Media HAWK:AI Knowledge Hub

Your contact for press and public relations: press@hawk.ai

Hawk AI is the only supplier from 22 profiled companies to receive the XCelent Advanced Technology 2024 award.

How is Neonomics using AML compliance technology from Hawk AI to deliver the next generation of payments and financial services across Europe?

Hawk AI today announces the appointment of Robin Lee as General Manager for the Asia-Pacific (APAC) region.

Built-for-purpose AI technology helps banks identify suspicious activity in real-time, at scale via Anomaly Detection, Pattern Detection, False Positive Reduction, and pKYC use cases.

Learn how the EU AI Act could impact banking AML and fraud processes, and how technology can address its requirements.

Hawk AI has further strengthened its leadership team with the addition of Michael Shearer as Chief Solution Officer.

Instant payments can create headaches for fraud teams, as faster payments enable faster fraud. The good news is that AI can help.

Hawk AI, Germany’s leading provider of anti-money laundering surveillance technology for banks, payment firms, and fintechs, today announced OTTO Payments, the payments division serving the otto.de marketplace, as a client.

HAWK:AI was recognised as a Rising Star in the Best Transaction Monitoring Solution category in the 6th Regulation Asia Awards for Excellence 2023 at an in-person ceremony on 14 November 2023.

We'd like to thank Forbes for nicknaming us the 'Cybercops from Munich'! Find the full article right here.

Hawk AI, the leading provider of technology for fraud and anti-money laundering surveillance, has further strengthened its leadership team with the addition of Maximilian Riege as Chief Risk Officer.

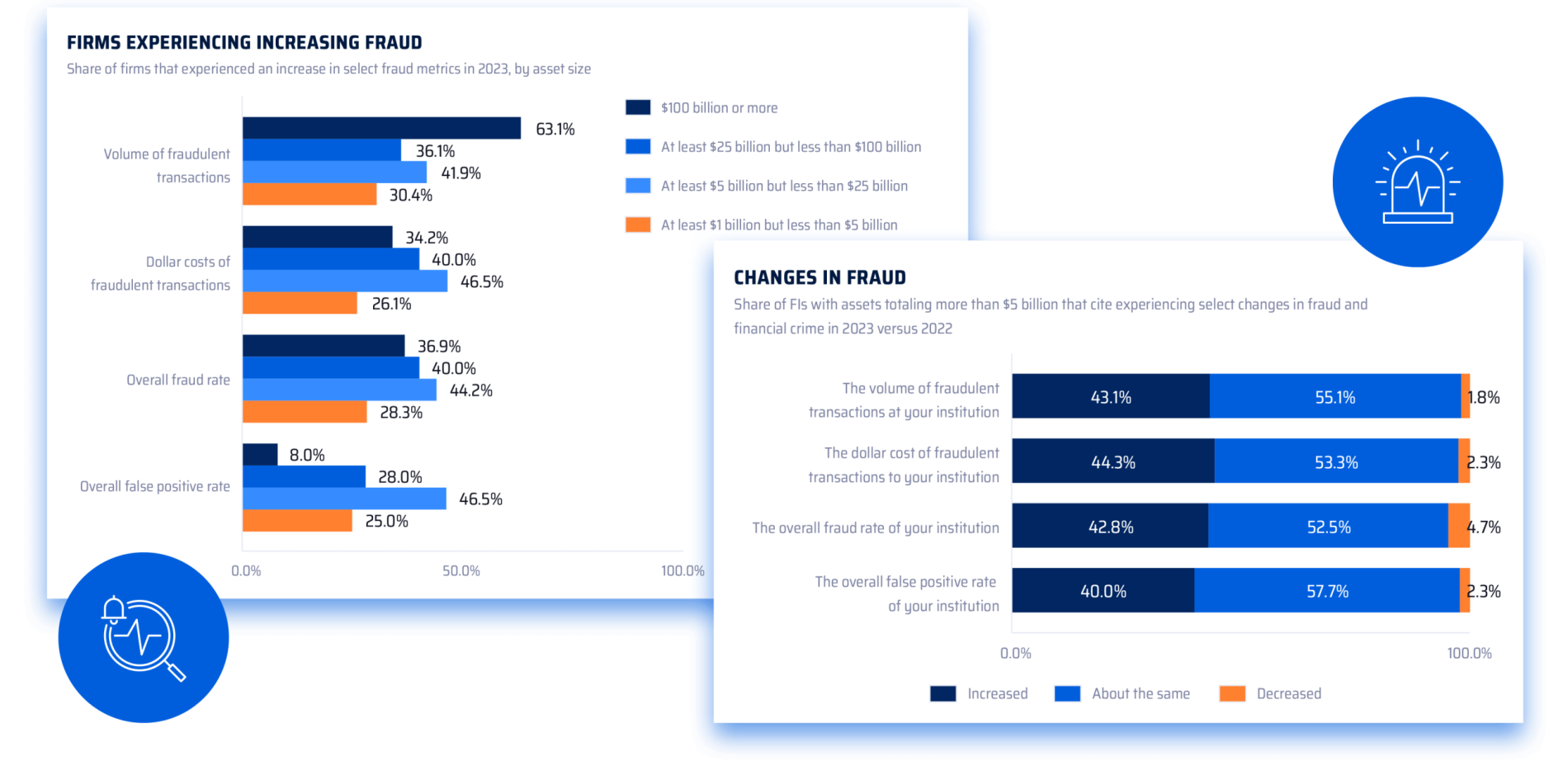

More than 40% of financial institutions reported year-over-year growth, extending a worrying trend.