Transaction Monitoring Maximize AML risk coverage and reduce false positives

Enhance risk detection with Hawk’s AML Transaction Monitoring software. Fuse traditional rules with AI for efficient, effective alerts, minimizing false positives. Optimize your risk management to suit your organization.

Increase your AML effectiveness and efficiency with Transaction Monitoring software from Hawk

Hawk’s Transaction Monitoring system enables improved risk management, combining rules and AI to create effective controls that are appropriate for your organization

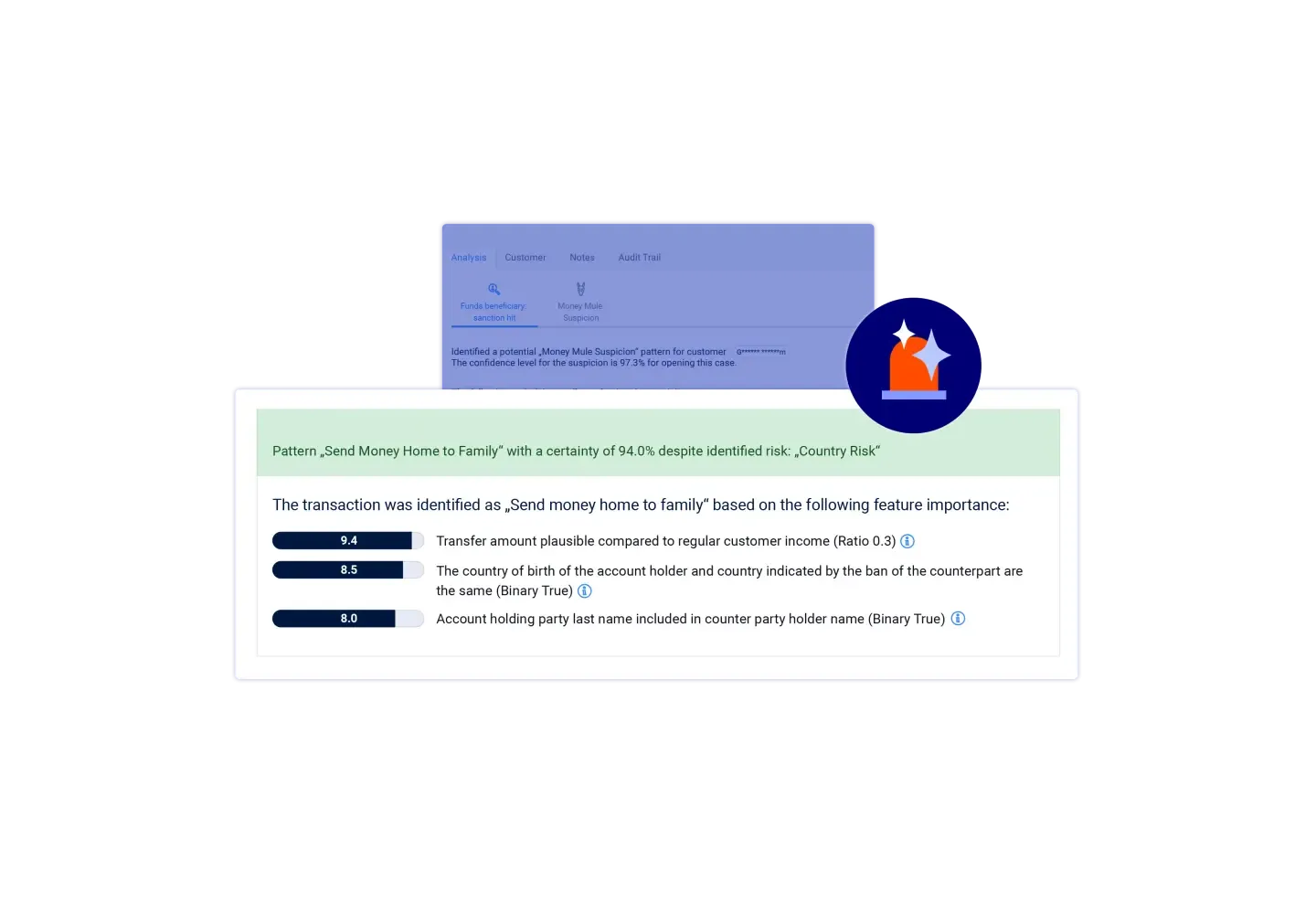

By adding Hawk’s explainable AI, you can further increase your risk coverage by using anomaly detection to detect suspicious activity that traditional rules won’t catch

