Anti-Money Laundering Airtight compliance, without the noise

Mitigate risks more effectively—even in your blind spots. With explainable AI at its core, Hawk's AML solution increases coverage, identifying threats your current technology misses, while also reducing false positives. It boosts investigation speed and quality with clear, auditable rationale for every alert.

Comprehensive AML Platform Meet AML obligations today and in the future

Money launderers move with speed, scale, and sophistication, but most AML solutions can’t keep up. This leaves institutions exposed to true threats and regulatory risk as false positives slip through, putting pressure on costs and morale.

AI is delivering results, enabling FIs to strengthen their defenses to a standard that is quickly becoming the norm. Hawk's AI-native anti-money laundering (AML) technology is proven to pinpoint laundering other platforms miss while keeping false positives at bay.

With customer due diligence, watchlist screening, and transaction monitoring all in one place, you gain a unified view of risk that drives faster, more accurate decisions—without compromising compliance.

The Hawk Difference Discover how Hawk raises the bar for efficient anti-money laundering compliance

The Traditional Way

- Detection logic that misses nuanced risks and floods your teams with false positives

- Heavy reliance on vendor services to build and adjust rules, slowing response times and limiting control

- AI retrofitted to legacy systems, limiting functionality and impact

- Batch-based detection that flags money laundering months after it happened

- Offline testing environment that leads to stale models

- Difficult to understand AI and outdated interfaces that bring confusion and slow investigations

- Disjointed AML and KYC systems that fragment data and obscure the full customer risk picture

- Limited deployment flexibility creating a less than ideal set up

The Hawk Way

- Explainable, precision-built AI detection models that surface more suspicious activity with fewer false positives

- Agile, self-serve rule configuration and sandbox testing so you can adapt detection in minutes, not months

- AI-native solution ensuring higher performance

- Real-time detection with the optionality to stop suspicious activity as it occurs

- Production simulation with live data for precision model development

- Human-understandable model explanations that reduce investigation time and strengthen regulatory defensibility

- Unified KYC, screening, and transaction monitoring in one platform, delivering a complete, contextual view of risk

- Flexibility to deploy your way with SaaS, VPC, and on-prem options

AML Product Suite AI-powered compliance software that shields your institution from risk with precision

Customer Risk Rating

Maintain due diligence throughout the customer lifecycle using dynamic and static data to maximize risk coverage

