Check Fraud Stop fraud before checks clear with precision AI

Cut losses and thwart more fraudsters with AI-driven image forensics and cross-channel check fraud protection.

Product Highlights Shut down check fraud before deposits turn into losses

Spot subtle manipulations and cross-institution fraud with AI-driven image forensics and consortium insights, powered by Mitek

Reduce friction for legitimate customers with made-for-you AI models, production-grade simulation, and self-serve rule management

Spot more dubious activity, building cross-rail and channel analytics without the heavy lift of implementing a standalone check fraud solution

Check Fraud Detection Software Catch what humans miss with AI-driven check fraud software

Leverage Hawk’s AI-powered fraud transaction monitoring together with Mitek’s image forensics to prevent fraud typologies like synthetic checks, check washing, kiting, and paperhanging.

Detect threats with higher precision

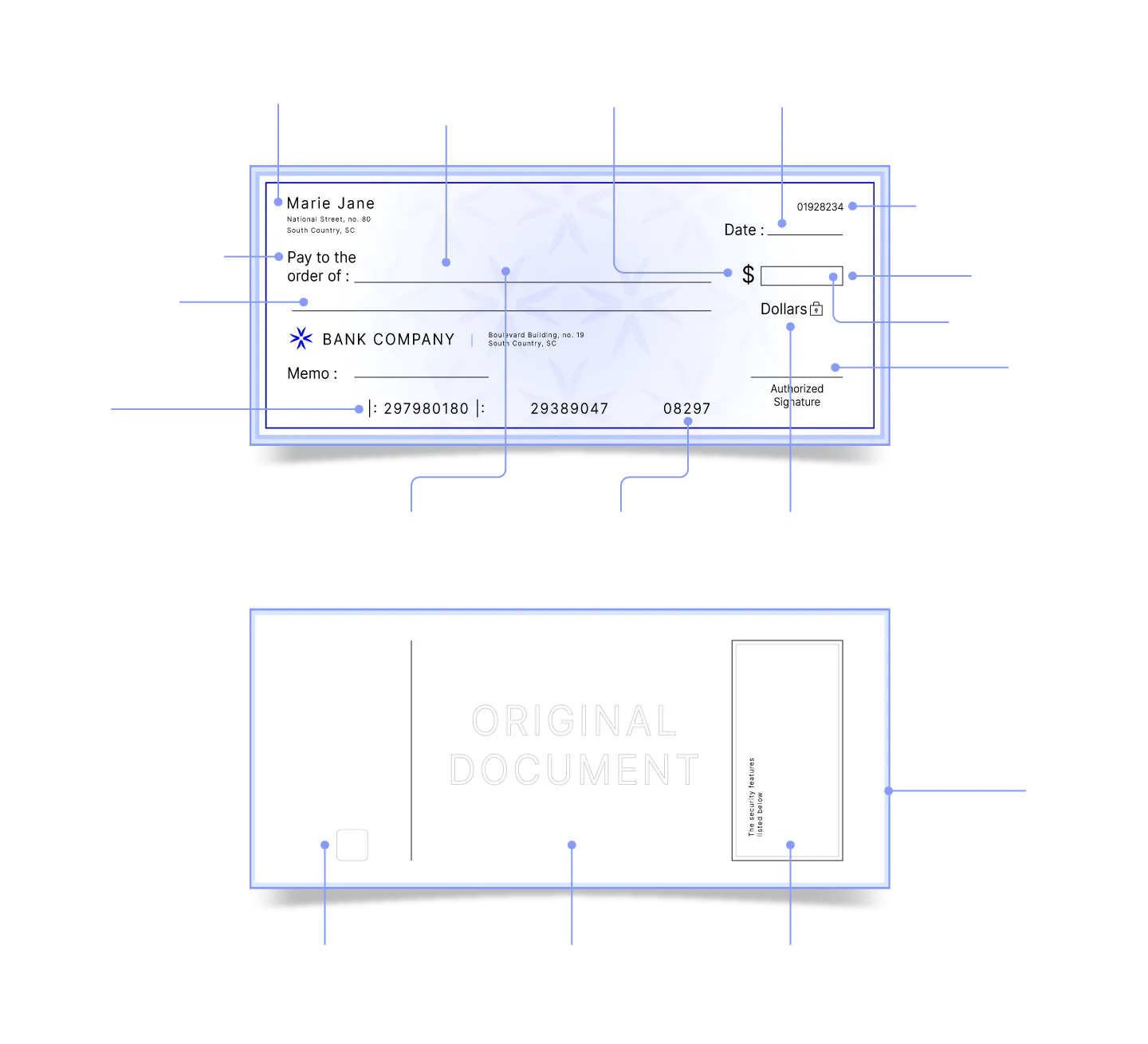

- Identify visual anomalies: AI-driven image analysis uses Optical Character Recognition (OCR), computer vision AI models, and algorithms to analyze 24 check attributes, including text and handwriting style, content layout, and signature and identity attributes

- Detect fraudulent check patterns: Cover all bases with anomaly detection, false positive reduction, and rapidly trained fraud typology AI models

- Tap into consortium intelligence: Mitek’s consortium shares cross-institution data to identify suspicious checks, stopping fraudulent checks in their tracks

- Accelerate alert review: Contextual AI explanations bring investigator clarity, leaving nothing open to interpretation

Streamline your check fraud prevention

- Quick integration with one rail-agnostic API

- Support for both API and batch processing

- Ability to process a variety of check types (eg. personal checks, cashier’s checks, transit checks, money orders)

- Coverage across multiple channels (eg. Remote Deposit Capture (RDC), mobile, ATMs, in-branch teller services)

