Customer Screening Pinpoint customer risk with precision

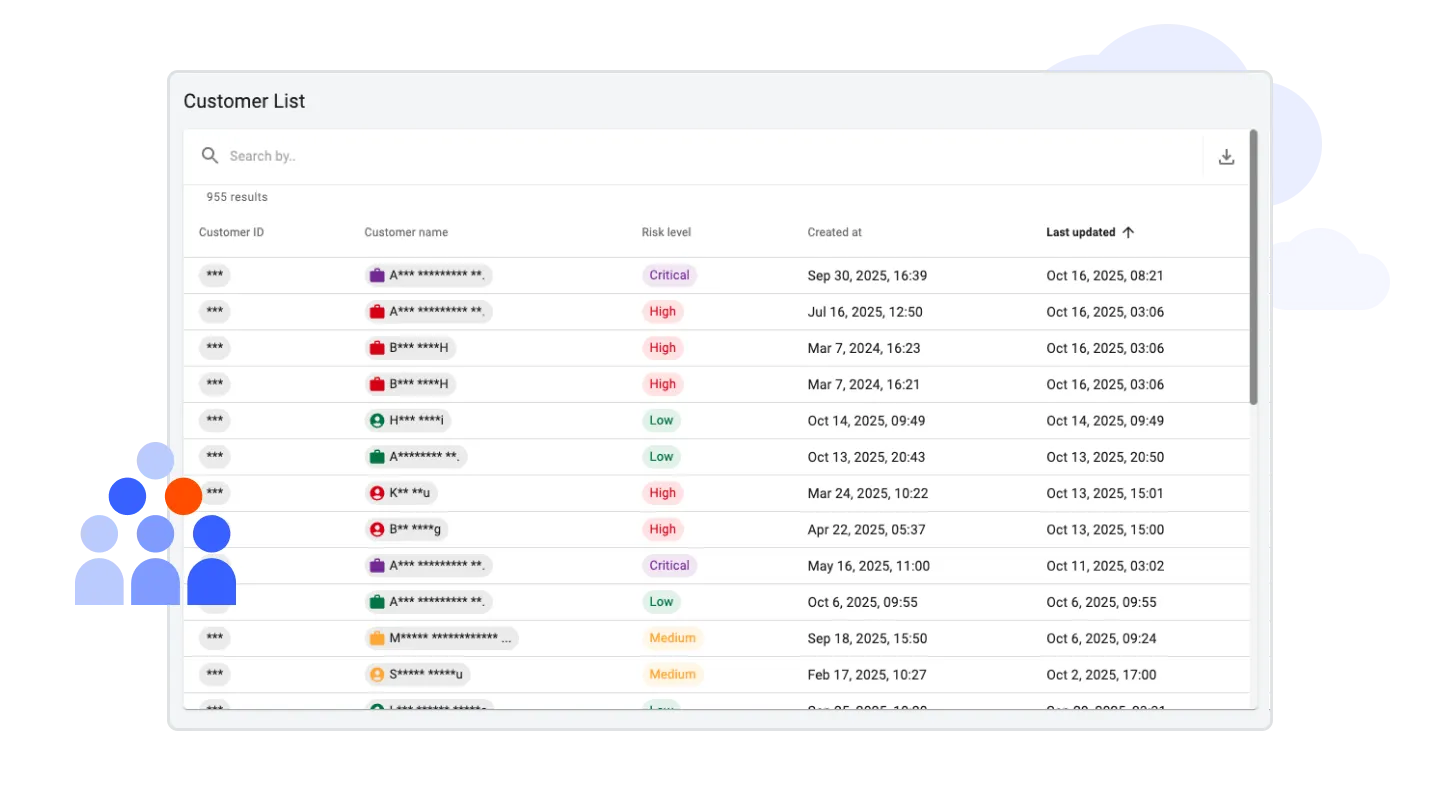

Screen against global watchlists, including sanctions lists, politically exposed persons (PEP) databases, and adverse media. Hawk cuts false hits, allowing you to better understand risk while maintaining a smooth user experience for new and existing customers.

