Case Management Reduce average investigation time

Efficiently route, investigate, and action alerts across AML, fraud, and screening, managing your entire FinCrime program from one place.

Product Differentiators Streamline operations with a modern case manager

Empower even the most junior of staff, given the right permissions, to set rules, manage alert workloads, and investigate activity

Make it easy for analysts to dissect what exactly is going on and whether it's criminal, with complete context on the customer and transaction(s)

Break down data siloes. Streamline operations and get better insights with your entire financial crime, fraud, and compliance program all in one place

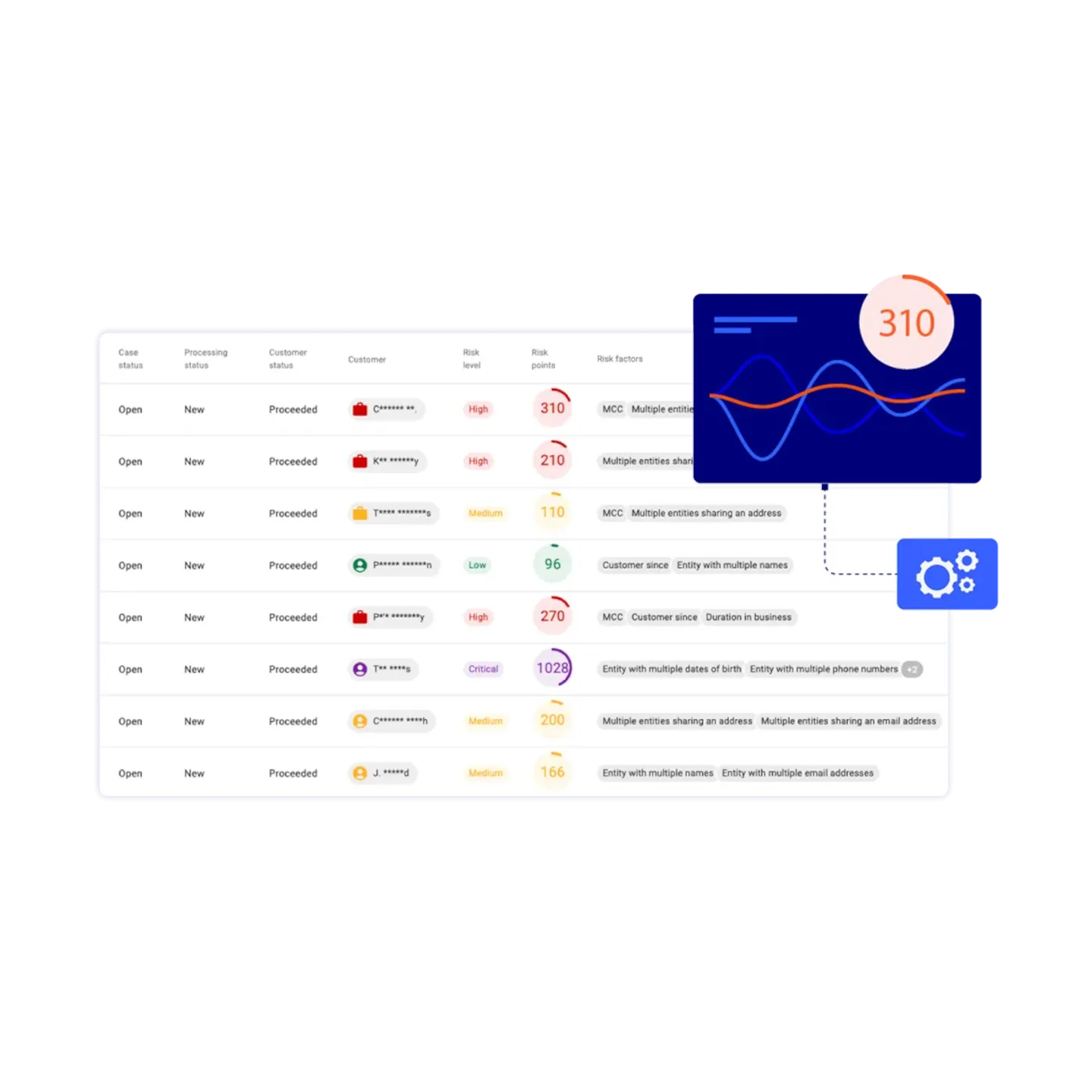

Alert and case management Review alerts with speed

Consolidate your financial crime and compliance data and alert management into Hawk's integrated platform, including:

- User and role management with permissions-driven access

- Alert queues and assignment, with powerful filters to prioritize review

- Email and in app notifications and due date reminders

- Pre-built investigative workflows for fraud and AML cases

- Intuitive investigative interface with a 360 degree view of each customer

- Alert escalation and 4-eye review / approval processes

- Integrated audit trails and regulatory reporting

- Alert sampling and quality assurance

- Program performance monitoring and productivity dashboards

The Hawk Difference Discover how Hawk raises the bar for efficient payment screening

The Traditional Way

- Generic user permissions that grant too much or too little access

- Unclear alert prioritization creating carried risk and missed deadlines

- Lots of data but no clear explanation of why an alert is flagged

- Narrow-minded and inefficient investigations

- Inconsistent decisions depending on who reviewed an alert

- Fragmented systems with no one place for management oversight

- Inability to assess analyst performance and outcomes

The Hawk Way

- Granular user permissions that ensure role-appropriate access

- Dynamic filters and scoring for clear prioritization

- Accessible model explanations that drive clarity

- Customer-centric, context-driven investigations for accurate decisions

- Pre-built workflows for consistent, process-driven reviews

- Centralized management dashboards with performance insights

- Continuous analyst upskilling with alert sampling and QA

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Articles & Resources The latest from Hawk

Discover how Agentic AI helps financial institutions streamline the AML investigative process through data collection, case categorization, and the automated crafting of a SAR narrative.

Financial institutions looking to boost their real-time risk detection and investigation capabilities can now use a groundbreaking innovation from Hawk.

Learn how Generative AI can help Financial Institutions detect sanctions violations, money laundering, and fraud, aid investigations, and improve QA processes.

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have