Transaction Fraud Cut payment fraud with real-time protection

Prevent fraud at the point of payment—across traditional, instant and P2P rails.

Product Differentiators Strike fast, stopping payment fraud with hawk-eyed precision

Stop unauthorized fraud in its tracks with AI models tailored to your transaction patterns, matured, and deployed in under three days

Halt fraud instantly (150 ms average) and release legitimate funds quickly with crystal-clear AI reasoning for each flagged transaction

Create, test, and deploy fraud rules on the fly to block flash fraud and fraudsters testing the limits of your controls

payment fraud detection software Shut down attacks by addressing risks at speed

Don't let misleading 'real-time' claims and reliance on external support leave you exposed; get effective protection with tailored transaction fraud defenses and agile control

Prevent payment fraud with real-time precision

- True real-time payment and card fraud detection (150 ms average)

- Support for all payment rails with rail-agnostic API (ACH, BACS, Card, Check, P2P, SEPA, Wire)

- Payment interdiction that allows you to block, hold, and release transactions

- Out-of-the-box rule guidance including ACH/wire fraud, ATM fraud, card fraud, check fraud, merchant fraud, and more

- Self-serve rule management, configuration, and live sandbox testing

- Rapidly trained AI models to detect chargeback fraud, stolen credit cards, and more

