FRAML Integrate your fraud and compliance programs

Hawk enables financial institutions to realize the many benefits of AI-powered fraud and AML convergence, including cost savings, improved investigation context, increased detection accuracy, and enhanced response to regulatory requirements.

Framl Solution Enhance your response to regulatory requirements with a combined approach

The benefits of FRAML

Many financial institutions, especially mid-sized or fast-growing FIs, have recognized the benefits of converging fraud and AML

- 56% of mid-sized banks and credit unions have already converged AML and fraud systems

- The cost savings are significant: 77% expect to save over $1M within the first 5 years of convergence, with 36% expecting savings to exceed $5M

- Other benefits include increased detection accuracy and effectiveness, improved investigation context, and enhanced response to regulatory requirements

A FRAML approach can enable FIs to overcome challenges in their AML and fraud prevention operations, including analyst staffing, investigation management, and cost optimization.

The Hawk solution

Hawk’s AI-powered platform enables FIs to successfully realize the benefits of converging fraud prevention and AML. With Hawk you can:

- Provide data once across use cases with a shared data infrastructure

- Respond in real-time but analyze activities over longer time frames

- Consolidate insights on customers so fraud and AML teams consistently have the right information to make informed decisions

- Provide flexibility to respond to changing demands and pivot resources to where they’ll have the most impact

The Hawk Difference Discover what sets Hawk apart in combining Fraud & AML processes

The Traditional Way

- Two separate, complex technology stacks that are costly and difficult to manage

- Misleading “real-time” claims that lag by seconds or minutes

- Multiple API endpoints that complicate set up and data maintenance

- Reliance on external support to manage rules

- Offline sandboxes that rely on stale data

- Ineffective, one-size-fits-all AI models

- Slow investigations from manual data reconciliation and siloed data access

- Machine-language AI explanations that slow down case reviews

- Outdated user interface that slows down workflows and creates a steep learning curve for new users

The Hawk Way

- Unified detection on a single platform that simplifies system management, lowers TCO, and allows you to pivot resources

- True real-time response (150 ms average) coupled with ability to analyze activities over longer time frames