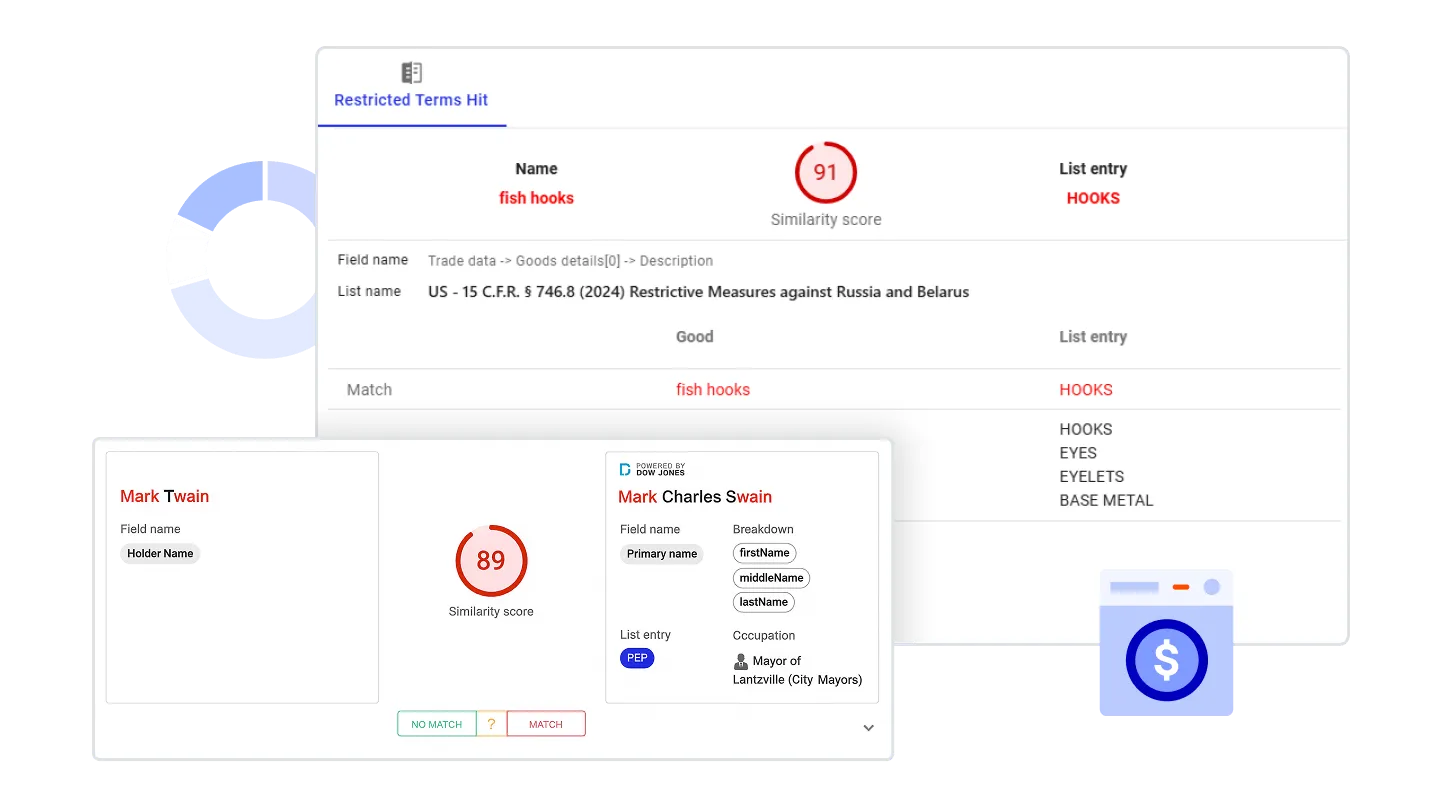

Customer Screening

Screen against global sanctions lists, watchlists, politically exposed persons (PEP) lists, and adverse media databases

Payment Screening

Screen payments to identify and prevent suspicious transactions, using powerful matching technology

