Customer Risk Rating Personalized risk insight, focused risk monitoring

Better understand the risk of your customer throughout their lifecycle. Hawk's static, dynamic, and behavior-based risk scoring allows you to effectively manage each customer's risk, applying the right level of scrutiny in monitoring.

Product Highlights Better understand customer risks & refine downstream monitoring

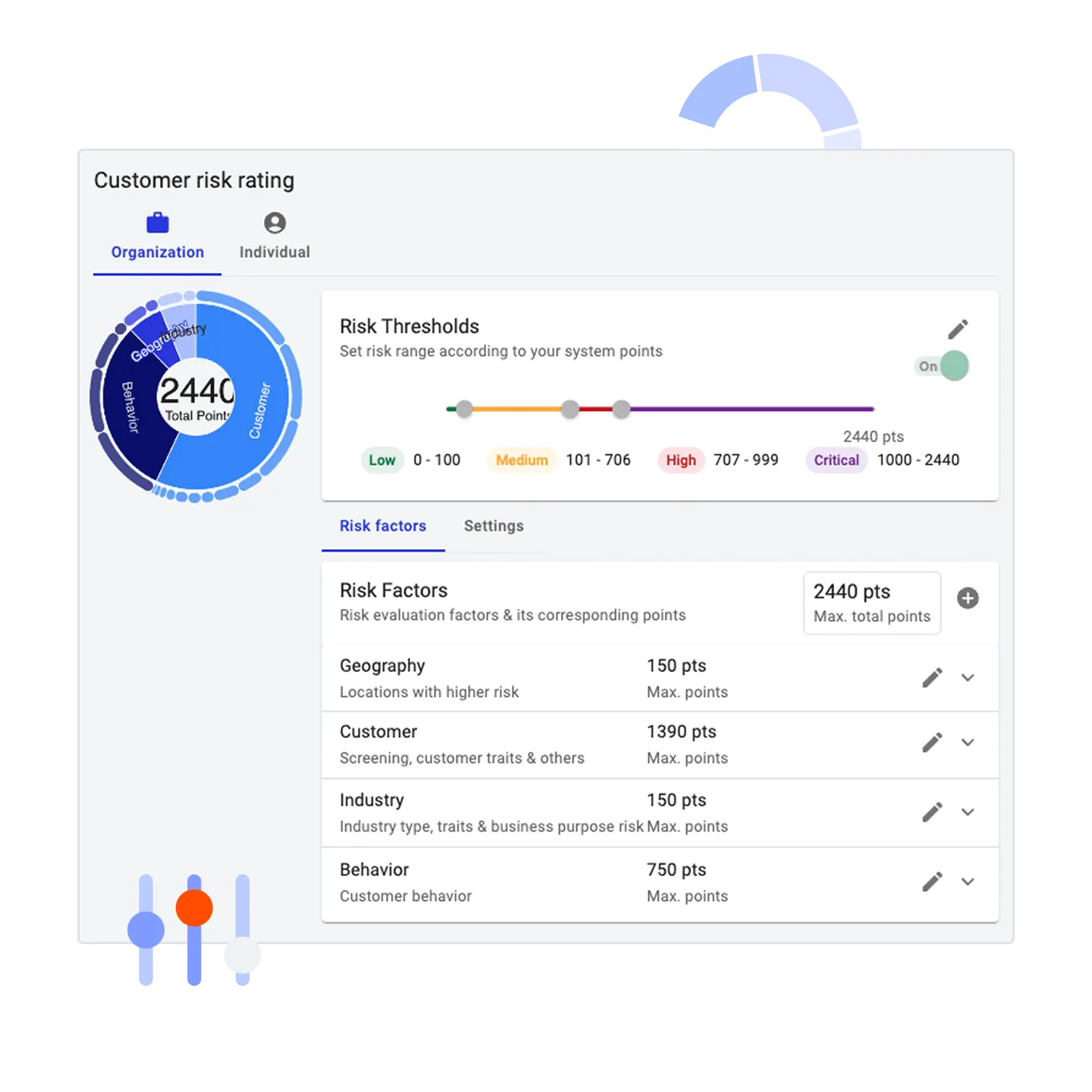

Set risk factors, adjust thresholds and tailor time- and trigger-based scheduling, with intuitive point-and-click controls