AI also enhances your alert triaging and prioritization, enabling you to significantly reduce your false positives and achieve maximum efficiency for your operation

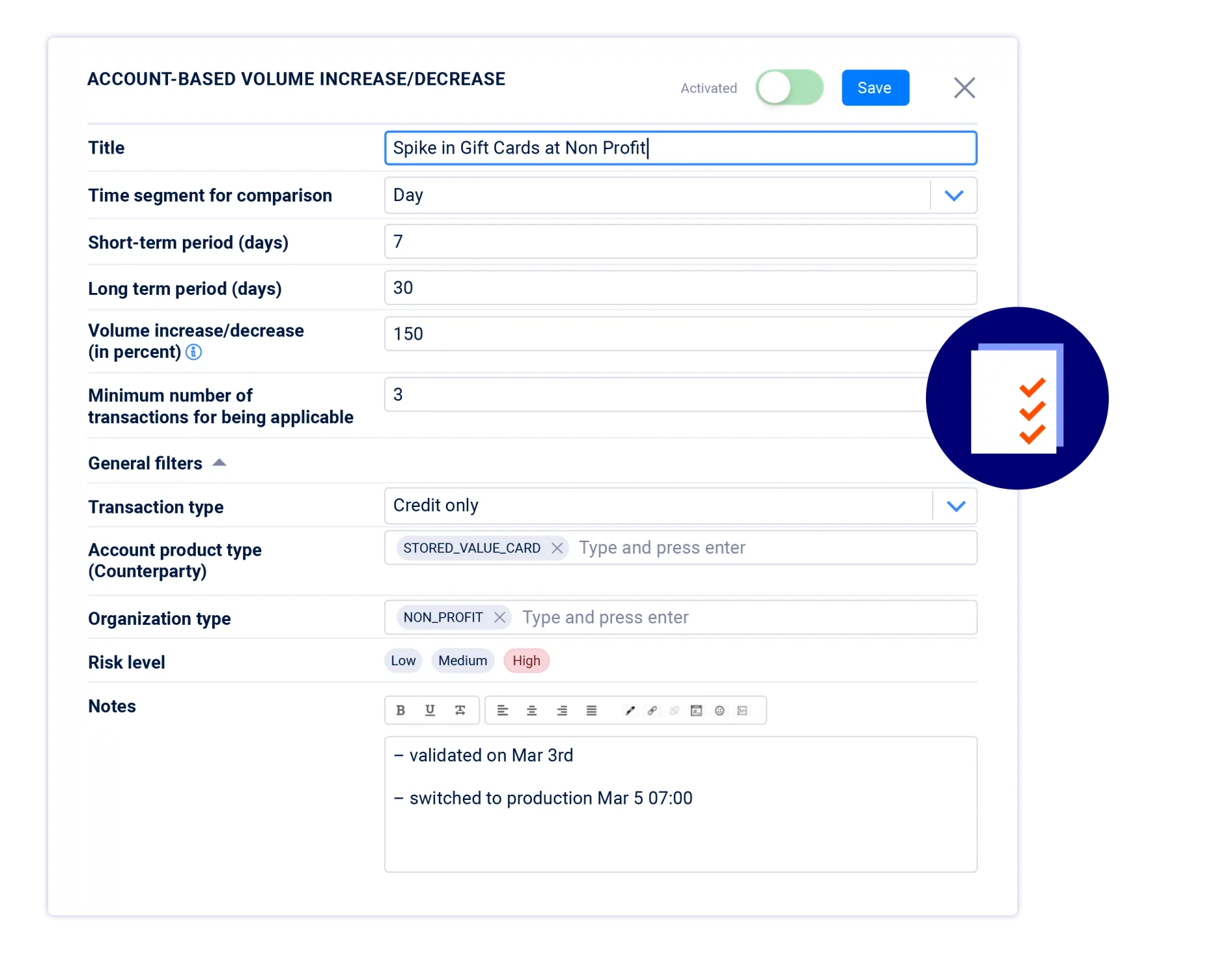

Hawk’s no-code interface enables the creation of customized rules to help detect suspicious behavior, reduce false positives through targeted tuning, and maximize risk detection

How can AI improve your transaction monitoring?

Imagine you create three rules to automatically flag known behaviors. Each rule will increase the number of false positives, leaving you with a high false positive rate and a high volume of alerts to manage.