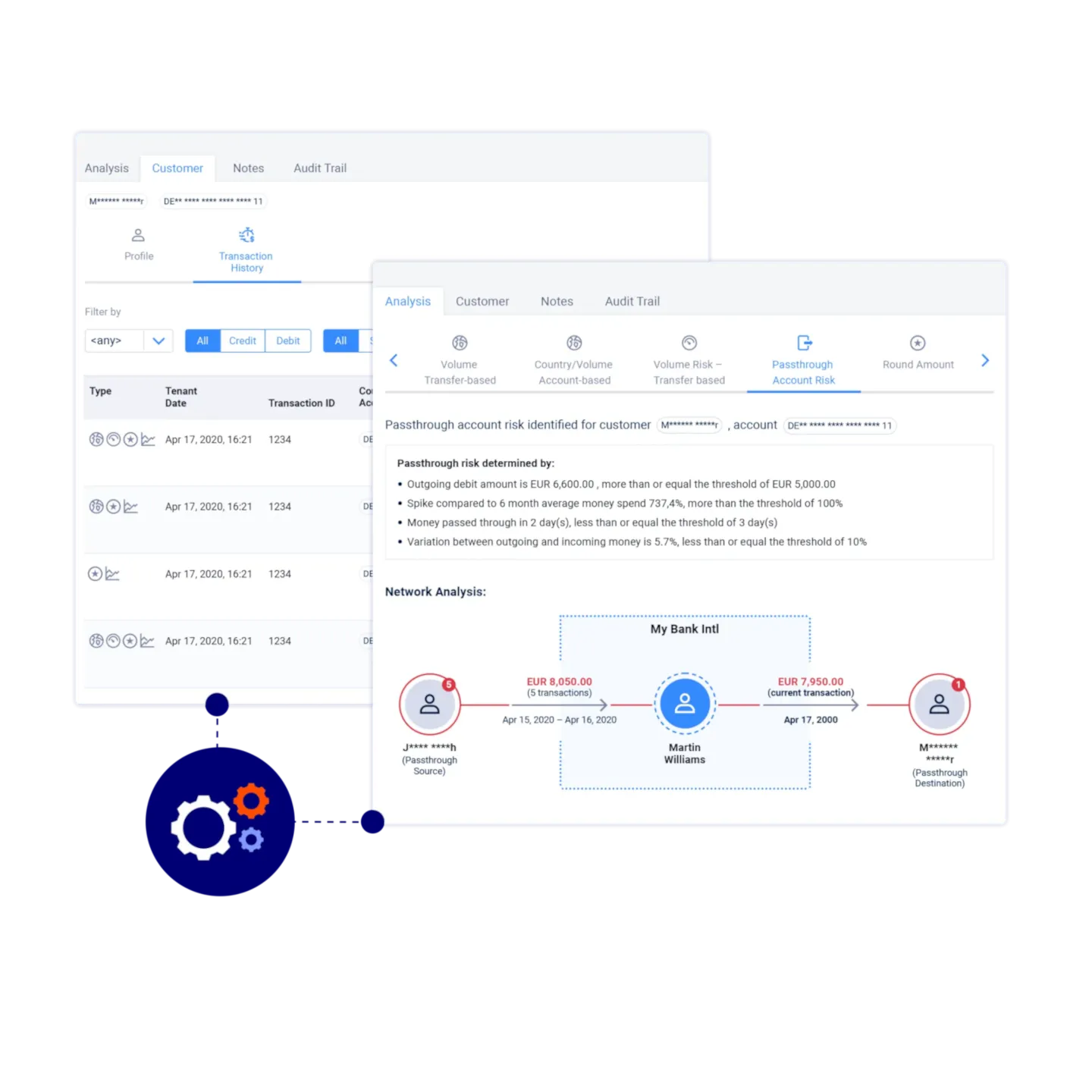

Transaction Monitoring

Increase risk coverage and reduce false positives, with the option of explainable AI to significantly increase performance

AML AI Overlay

Gain the efficiency and effectiveness of tailored AML detection without replacing existing systems and lengthy development cycles

Analytics Studio

Streamline the entire AI lifecycle with self-service, regulator-ready model development that eliminates technical bottlenecks and documentation burdens

Alert & Case Management

Get a holistic view of your alerts and maximize efficiency with a unified case manager

SAR / CTR Filing

Accelerate your SAR process from detection to submission, without compromising on narrative quality