- Single API endpoint to provide data once/use for any use case

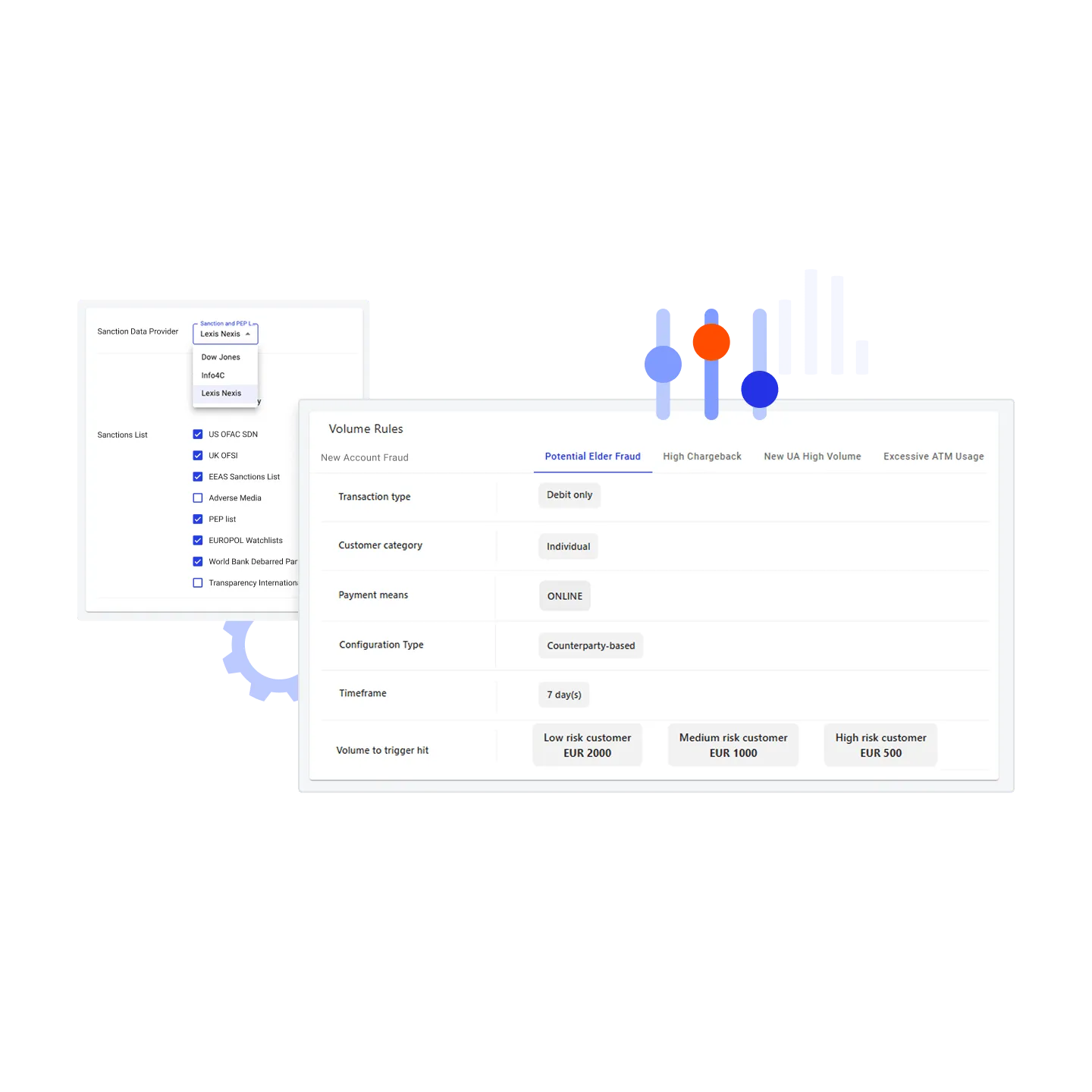

- Complete control to optimize detection with agile, self-serve rule management and optimization