Instead, AI allows you to generate a larger set of fine-grain ‘rules’ that look for specific combinations of behavior. This gives you the increased risk coverage that you need while avoiding the volumes of false positives. Read more on the ‘fine-grain’ capabilities of AI compared to ‘coarse-grain’ manual rules.

Reduce false positives

Hawk's Transaction Monitoring software provides the option of using explainable AI to help you avoid high volumes of unnecessary alerts. False positives have been reduced by an average of 70%, enabling your analysts to focus attention on the right cases.

Detect unseen and novel financial crime

Hawk's AI anomaly detection technology enables you to find new patterns of suspicious behavior that traditional rules won't pick up.

Configure and customize rules

With Hawk's modern, intuitive no-code user interface, you can create and customize rules without developer or vendor input.

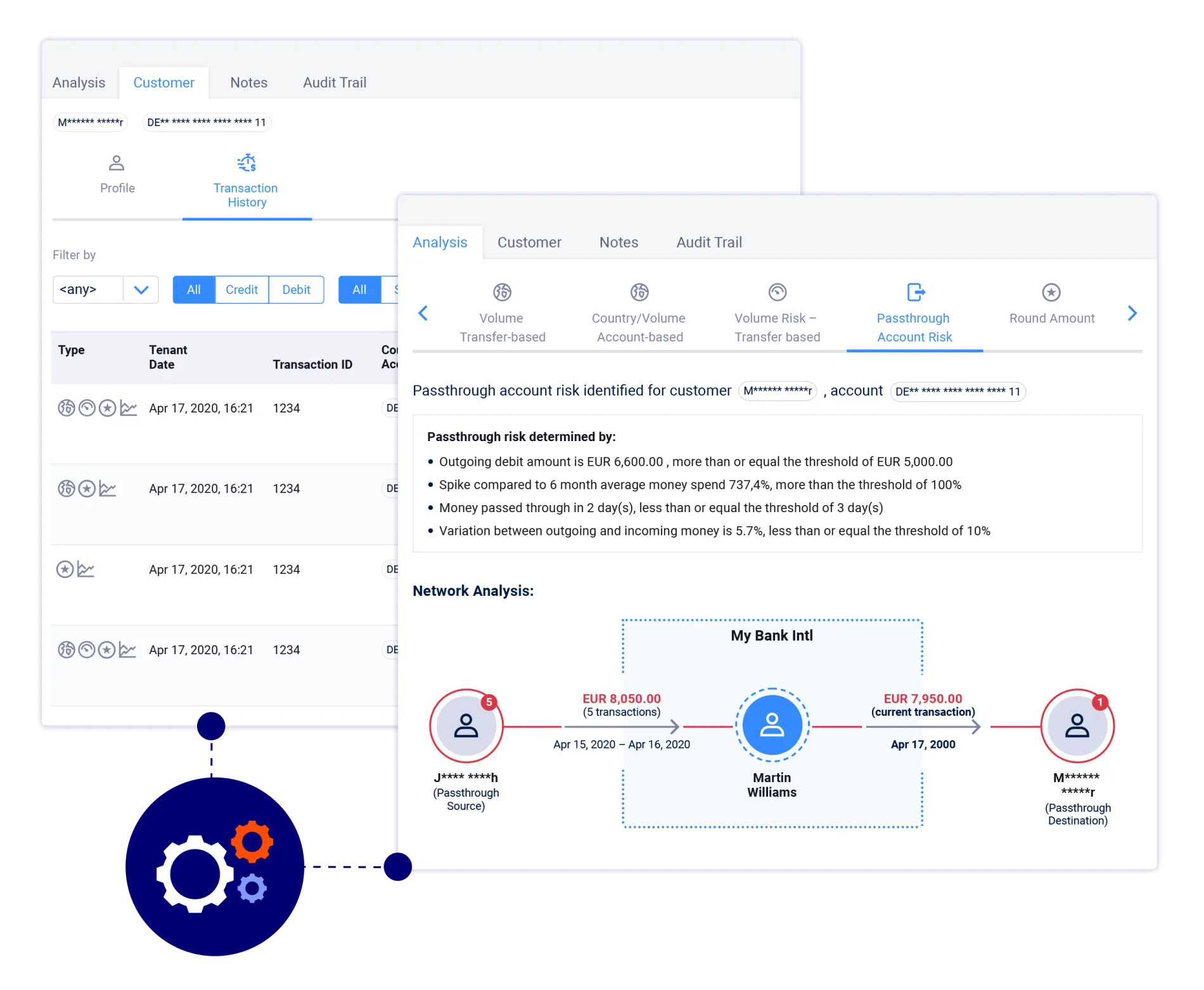

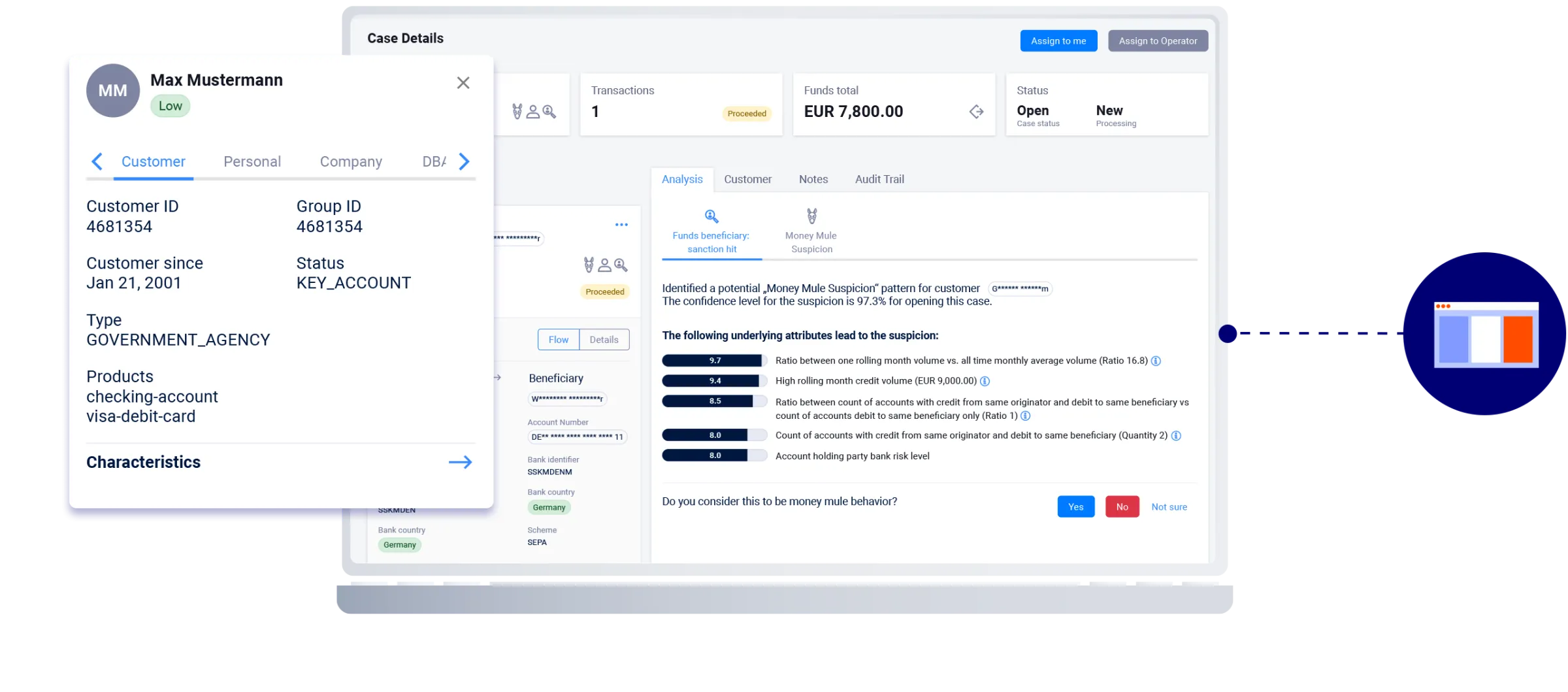

Simplify tasks with unified Case Manager

Bring data together in one interface, empowering analysts to rapidly and thoroughly inspect cases without switching systems. Quickly identify the reason for the alert and find possible courses of action. The dashboard view produces additional top-down insights on transaction monitoring activity. This allows you to rapidly identify issues with workload, hit handling performance, or case backlog.

In numbers: the Hawk impact

3 – 5x

increase in risk detection using AI

70%

average false positive reduction

A complete solution for AML transaction monitoring

See our Transaction Monitoring system in action

Find out how Hawk can help you to increase risk coverage, improve efficiency, and comply with regulations.