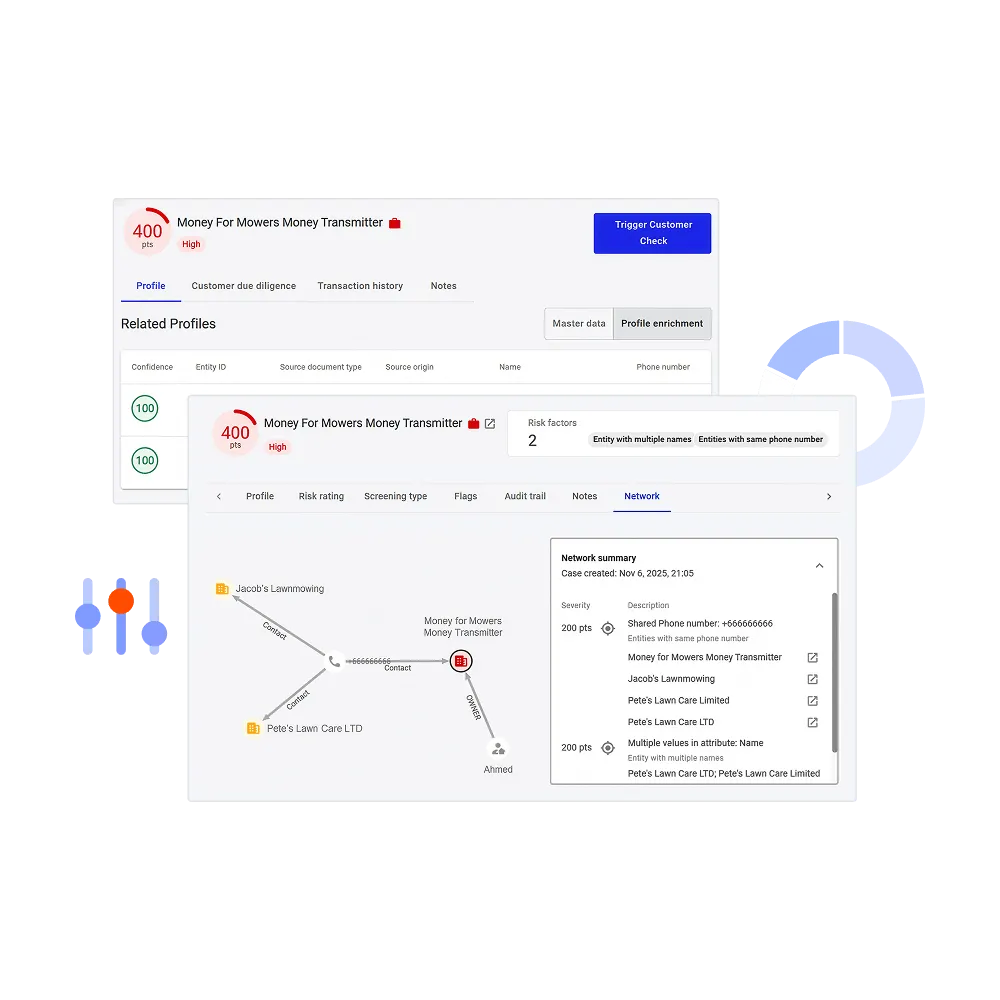

Entity Risk Detection

Gain a clearer understanding of customers and networks to increase the effectiveness and efficiency of your risk detection and investigations

Stop known and emerging money laundering threats with AI precision

Known money laundering threats

Surface classic money laundering patterns—like structuring and rapid movement of funds:

- Flexible rule templates can be configured to capture typologies relevant to your business

- Integration with Scorechain allows monitoring of on-chain crypto transactions

- False positive reduction models cut unnecessary noise, allowing a rules safety net without the downside

Illicit Activity

Spot criminal activity including tax evasion, sanctions evasion, and trade of restricted goods:

- Day one defense AI models identify typical criminal activity

- Customer and payment screening protect your institution from shady activity, looking for risky key words that could expose you to more than just sanctions risk

Complex Money Movement

Don’t let network activity prevent you from following the money trail:

- Entity risk detection identifies relationships between entities to give you a bigger picture of what is going on

- Network detection and visualization pinpoints complex money movement patterns

Mules Networks

Pinpoint mules, witting and unwitting, moving dirty money through your accounts:

- Behavioral analytics flag accounts with high volumes of incoming funds from disparate sources

- AI analytics identify skimming or commissions on mule activities

Anomalous Behavior

Catch suspicious behaviors and risks you don’t know you have:

- Semi-supervised anomaly detection contextualizes transactional activity to pinpoint abnormal behavior

- Model explanations accelerate investigations, clearly telling investigators why ‘suspicious’ activity is actually suspicious

Learn why forward-thinking Risk & AML leaders choose Hawk

Hawk's highly customizable SaaS solution and modern case management interface empowered us to adopt a more efficient approach to combating financial crime.

Horst Gottsnahm, Chief Risk Officer, VakıfBankHawk provides reasoning behind each flagged alert, which does most of the heavy lifting for our compliance team. Instead of being reactive, we are now proactive.

Deepak Baran, Head of Financial Technology, Vodafone FijiHawk's innovation is ahead of the competition.

The Forrester Wave™: Anti-Money Laundering Solutions, Q2 2025The Hawk team demonstrated technology leadership and willingness to work closely with us to hit ambitious goals.