Leverage any of your own custom attributes as risk factors to reflect the distinct risks of your customer base

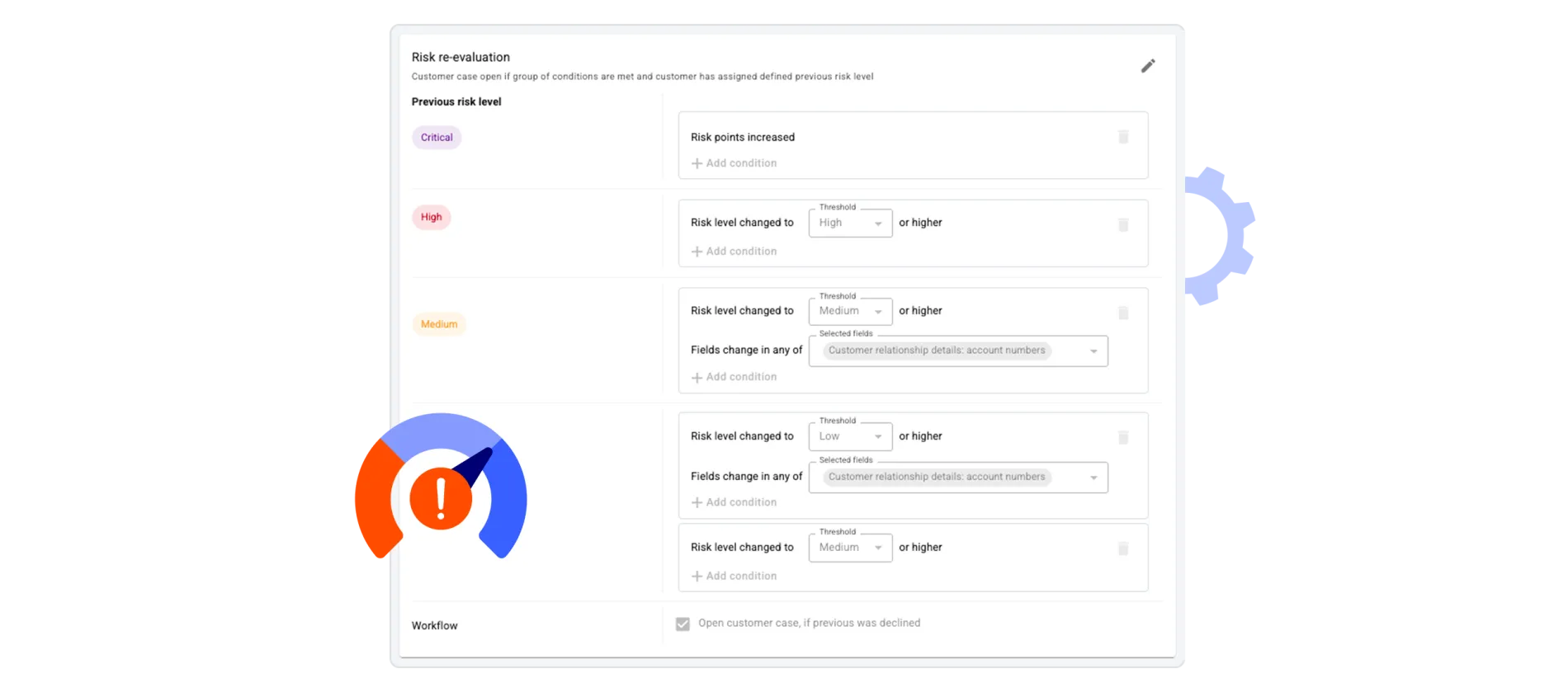

Capture significant risk decisions and deviations from expected activity in a customer’s risk score at the next scheduled review

