Entity Risk Detection Entity intelligence that surfaces hidden threats

Increase the efficiency and effectiveness of your AML and fraud program with a clearer understanding of each customer’s risk through entity and network analytics.

Product Highlights Find hidden risk with a supercharged understanding of entity relationships

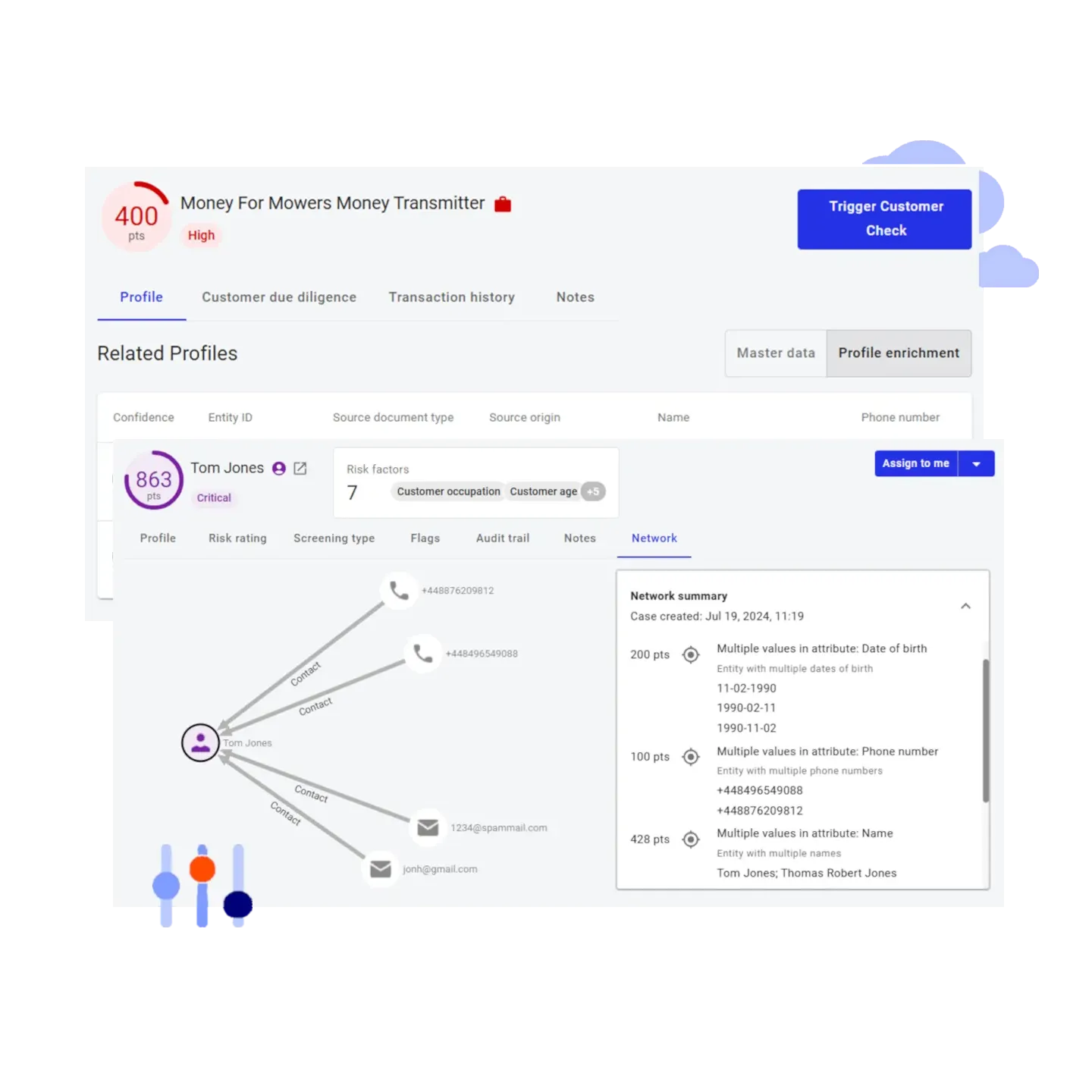

Build an accurate 360° view of each customer, leveraging all available data without additional engineering effort

Strengthen customer risk rating, capturing hidden links and indirect exposure traditional factors miss with relationship and behavior-driven risk signals

Contextualize an entity’s activities, easily spotting relevant connections during an investigation with automatic risk network visualization

Effective entity risk detection Evaluate risk with precision

Right-size monitoring with improved risk scoring and segmentation

- Entity resolution of customer data

- Automated network generation and risk propagation

- Entity and network-based analytics to identify targeted risks like ID manipulation and risky connected entities

- 360° view and lean visualization of each customer’s network highlighting relationships and related risks for investigators

The Hawk Difference Discover how Hawk raises the bar for entity and network analytics

The Traditional Way

- Inability to get a clear picture of who you're doing business with

- Data silos leading to incomplete customer insights and blind spots

- Risk ratings based mostly on information provided by a client at onboarding, not ongoing activity or indirect risk

- Manual investigations needed across fragmented systems to uncover hidden or emerging risks

- Inability to see what network an entity operates in without a huge investigative effort

The Hawk Way

- Clear understanding of each entity, even across duplicate profiles and accounts

- Consolidated entity profiles for a 360° view of customer risk

- Network analytics that reveal hidden relationships and anomalies

- Automated visualization of a customer network to support investigations and case closure

- Entity network insights for faster, more accurate investigations

Articles & Resources The latest from Hawk

In this article, we discuss how Entity Risk Detection technology helps financial institutions identify entity risk at onboarding, connections to higher-risk entities, shell company risk, and account opening fraud risk.

In this article, we explore how Entity Risk Detection technology helps banks solve risk management problems by surfacing unknown money laundering, fraud, and sanctions risk in customer attribute data.

Learn about the top drivers of change in fraud and AML compliance, according to the latest FRAML report released by Celent and Hawk

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have