- Production-grade sandbox with live data for reliable testing

- Day one defense models for personalized protection at speed

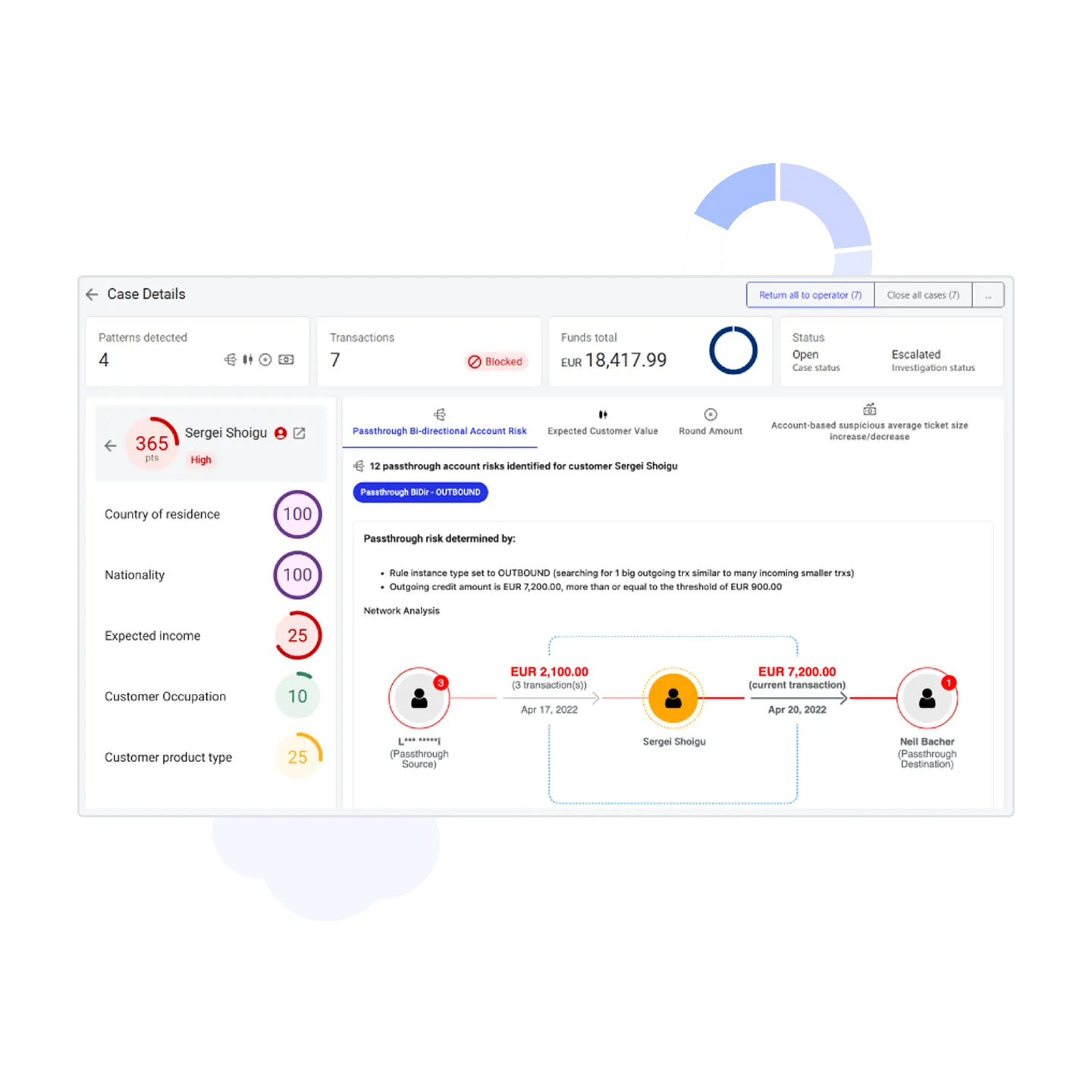

- Consolidated insights on customers so teams consistently have the right information to make informed decisions

