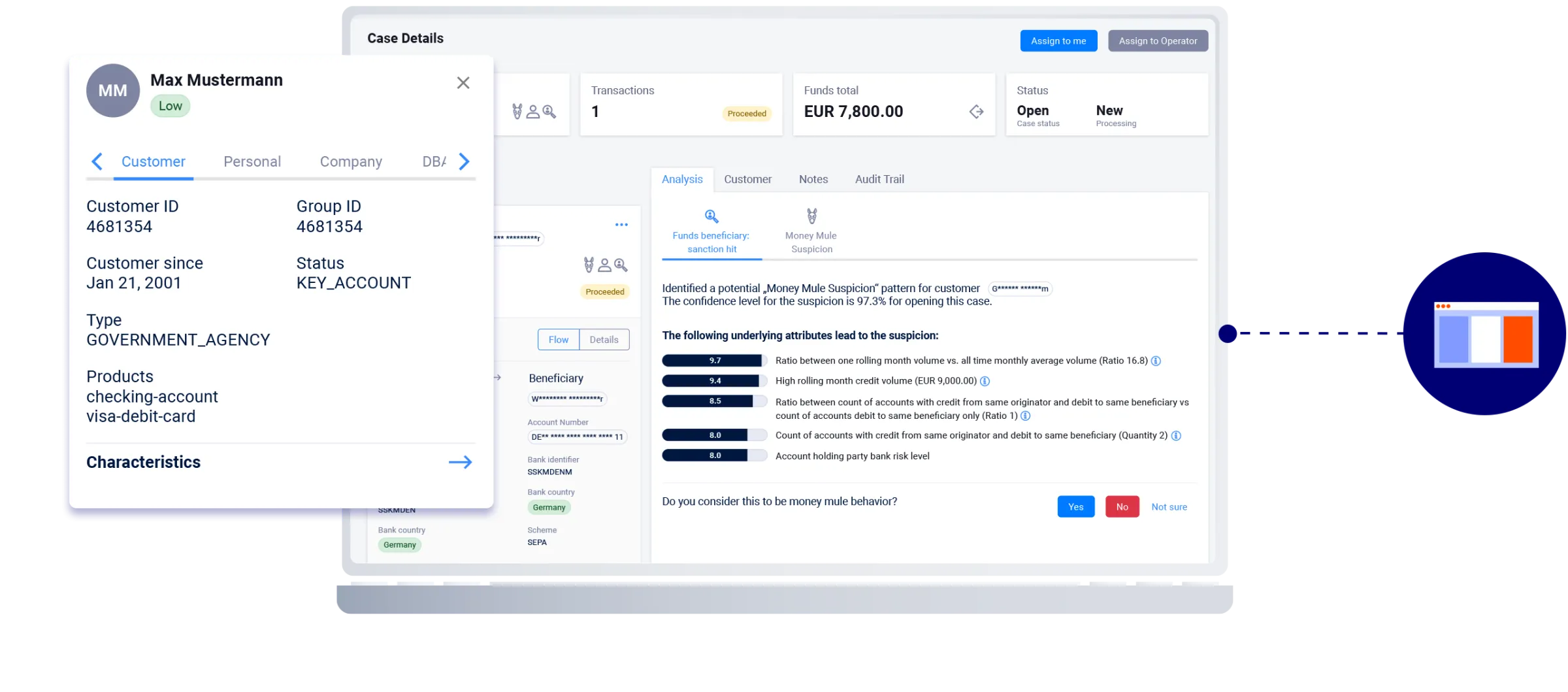

Monitor any transaction for red flags using a comprehensive set of rules in combination with behavioral analytics.

Give auditors the confidence that your transaction monitoring is comprehensive and world-class.

Key benefits of Hawk's AML Transaction Monitoring for banks:

- Fuse traditional rules with AI for maximum effectiveness and efficiency

- Dramatically reduce false positives

- Detect unknown crime patterns

- Use explainable AI to ensure stakeholders understand and trust the system

- Reduce time-per-case with a centralized interface

- Access full audit trails

Payment Screening Payment Screening for Banks

Screening customers and counterparties against sanctions and country lists, whether during onboarding or thereafter, is vital to remain compliant with regulations. Key benefits include:

- A modular solution that you can adopt as your needs change, in a unified interface to boost efficiency

- Fight false positives with artificial intelligence in a transparent and auditable manner

- Reduce time per case with a centralized interface, augmenting streamlined manpower with automation

Customer Risk Rating for Banks Continuously assess customer risk

Discover the risk rating of your customers in a clear and transparent manner. Banks can now dynamically score customer risk using internal and external data. Key benefits include:

- Combine static and dynamic data to form your own risk rating

- Reduce time per case with an integrated interface

- Self-service, no code configuration

Work with a recognized industry leader