Mirko Krauel, CEO, OTTO PaymentsIf you’re looking for a partner who truly understands the regulatory space, listens to what you need, moves fast, and actually delivers – go with Hawk. The tech is strong, the people are great, and honestly, it just works.

Denny Axt, Director of Compliance & AML, RatepayHawk doesn’t just offer AI — it delivers it in production. Rather than simply providing algorithms, the company fully operationalizes AI[...] to deploy it efficiently and at scale.

Chuck Subrt, Datos Insights

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Awards & Recognition Leading the industry forward

Learn how Hawk's AI-fueled technology is driving the future of AML detection, according to analysts and industry experts

Hawk Recognized as a Strong Performer in Anti-Money Laundering Solutions Report

Hawk Recognized by Chartis for Real-Time Transaction Monitoring

Hawk Recognized for AML Transaction Monitoring Innovation by Datos Insights

Aligned to your risk appetite, built for your industry

Focus on what matters with AML detection calibrated to your risk profile and industry context

Banking AI-powered compliance for the modern banking sector

Modernize your compliance program with AI-driven detection that increases precision while maintaining compliance with regulations, such as the US BSA-AML regulations, the EU Money Laundering Directives, and the UK Proceeds of Crime Act

- Unify CDD, screening, and transaction monitoring in one, efficient platform

- Reduce false positives upwards of 70% so you can focus on truly suspicious activity

- Streamline case investigations and reporting, reducing manual effort and time to SAR filing

- Improve auditability and regulatory defensibility with explainable AI

Payments A rail-agnostic AML solution that scales with your business

Move fast and stay compliant, scaling your AML program with payment volumes and product growth

- Detect and block suspicious transactions in <150ms average without disrupting payment flows

- Apply adaptive monitoring that scales as transaction volumes spike

- Reduce operational load with precision alerts that minimize unnecessary reviews

- Support embedded compliance for white-label and partnership models

FinTech The AML toolbox for fast-growing FinTechs

Tackle your compliance needs with an all-in-one AML solution that’s regulator trusted and scales with growth—from start up to global operations

- Dynamically risk score and monitor customers both at onboarding and on an ongoing basis

- Enable rapid product innovation, quickly adapting your compliance set up with low-code rule configuration and sandbox testing

- Meet regulatory scrutiny without heavy compliance overhead with pre-built workflows, AI explanations, audit trails, and end-to-end governance

- Support embedded compliance for white-label and partnership models

Crypto Blockchain monitoring for crypto platforms

Stay compliant and secure with an all-in-one solution built for the regulatory scrutiny of digital assets—monitoring on-chain activities of platform from early-stage exchange to global protocol.

- Dynamically risk score customers, wallets, and counterparties with on-chain and off-chain intelligence

- Enable rapid product innovation: Launch new tokens, exchanges, and features at speed with flexible, low-code compliance controls

- Meet global crypto regulatory expectations without heavy operational overhead with pre-built workflows, AI explanations, audit trails, and end-to-end governance

Marketplaces Comprehensive compliance for modern marketplaces

Don’t let your company become a vehicle for money laundering. Protect your users and business, monitoring trades and seller payouts for sanctioned, illicit, and suspicious activity

- Better understand the risk of customers and merchants alike to prevent misuse by bad actors

- Block sanctioned users and accounts in real time

- Use behavioral analytics to spot hidden risk patterns (e.g., collusion, structuring)

- Make clear, auditable decisions to build trust with partners, banks, and regulators

Articles & Resources The latest from Hawk

Discover how Agentic AI helps financial institutions streamline the AML investigative process through data collection, case categorization, and the automated crafting of a SAR narrative.

Read about AI-enabled compliance in the new industry report by Hawk and Chartis.

From our recent research with Celent: read about the top challenges faced by banks when it comes to ensuring AML compliance and how those challenges can be overcome.

Related solutions Explore Hawk's Integrated AML & CFT Suite

Frequently Asked Questions Want to know more?

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have