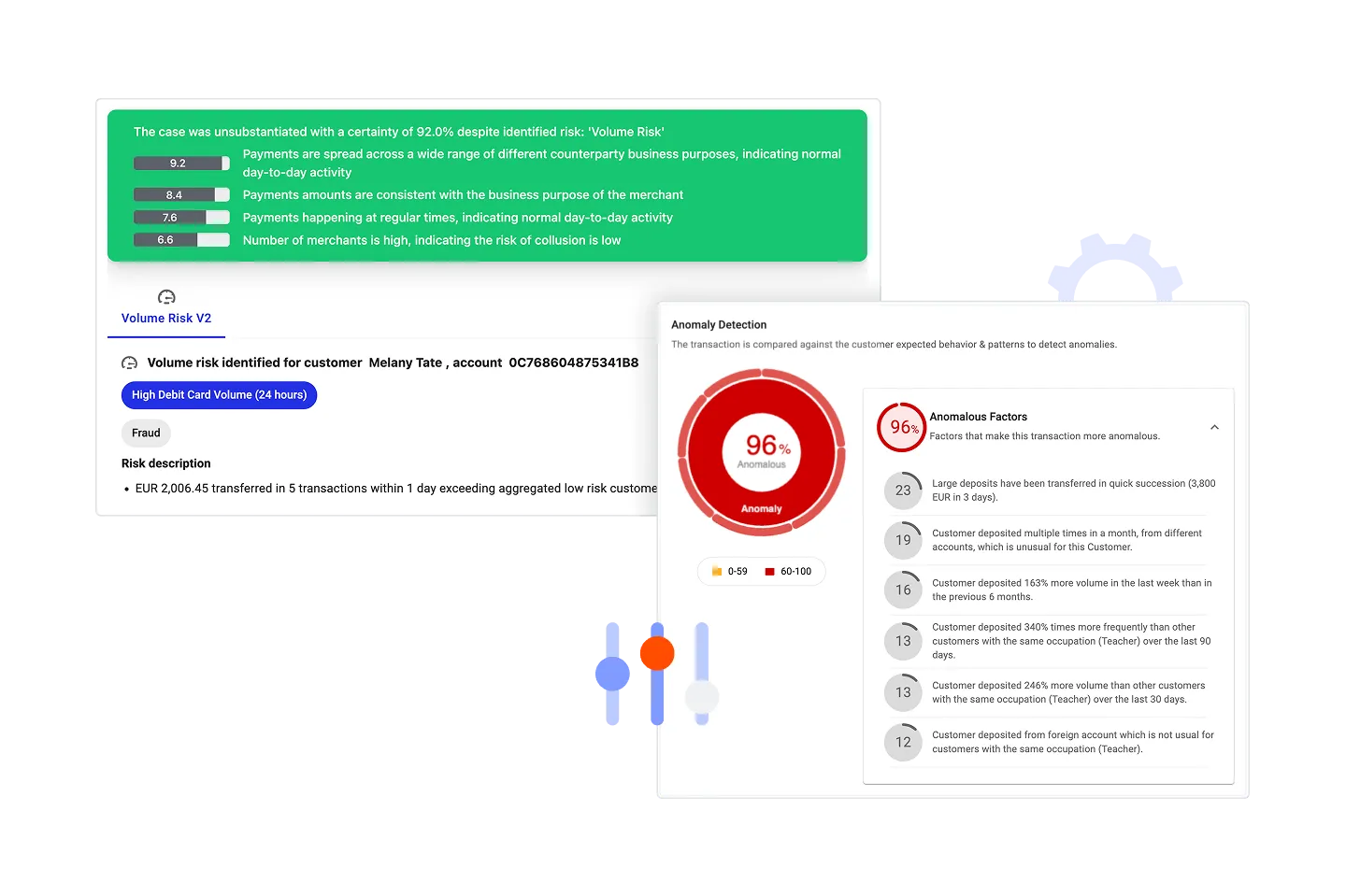

- Contextual AI explanations that give clarity, accelerating investigations

- Sleek interface and unified case management

Product Suite Unified financial crime & compliance management

Combine insights, accelerate investigations, and streamline resource management with a single, consolidated system

Customer Risk Rating

Maintain due diligence throughout the customer lifecycle using dynamic and static data to maximize risk coverage

Customer Screening

Screen against global sanctions lists, watchlists, politically exposed persons (PEP) lists, and adverse media databases

Payment Screening

Screen payments to identify and prevent suspicious transactions, using powerful matching technology

Transaction Fraud

Monitor transaction behavior to detect fraudulent patterns across all channels and payment methods

AML Transaction Monitoring

Increase risk coverage and reduce false positives, with the option of explainable AI to significantly increase performance

Alert & Case Management

Get a holistic view of your alerts and maximize efficiency with a unified case manager

Trends in Fraud & AML Convergence at US Mid-Sized Banks & Credit Unions

Discover the benefits and ROI that US mid-sized banks and credit unions are already seeing from adopting a FRAML approach.

How Hawk drives end-to-end efficiency across fraud & AML

Unified Integration & Data

Achieve FRAML quickly with a platform designed for convergence:

- Purpose-built to ingest and process risk data in both real-time and bulk, allowing you to unify fraud and AML processes

- Integration via a single API brings together fraud and AML data, facilitating a holistic customer view

- Rapid time-to-value: Direct integration with core banking platforms, like CSI, FIS, Fiserv, and Jack Henry

Precision Risk Detection

Drive superior detection accuracy with explainable AI models and full control over your rules:

- Respond to threats with agility: Optimize rule coverage without external support with self-serve rule configuration and sandbox testing

- Slash false positives: Hawk's made-for-you AI models contextualize customer activities while improving analyst clarity

- Get tailored typology protection: Leverage rapidly configured Day One AI models (for ATO, APP fraud and more) for custom protection at the speed of out-of-the-box models

- Make defensible, audit-ready decisions: Rest assured with full model transparency and governance, including version control, model lineage, and AI explanations that provides transparent decision rationale to auditors and regulators

High Efficiency Analyst Toolkit

Maximize analyst productivity and eliminate blind spots with:

- Consolidated case management: Consolidate all fraud and AML alerts into a single platform, eliminating data silos and streamlining resource management

- Cross-functional collaboration: Intuitive dashboards and collaboration tools facilitate seamless information sharing and cross-training, reducing duplicate efforts

- Program controls & quality assurance: Ensure analysts conduct all necessary tasks and make accurate, quality decisions with automated workflows, 4-eyes reviews, and alert sampling processes