AML risk scoring software Capture risks relevant to your institution

Go beyond static risk data – get accurate risk levels that factor in many dimensions of client risk and ensure risk-appropriate client monitoring

- Inherent risk factors along customer, geography, and product dimensions, like age, country of origin, occupation, business purpose, type of business, and UBOs

- Behavioral risk factors, including deviations from expected behavior and value, and anomalous behavior

- Confirmed financial crime risks, like sanctions hits, adverse media, political exposure, and SARs filed

Customizable risk assessment tool Tailor risk scoring to your own risk appetite

Get a risk model that fits your policies, not the other way around, with a range of optionality to address your needs

Overcome gaps in customer data

Apply the highest risk factor value when data is missing

Ensure a compliance-ready risk posture

Leverage Hawk’s rating against your internal score, automatically applying the higher rating

Align with your evolving risk decisions

Manually override risk levels on individual customer profiles with the right permissions

Adapt controls to regional needs

Empower different regions with their own customized risk models through Hawk’s multi-tenant structure

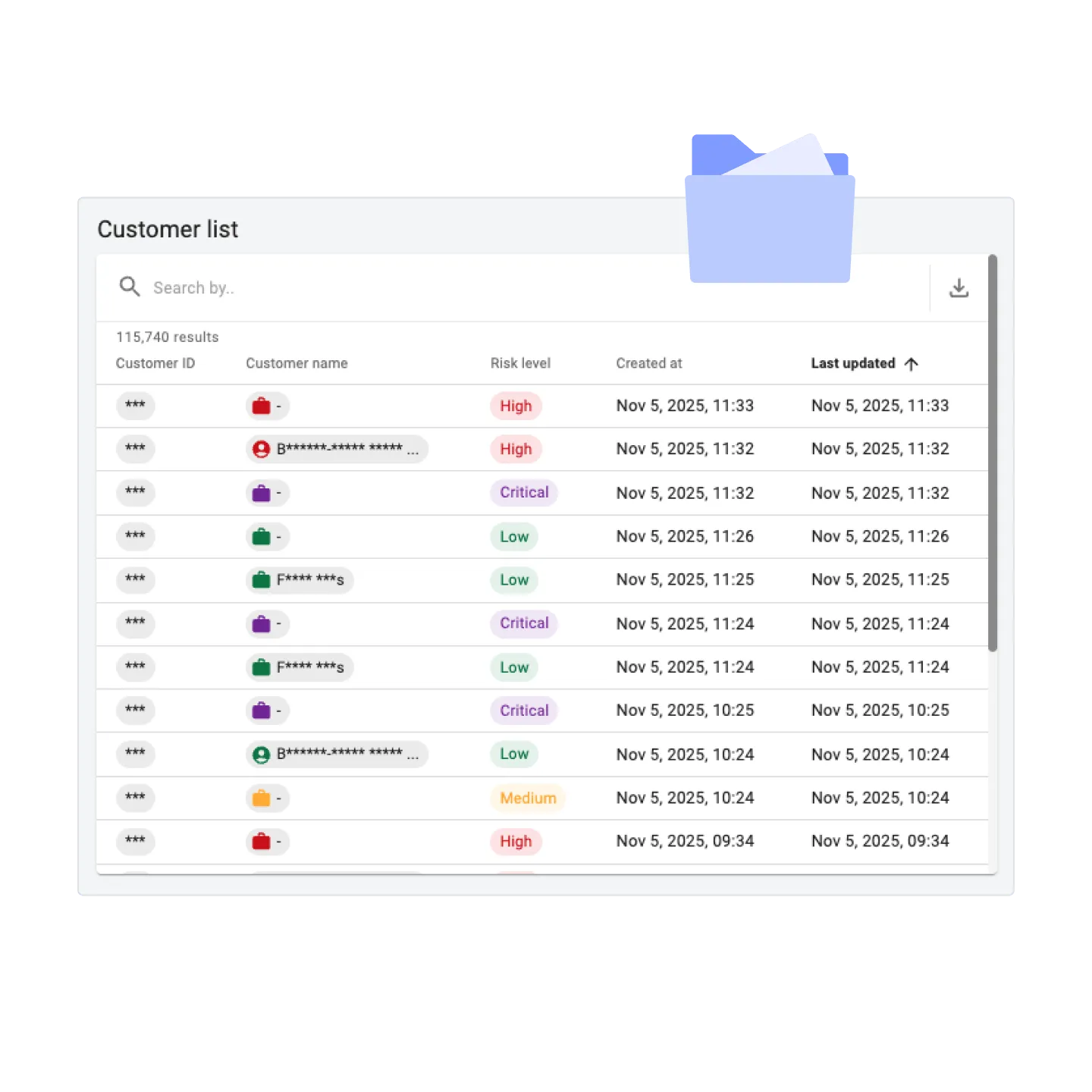

Gain a hawk-eyed view into your organization’s risk profile

Understand your overall risk profile with a consolidated list of all customers and their risk rating

- Easily search for a customer’s profile

- See how their risk evolved with a history of profile changes

- Extract customer profile information for sharing with regulators, auditors, or colleagues

- See historical actions with a full audit trail

The Hawk Difference Discover how Hawk raises the bar for efficient customer risk rating

The Traditional Way

- Outdated, static risk ratings that fail to reflect a customer’s true risk

- Lack of granular configuration to reflect the distinct risks of your customer base

- Dependency on third-party support to make changes

- Disjointed risk profiles with disparate data

- Structure that only supports a global AML approach

The Hawk Way

- Static, dynamic, and behavior-based risk scoring

- Ability to leverage any custom attribute as a risk factor

- Intuitive point-and-click controls to set risk factors, adjust thresholds, and tailor scheduling

