Risk Screening Precise screening with minimal friction

Protect your institution and meet sanctions obligations with minimal customer friction. Accurately understand customer risk and block risky payments with high-precision screening for sanctions, PEPs and adverse media.

Risk Screening Solution Get precision hits, no alert fatigue

The age-old problem in screening?

High false positive volumes. As customer and transaction volumes grow, legacy systems can’t keep up. Disjointed tools slow teams down, forcing them to spend valuable hours clearing false hits while good customers await updates.

Hawk’s AML screening software brings accuracy and speed. A proprietary, flexible screening algorithm delivers precision, while the unified cloud infrastructure ensures fast performance.

That means fewer held payments, faster customer onboarding, and sharper detection of genuine risks, across sanctions, PEPs, and adverse media.

The Hawk Difference Discover how Hawk raises the bar for efficient watchlist screening

The Traditional Way

- Payments blocked unnecessarily

- Generic algorithm, not built specifically around screening use cases

- Slow processing and poor scalability

- Costly maintenance with individually mapped connections to each payment rail

- One-size-fits-all approach that doesn’t reflect local regulations

- Hardcoded rules, managed by vendor support team

- Outdated user interface requiring many clicks and one-hit-at-a-time reviews

The Hawk Way

- Friction-right controls with low false positives

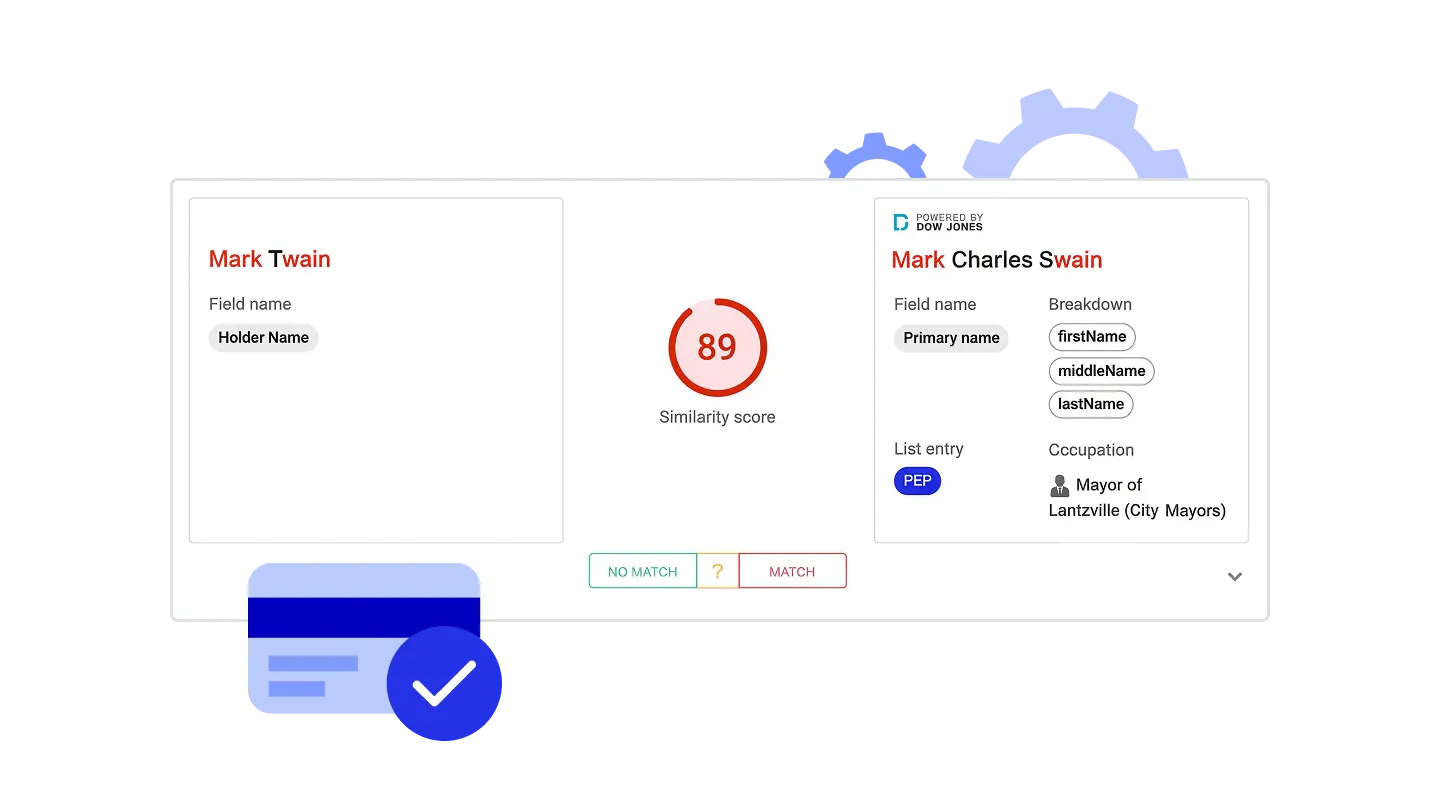

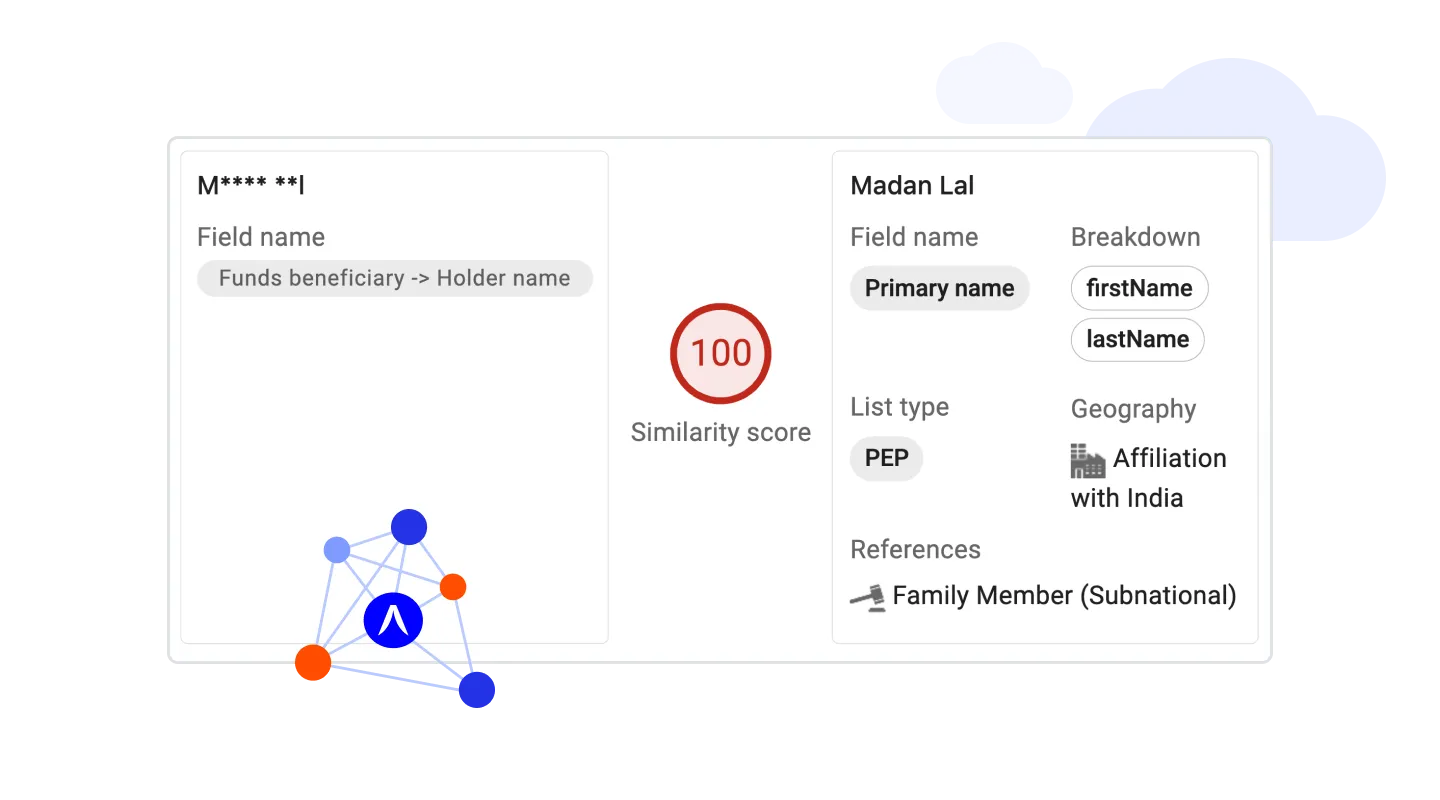

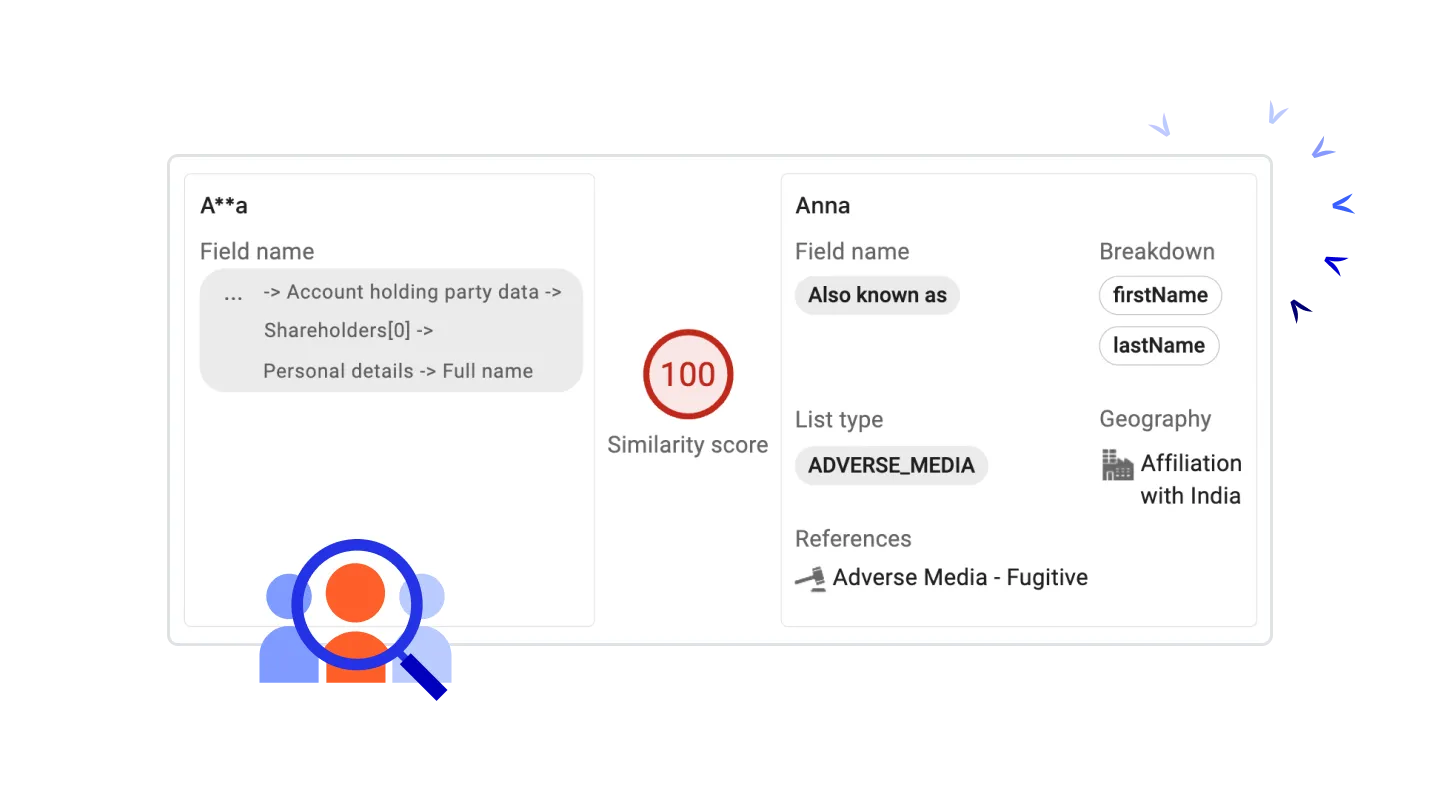

- Proprietary fuzzy matching algorithm with granular, rule-specific tuning settings

