Scam & Mule Detection Break the scam chain and protect victims

Build customer loyalty with AI-powered protection that pinpoints authorized fraud to protect your customers and your institution.

Product Differentiators Safeguard customer trust and your bottom line with agile defenses

Uncover fraud perpetrators, victims and mules from the get-go with AI models personalized to your client base and risks

Easily create and adapt rules using available risk data with self-serve configuration, scam-specific rule guidance, and live sandbox testing

Detect when client activity deviates from expectations, showing potential scam risk, with anomaly detection and contextual analysis across incoming and outgoing funds

Scam detection software See an immediate and lasting impact on scam prevention

Scam tactics evolve fast—and so can your safeguards. Hawk provides the tools to prevent customers from falling victim to scams by continuously fortifying defenses

Prevent scam in true real time

- True real-time scam prevention (150 ms average)

- Ability to monitor any data point, across both incoming and outgoing funds

- Out-of-the-box rule guidance to catch advance fee scams, elder fraud, investment scams, and more

- Self-serve rule management, configuration and sandbox testing

- AI models to detect known scam patterns, anomalous behavior, and reduce false positives, complete with model governance

- Payment interdiction to block, hold, and release transactions

- Webhooks to trigger customer education, fraudster offboarding, or special customer care workflows

Protect customers from common scam patterns

Monitor for fraudulent schemes relevant to your business and customers, across all payment rails

Romance Scams

Prevent customers from sending money to fraudsters posing as romantic partners:

- Detect unusual transfer patterns and repetitive payments to the same recipient

- Flag payment references that suggest emotional appeals, emergencies, or personal crises

Investment Scams

Protect customers from fake investment schemes promising guaranteed returns:

- Analyze payment references for mentions of “investments,” “returns,” or urgent funding requests

- Detect repeated high-value transfers or suspicious deposit patterns

Purchase Scams

Stop customers from paying for products that never arrive:

- Monitor transfers to merchants with payment histories that don’t align with their business profile

- Flag payment references indicating orders, shipping, or prepayment requests

Fake Job Offers

Prevent customers from losing money to fraudulent employment offers:

- Identify transfers requesting upfront fees or unusual payment methods

- Analyze payment references for “training,” “equipment,” or other job-related keywords

- Flag accounts with multiple suspicious job-related payment patterns

Fight scammers and safeguard customers today with AI-powered protection

The Hawk Difference Discover how Hawk raises the bar for efficient mule and scam prevention

The Traditional Way

- Ineffective, generic out-of-the-box AI scam and mule typology models

- Reliance on external support to manage rules, delaying scam intervention

- AI that generates alerts unclear explanations on why alerts are triggered

- Outdated user interface that slows down investigation of scam rings

The Hawk Way

- Day one defense models for personalized protection at the speed of out-of-the-box models

- Full control with flexible, self-serve rule management

- Clear and contextual AI explanations which speed up alert review

- Sleek interface and unified case management to connect the dots between multiple scammer and mule accounts