- Unified risk profiling that combines internal and external data

- Multi-tenant structure to support regional customer risk assessment

Strengthen AML compliance across the customer lifecycle

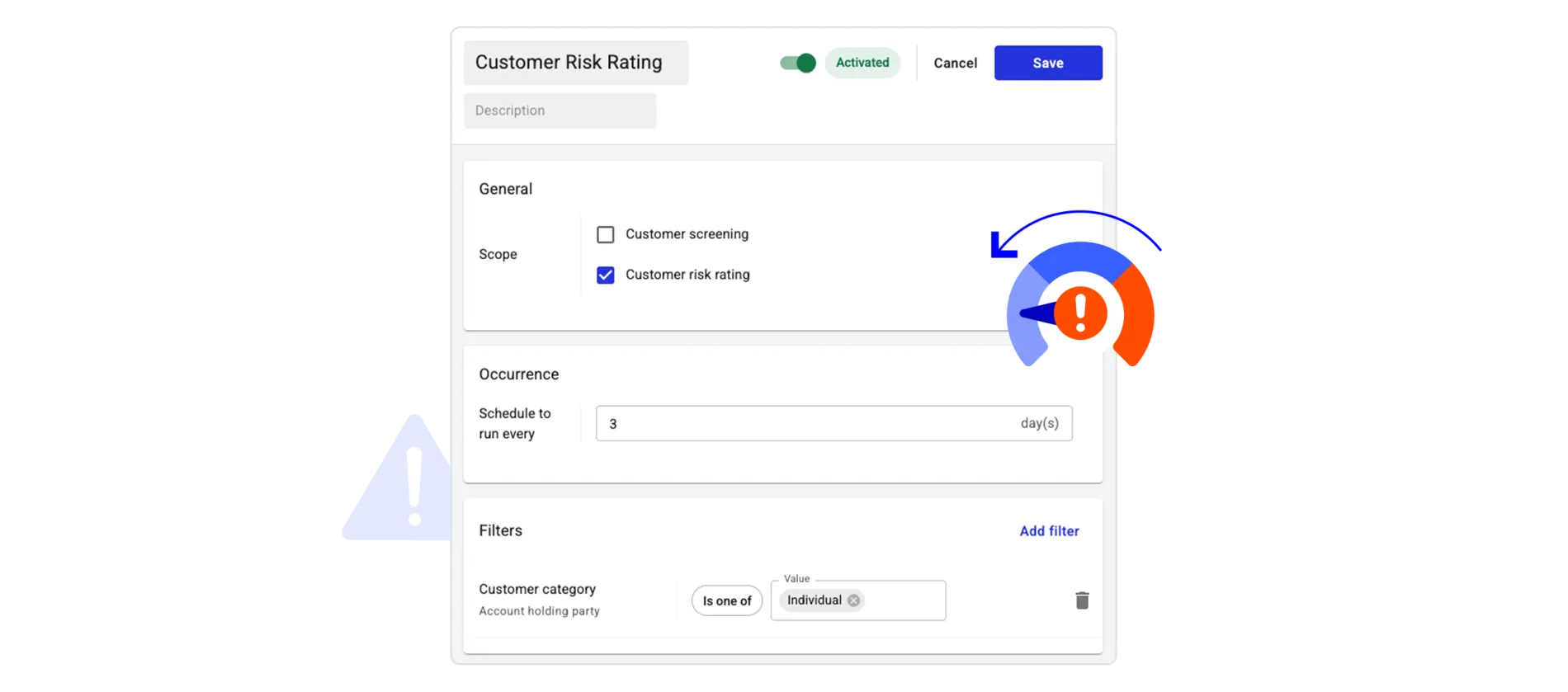

Review customers’ risk during onboarding, at regular cadence, on demand, or in response to significant changes

Customer Due Diligence at Onboarding

Accurately assess customer risk from the start—automatically get risk scores in your KYC solution and identify high risk customers through Hawk’s API

Periodic Reviews

Refresh customer risk ratings at defined intervals to ensure appropriate segmentation and ongoing monitoring

Ad-Hoc Risk Assessments

Quickly reassess customer risk whenever new information or suspicious activity surfaces

Trigger-Based Reviews

Automatically update risk ratings in response to defined events, such as an increase in the risk score, a change in risk level or a change in customer account number

Awards & Recognition Leading the industry forward

Learn how Hawk's AI-fueled technology is driving the future of AML & CFT, according to software analysts and industry experts.

Forrester Wave Hawk Named a Strong Performer in Anti-Money Laundering Solutions Evaluation

Hawk has been recognized as a Strong Performer by Forrester in its new report “The Forrester Wave™: Anti-Money-Laundering Solutions, Q2 2025”. In the report, Forrester stated; “Hawk’s innovation is ahead of the competition.”

See risks clearly and respond decisively with precise customer risk assessment tools

Hawk's AI Manage AML Risk effectively with AI

Leverage Hawk’s AI-powered transaction monitoring together with dynamic customer risk rating to segment clients better and spot money laundering threats with increased precision

Advanced Anomaly Detection

Take behavioral risk scoring and segmentation one step further, using machine learning algorithms to identify anomalous activity compared to each client’s own historical behavior and versus their peers

Pattern Recognition

Employ AI models to recognize known criminal patterns, spotting illicit activities with greater precision for each client segment than rules alone

False Positive Reduction

Amplify the impact of good risk rating and segmentation, further refining detection outputs with AI so compliance teams can focus on genuine risks

Explainable AI

Benefit from AI that provides clear, contextual explanations, for faster customer risk understanding and alert reviews

Articles & Resources The latest from Hawk

We discuss how AI technology can help banks perform more trigger-based AML checks instead of periodic reviews, making their AML programs more effective and efficient.

Learn about the Wolfsberg Group's Statement on Effective Monitoring for Suspicious Activity, which recommends that banks move from AML transaction monitoring only to a broader approach incorporating more customer data.

Hawk is pleased to announce the successful deployment of its advanced anti-financial crime platform for VakıfBank International AG, setting a new standard in anti-money laundering (AML) compliance and perpetual KYC.

Frequently Asked Questions Want to know more?

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have