- 150 ms avg. response time for payment screening at scale

- Easy maintenance thanks to uniform payment rail mapping via single API

- Multi-tenant structure that supports regional regulations

- Self-serve model configuration and sandbox testing

- Simplified, unified view of all watchlist hits

Product Suite A unified screening system with a centralized case manager

Customer Screening

Maintain due diligence throughout the customer lifecycle using dynamic and static data to maximize risk coverage

Payment Screening

Screen payments to identify and prevent suspicious transactions, using powerful matching technology

Hit Resolution & Management

Get a holistic view of your alerts and maximize efficiency with a unified case manager

Our main screening features at a glance

Sanction Screening

Identify and block transactions involving sanctioned entities, countries, and sectors.

- Automated screening against global and local sanctions lists (OFAC, OFSI, UN, EU, etc.)

- Routine list updates for compliant, ongoing screening

- Configurable fuzzy matching logic to reduce false positives

PEP & RCA Screening

Pinpoint politically exposed persons (PEPs) and relatives/close associates (RCAs) with close ties to your institution.

- Coverage of domestic and international PEP and RCA databases

- Ongoing monitoring for status changes or new associations

- Screening at customer onboarding (either automated or ad-hoc searches) and during periodic reviews

Adverse Media Screening

Uncover reputational and financial crime risks through negative news and adverse media sources.