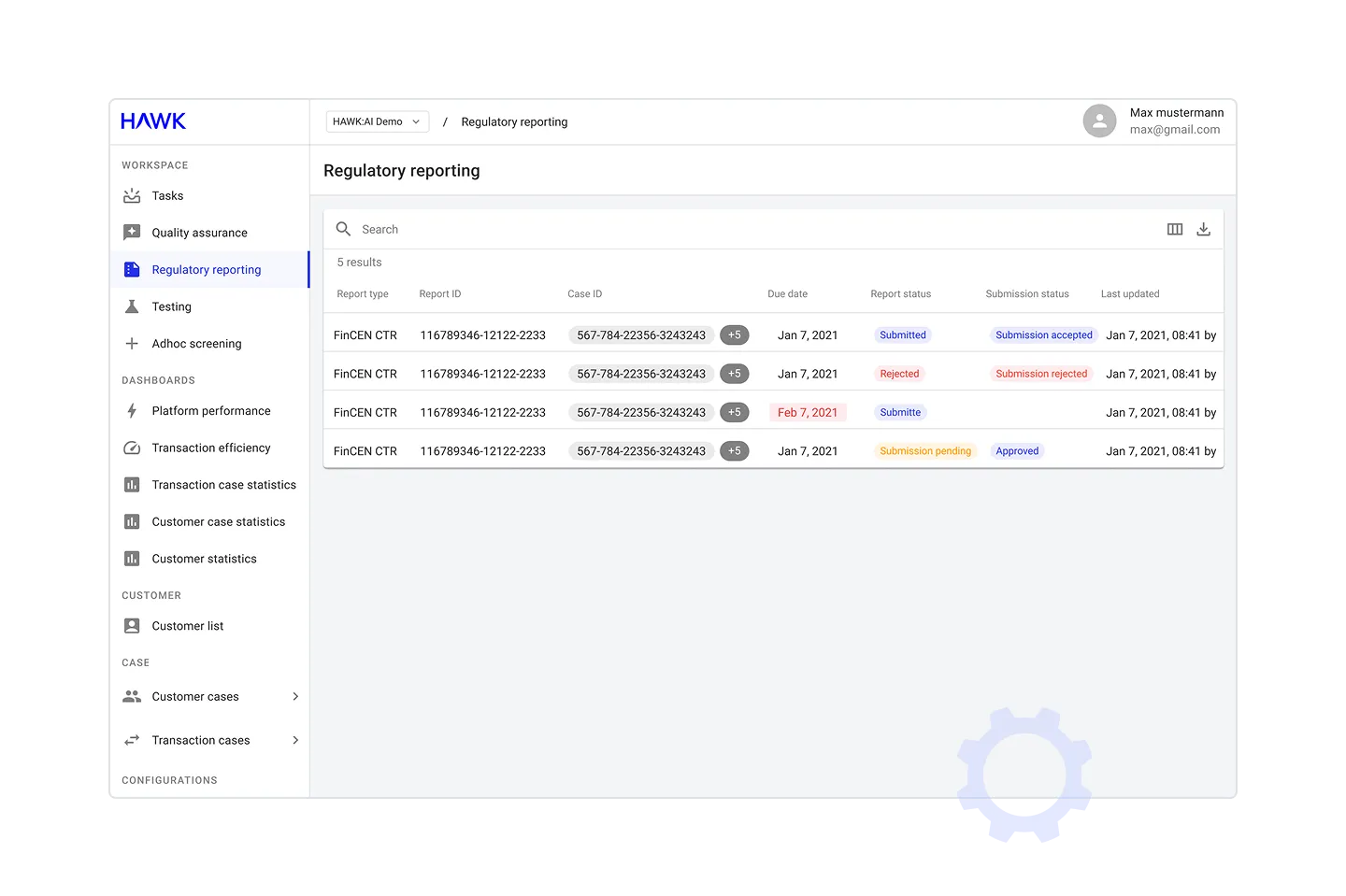

Streamlined Regulatory Compliance

Ensure fast, transparent, and regulator-ready reporting.

- Regulator-approved AI explanations: Hawk provides clear AI model explanations and complete model governance documentation, ensuring seamless audits and examinations

- Centralized reporting hub: Manage and view all regulatory reports (SARs, STRs, CTRs) in one centralized space, simplifying process oversight

- Smooth regulatory submissions: Easily prepare GoAML SAR reports and directly e-file SARs and CTRs with FinCEN, ensuring your reporting is as fast and streamlined as your converged FRAML operations

Articles & Resources The latest from Hawk

New report from Celent and Hawk shows that over half (53%) of US mid-market banks and credit unions are looking to expand their convergence of anti-money laundering and fraud prevention.

Banks and credit unions are seeing significant return on investment from the convergence of fraud and AML, while also benefitting from better risk visibility and numerous other advantages. Find out more in Celent's report.

Discover how US banks are approaching the convergence of fraud and AML and read all the takeaways from our webinar with ACAMS.

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have