Resource Center Industry insights, news, and announcements

Articles sorted by actuality

Hawk AI, Germany’s leading provider of anti-money laundering and fraud surveillance technology for banks, payment companies, and fintechs, has been awarded the Xcelent Advanced Technology 2023 award, highlighting Hawk AI as the most advanced AML Transaction Monitoring system on the market.

Hawk AI, the leading provider of Fraud and AML surveillance technology for banks, fintechs, and payment firms and Fourthline, the RegTech leader that provides AI-powered and compliant KYC and AML solutions, today announced a strategic partnership combining Fouthline’s KYC-compliant customer onboarding and Hawk AI’s transaction monitoring to fight fraud and AML.

Hawk AI, the leading platform for AML (Anti-Money Laundering) Surveillance, has once again been named one of the top 100 AI Fintech companies in the world by Fintech Global.

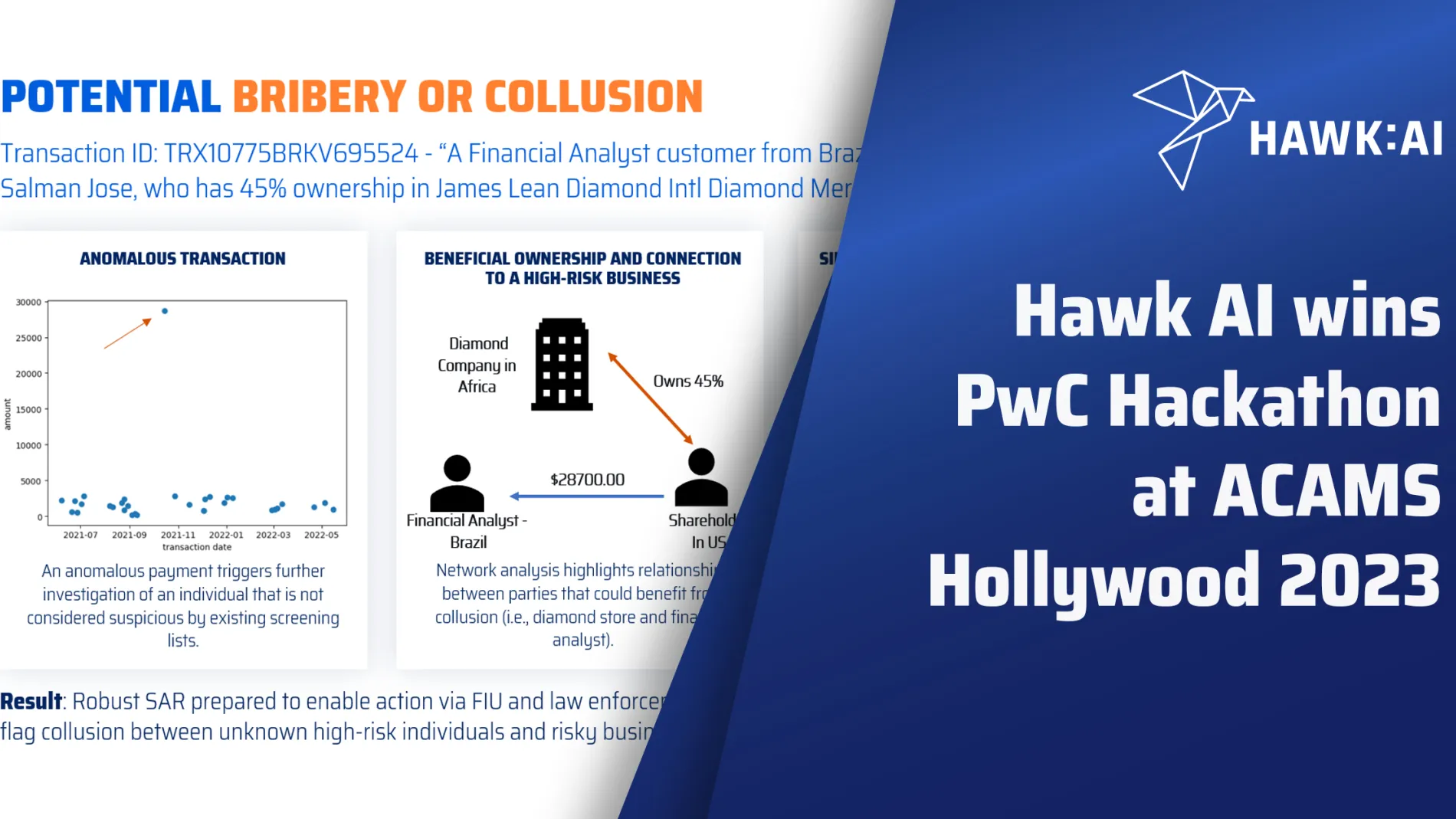

In May 2023, Hawk AI participated in the PwC Hackathon at ACAMS Hollywood.

The competition aimed to identify maximum suspicious transactions and/or new trends in the provided data and artfully present our findings. Based on our company vision of streamlining the process for frontline operators and enabling them to efficiently generate high-quality true positive Suspicious Activity Reports (SARs), our data science and product teams set on working through the supplied data sets to detect financial crime.

Hawk AI, Germany’s leading software provider of anti-money laundering surveillance technology for banks, payment firms, and fintechs, today announced a new partnership with Scorechain, the leading crypto AML compliance solution provider, to unveil a holistic end-to-end transaction monitoring solution for comprehensive compliance.

At this year’s ACAMS Hollywood conference, Hawk AI hosted a panel discussion with experts from CSI and Oliver Wyman about the innovative ways that financial institutions can overcome inertia and seamlessly integrate new financial crime and fraud detection technology into their operations. The panel discussed the appetite for cloud and AI/Machine Learning technology, the obstacles to Implementing new technology, system augmentation vs. “rip and replace,” making the business case for new technology, and more.

Fraud and Anti-Money Laundering (AML) are converging. In a webinar on FRAML, experts from Hawk, North American Bancard, and Global Vision Group discussed regulatory and market pressures on financial institutions, information silos between Fraud and AML teams, degrees of FRAML integration, using AI to detect fraud and financial crime, and combining human and tech power to achieve FRAML goals.

At a recent Fraud & Financial Crime conference in New York, Hawk AI co-founder and CTO/CPO Wolfgang Berner addressed the obstacles to trusting AI, and the steps that FIs can take to overcome them.

Alviere, the leading embedded finance platform provider, announced today that it has selected Hawk AI, a leading global provider of anti-money laundering (AML) and fraud prevention technology for banks and payment companies, as an AI-powered surveillance suite provider to help enable expansion into new markets.

VR Payment, der Zahlungsspezialist der genossenschaftlichen FinanzGruppe Volksbank Raiffeisenbanken und Teil der DZ BANK Gruppe, verkündet seine Zusammenarbeit mit Hawk AI, Deutschlands führendem Anbieter von Software zur Geldwäschebekämpfung und Betrugsprävention.

VR Payment, the payment service provider for Volksbank Raiffeisenbanken and part of the DZ BANK Group, announces its collaboration with Hawk AI, Germany's leading provider of anti-money laundering and fraud prevention software.

At a recent webinar, experts from Hawk AI and Aux discussed all these issues and more, as well as the solutions that credit unions can employ to get a holistic view of their members and ease the burdens on their compliance teams.