- Continuous monitoring of global news

- Multilingual coverage for cross-border investigations

- Scalable processing to handle high volumes of clients

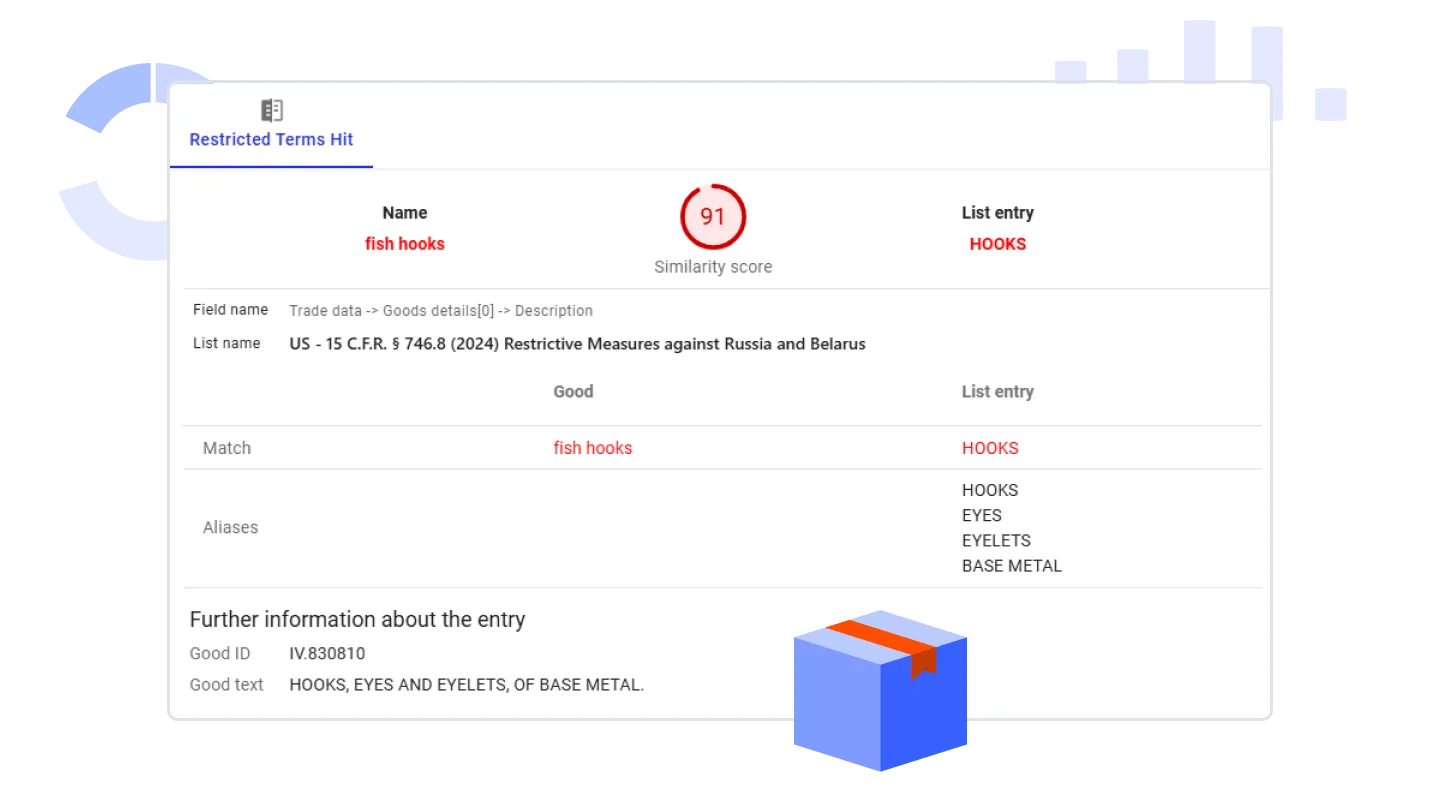

Dual-Use Goods Screening

Detect payments for goods, technologies, and services with both civilian and military applications.

- Automatic classification against international dual-use goods lists

- Payment interdiction to block transactions before settlement

Embargo Checks

Prevent prohibited transactions involving embargoed countries, regions, or entities.

- Jurisdiction-specific embargo rules (UN, EU, OFAC, national regulators)

- Flexible rule-building for country-specific restrictions

Learn why forward-thinking Risk & AML leaders choose Hawk

Hawk's highly customizable SaaS solution and modern case management interface empowered us to adopt a more efficient approach to combating financial crime.

Horst Gottsnahm, Chief Risk Officer, VakıfBankHawk provides reasoning behind each flagged alert, which does most of the heavy lifting for our compliance team. Instead of being reactive, we are now proactive.

Deepak Baran, Head of Financial Technology, Vodafone FijiHawk's innovation is ahead of the competition.

The Forrester Wave™: Anti-Money Laundering Solutions, Q2 2025The Hawk team demonstrated technology leadership and willingness to work closely with us to hit ambitious goals.

Mirko Krauel, CEO, OTTO PaymentsIf you’re looking for a partner who truly understands the regulatory space, listens to what you need, moves fast, and actually delivers – go with Hawk. The tech is strong, the people are great, and honestly, it just works.

Denny Axt, Director of Compliance & AML, Ratepay

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Awards & Recognition Leading the industry forward

Learn how Hawk's AI-fueled technology is driving the future of AML & CFT, according to software analysts and industry experts.