- Automatic AI model governance

AI from Hawk Generate an instant return on investment with explainable AI

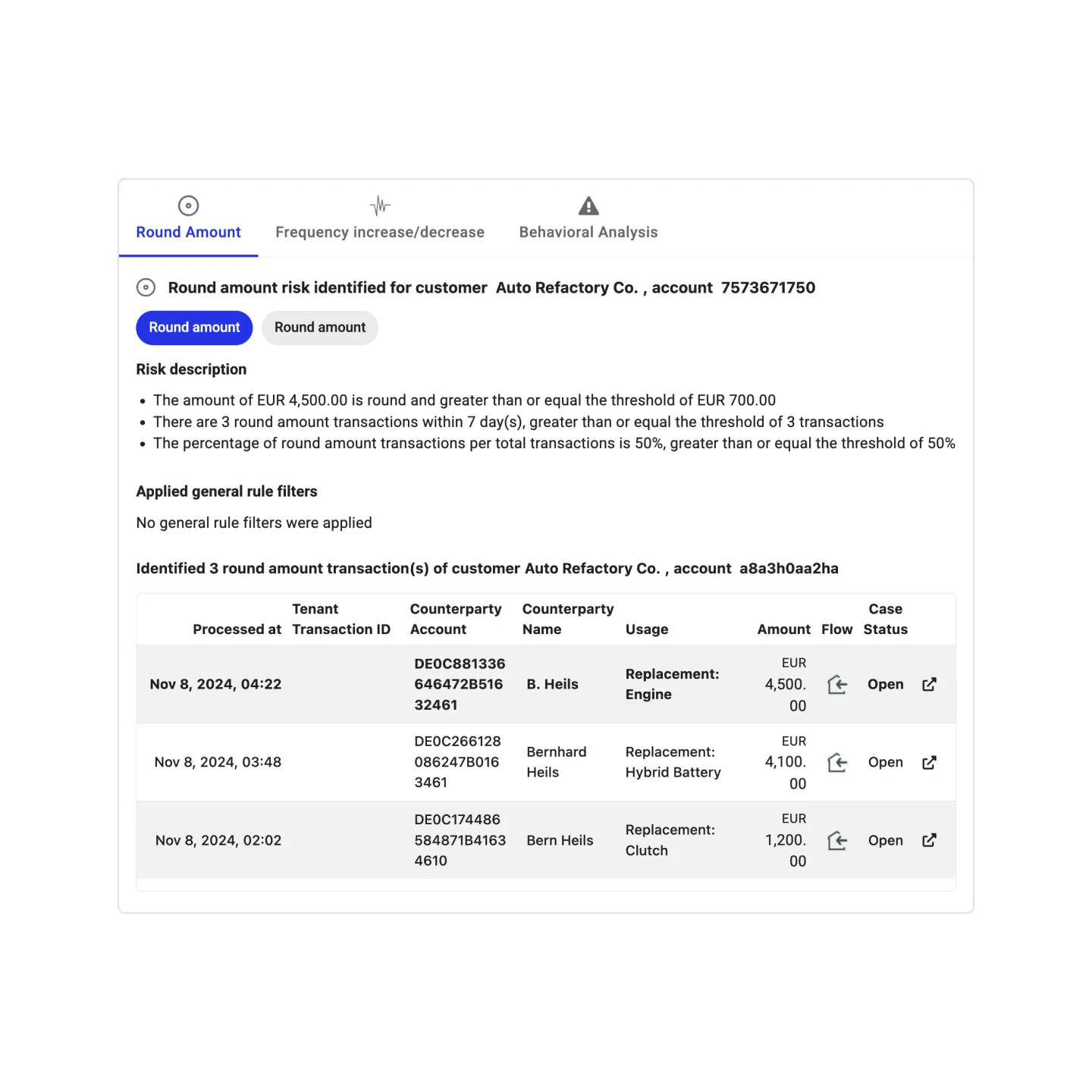

AI transforms transaction fraud detection, reducing unnecessary alerts and providing clarity that enables analysts to act with confidence, all while keeping legitimate customers’ payments moving.

Cut losses from known transaction fraud patterns

Transaction fraud-specific machine learning models are tailored to your distinct card and payment fraud risks and deployed at speed with Hawk’s Day One Defense Models

Quickly spot new types of unauthorized fraud

Hawk’s advanced anomaly detection models protect customers by detecting suspicious payments outside of their typical behavior

Cut unnecessary customer friction

Reduce noise with made-for-you false positive reduction models and accelerate transaction review with intuitive AI explanations

Prevent more suspicious payments with a true real-time payment fraud solution

The Hawk Difference Discover how Hawk raises the bar for efficient payment fraud detection

The Traditional Way

- Ineffective, generic out-of-the-box AI fraud typology models

- Support team–managed rules that delay fraud response, letting some fraudulent transactions slip through.

- AI that generates alerts unclear explanations on why alerts are triggered

- Outdated user interface that slows down investigation creating friction

- Single control setup for all product lines and white-label customers

- Fragmented APIs with higher complexity and maintenance overhead

The Hawk Way

- Day one defense models for personalized protection at the speed of out-of-the-box models

- Full control with flexible, self-serve rule management

- Clear and contextual AI explanations which speed up alert review

- Sleek interface and unified case management, delivering cross-payment rail insights all in one place

- Multi-tenant structure for different business units or merchants

- One payment-rail agnostic API

No payment rail left unprotected

Easily add new payment methods on the fly with Hawk’s rail-agnostic API

ACH, SEPA & BACS

Secure domestic and cross-border payments, preventing fraudulent schemes like:

- ACH kiting or lapping

- Fraudulent SEPA credits

Card

Prevent fraudulent debit and credit card transactions and reduce chargebacks before they impacts your business. Detect risks such as:

- Card-present (CP) and card-not-present (CNP) fraud

- Card testing and BIN attacks

- Stolen card credentials

Check

Stop fraudulent checks before they clear. Detect fraudulent check activities including:

- Forged checks

- Altered checks

- Counterfeit checks

- Check kiting and floating schemes

P2P

Protect your customers and platform from scams and fraudulent peer-to-peer payments, including:

- Phishing attacks and social engineering

- Mule accounts

- Rapid transfers between accounts

SWIFT & Wire

Ensure high-value transfers are secure, and unauthorized payments are prevented. Fraudulent activity may involve:

- Fraudulent SWIFT messages

- Transfers to high-risk jurisdictions

Hawk's AI Day One Defense Models: How to get tailored fraud prevention AI models quickly

Hawk's Day One Defense Models are AI typology blueprints fine-tuned to the specific needs of each financial institution, to deliver hyper-personalization, fast deployment, and high accuracy.

Frequently Asked Questions Want to know more?

Articles & Resources The latest from Hawk

Read about the missteps to avoid when employing AI in your fraud prevention system, like underusing internal data, relying on generic models, or ignoring explainability.

Read about AI-enabled compliance in the new industry report by Hawk and Chartis.

New report from Celent and Hawk shows that over half (53%) of US mid-market banks and credit unions are looking to expand their convergence of anti-money laundering and fraud prevention.

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have