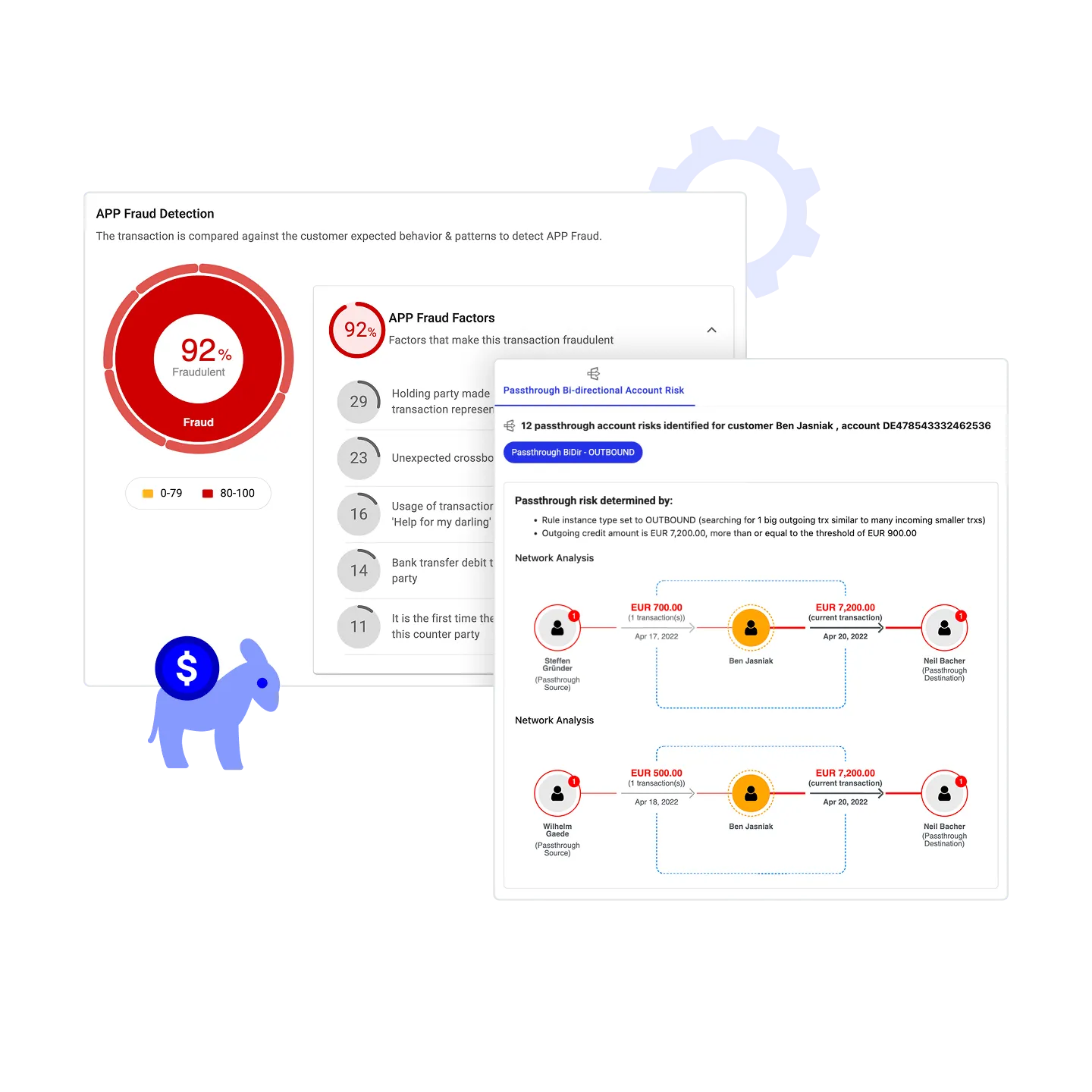

AI from Hawk Protect customers without slowing them down

Explainable AI reduces unnecessary alerts and empowers analysts to act confidently, keeping legitimate customers’ payments moving.

Block common scams instantly

Machine learning models trained on scam typologies protect customers against known threats in real time

Stop socially engineered payments in their tracks

Advanced text analysis flags suspicious payment references to prevent Authorized Push Payment (APP) fraud

Catch unusual behavior early

Anomaly detection pinpoints customers with sudden changes in transaction patterns or unusual behavior compared to their peer group

Spot mule networks and fraud rings

Hawk maps inflows and outflows across accounts to detect and dismantle criminal networks

Hawk's AI Day One Defense Models: How to get tailored fraud prevention AI models quickly

Hawk's Day One Defense Models are AI typology blueprints fine-tuned to the specific needs of each financial institution, to deliver hyper-personalization, fast deployment, and high accuracy.

Articles & Resources The latest from Hawk

Read about the missteps to avoid when employing AI in your fraud prevention system, like underusing internal data, relying on generic models, or ignoring explainability.

Read about AI-enabled compliance in the new industry report by Hawk and Chartis.

New report from Celent and Hawk shows that over half (53%) of US mid-market banks and credit unions are looking to expand their convergence of anti-money laundering and fraud prevention.

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have