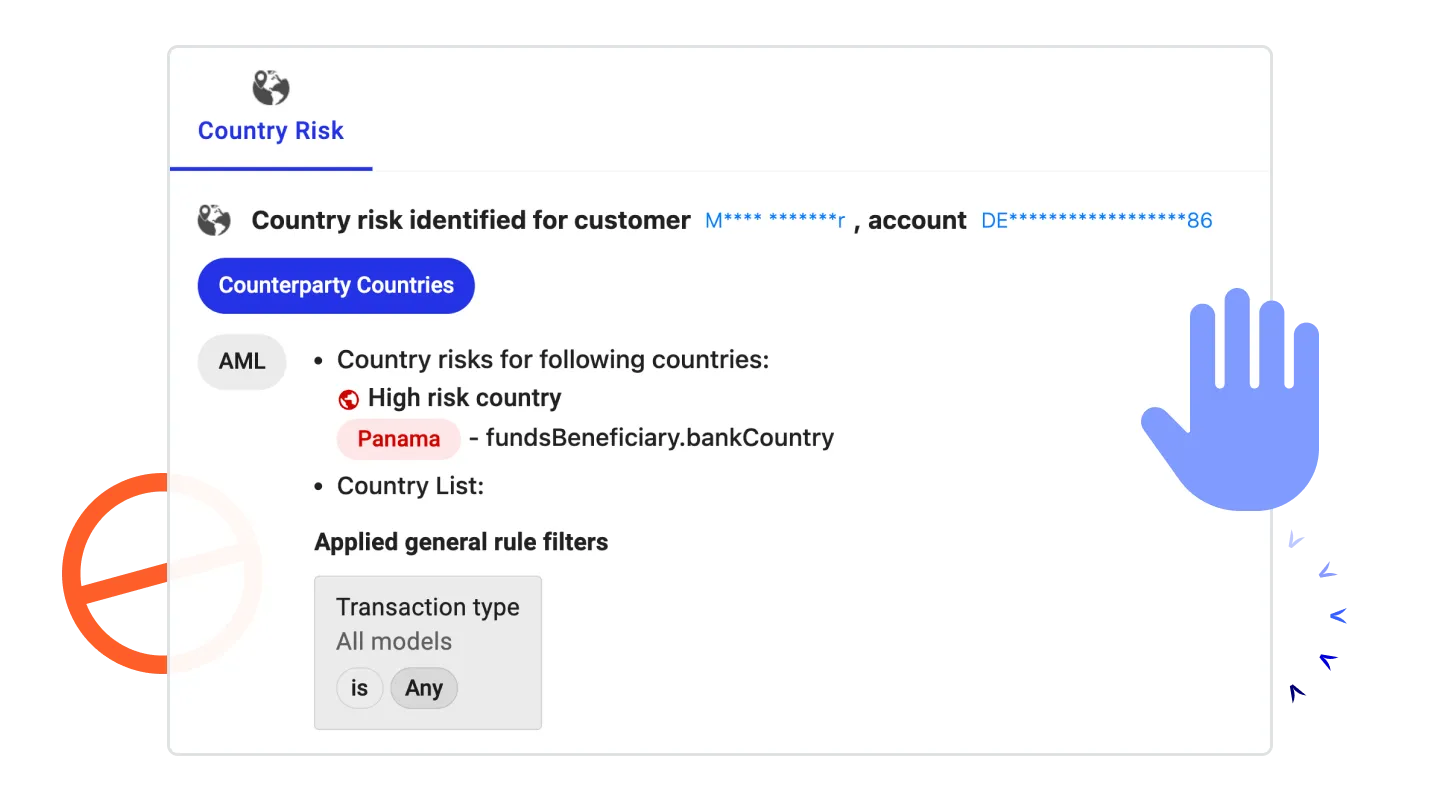

Ultra-granular AML screening, tailored to your risk appetite

Adapt the algorithm to your compliance needs, screening any customer data or payment field for risk, with rule-by-rule custom weighting

Banking Risk screening for the modern banking sector

Assess clients at onboarding and during their lifecycle, ensuring risk is managed no matter who they transact with through your bank.

Payments Versatile screening that adapts to your needs

Screen both payees and payors, assessing payments for risk in real-time. Assess transactions across all payment rails, both domestic and cross border.

FinTech Real-time screening for the FinTech industry

Screen clients and transactions for risk through real-time APIs. Hawk’s flexible screening works for all FinTech use cases, regardless of whether they’re cross-border, on-chain, for an emerging financial product, or conducted via technology / open banking partnerships.

Neobanks Scalable screening built for rapid growth

Get risk screening built for digital channels and your modern tech stack. Hawk’s true real-time processing (150 ms average) and API-first integration design allows you to do business at speed.

Articles & Resources The latest from Hawk

Learn how Generative AI can help Financial Institutions detect sanctions violations, money laundering, and fraud, aid investigations, and improve QA processes.

Discover how Hawk's AML & Screening technology has enabled Ratepay to stay compliant while managing a wide range of customer risk profiles.

Hawk is the only supplier from 22 profiled companies to receive the XCelent Advanced Technology 2024 award.

Related solutions Explore Hawk's AML & CFT suite

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have