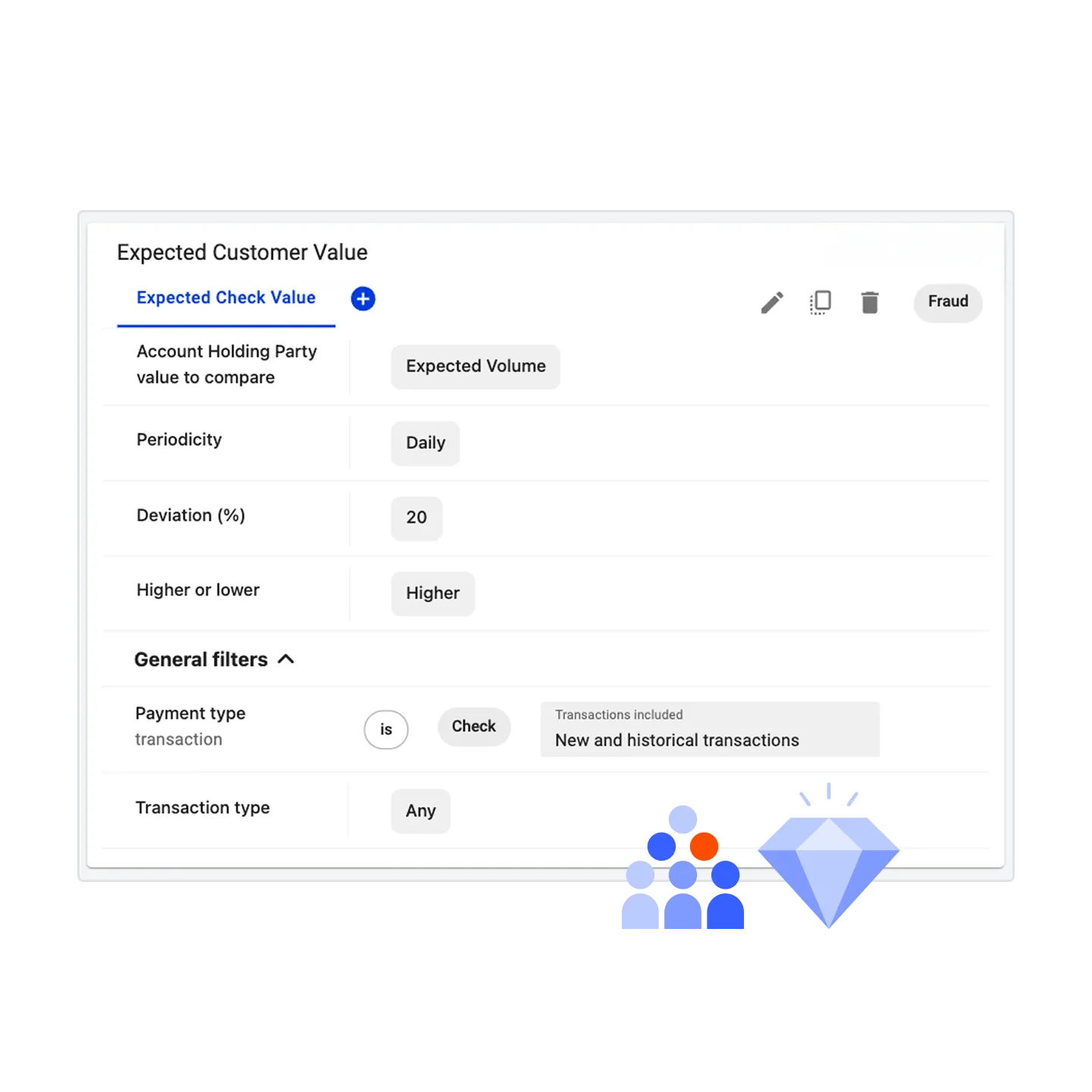

- Ready-to-use check fraud rules to hit the ground running

- Flexible rule creation and triggering to pinpoint suspicious payee activity

- Check attribute-specific risk scores and a best-fit historical reference for confident decisions on flagged checks

- Direct integration with Hawk’s fraud prevention solution for unified fraud management

The Hawk Difference Discover how Hawk raises the bar for efficient check fraud detection

The Traditional Way

- Outdated image forensics technology with poor accuracy

- Check fraud slips through because institutions are operating in isolation

- Reliance on external support to manage rules, delaying response time to fraud

- Confusing AI with limited visibility into why alerts are triggered

- Check data siloed from other payment rails, increasing the burden of operational maintenance

The Hawk Way

- Accurate check fraud detection combining best-in-class image forensics and precision AI

- Consortium insights allow FIs to suspicious checks across institutions

- Full control with flexible, self-serve rule management

- Clear and contextual AI explanations that speed up alert review

- Quick integration and easy maintenance of your fraud infrastructure with a single rail-agnostic API and unified fraud management

See Hawk's real-time check fraud detection & prevention software in action

Protect your bottom line, flagging fishy checks across the clearing process

Identify high-risk discrepancies through AI models and algorithmic analysis of 24 check attributes

Counterfeit Checks

Block counterfeit checks even if they’ve never been seen before. Hawk compares check attributes to Mitek’s consortium, uncovering anomalies in the MICR line, general geometry features, and more.

Altered Checks

Spot when a check’s handwriting, name and amount fields have been tampered with, before funds are released.

Forged Checks

Detect fraudulent drawer signatures or endorsements by using computer vision AI to analyze check images for subtle deviations from verified check profiles.

Check Floating

Stop fraudsters in their tracks with rules to detect rapid in and out flow of funds and high-value check deposits for a first-time depositor.

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Articles & Resources The latest from Hawk

Read about the missteps to avoid when employing AI in your fraud prevention system, like underusing internal data, relying on generic models, or ignoring explainability.

Learn how Hawk's new Fraud Day One Defense Models provide financial institutions personalized protection against common fraud attack vectors.

New report from Celent and Hawk shows that over half (53%) of US mid-market banks and credit unions are looking to expand their convergence of anti-money laundering and fraud prevention.

Frequently Asked Questions Want to know more?

Request a demo See a 500% return on investment with Hawk today

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have