Product Highlights Catch client-related risks without the alert backlogs and fatigue

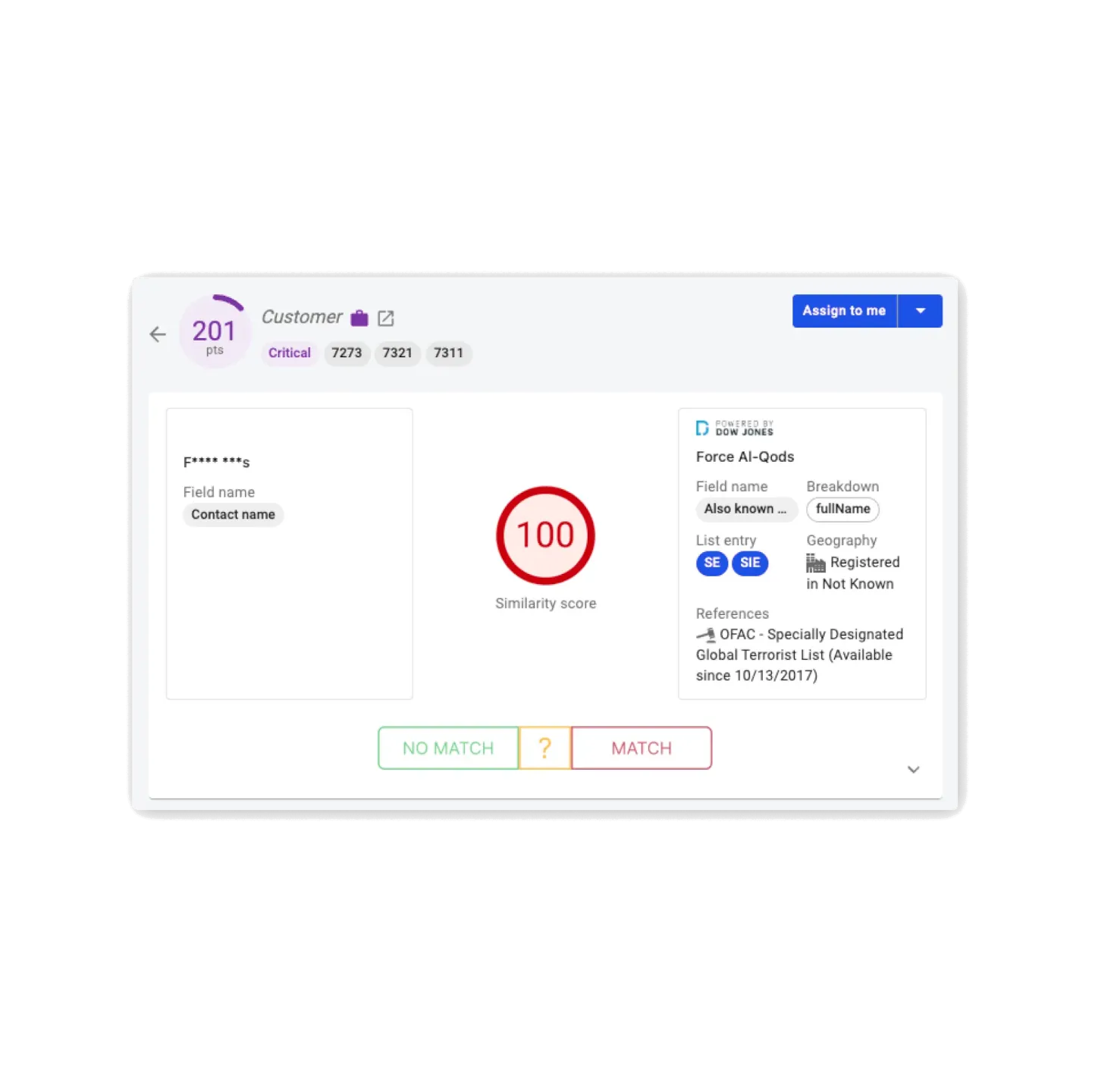

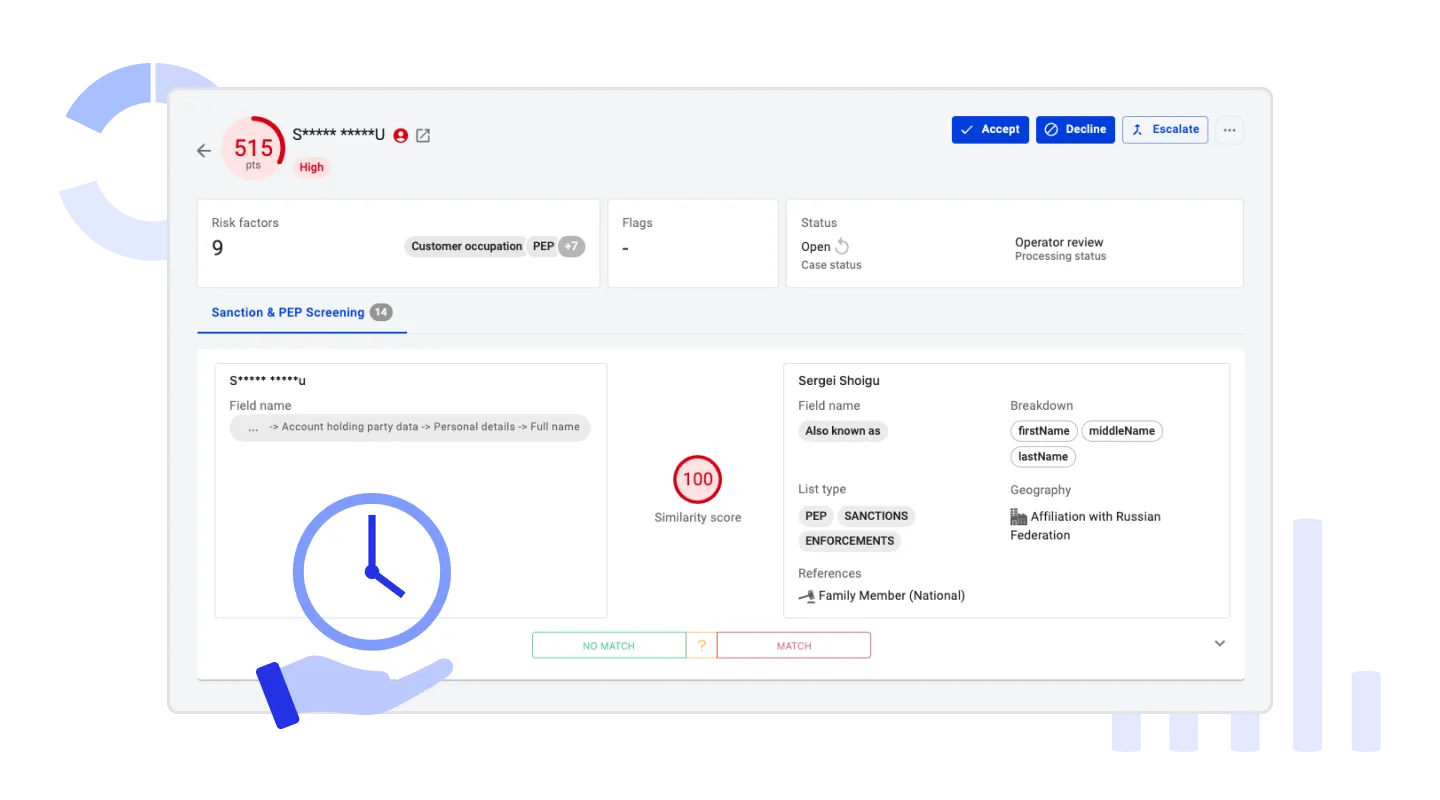

Catch customer risks with precision by screening any customer field with custom weighting, rule-by-rule

Easily add or remove lists without IT involvement and control which rules apply to each list

Don't review unchanged hits—remember past analyst decisions so alerts are only generated when customer or list data changes

Efficient risk screening Fast, flexible screening

Screen global watchlists and negative news efficiently.

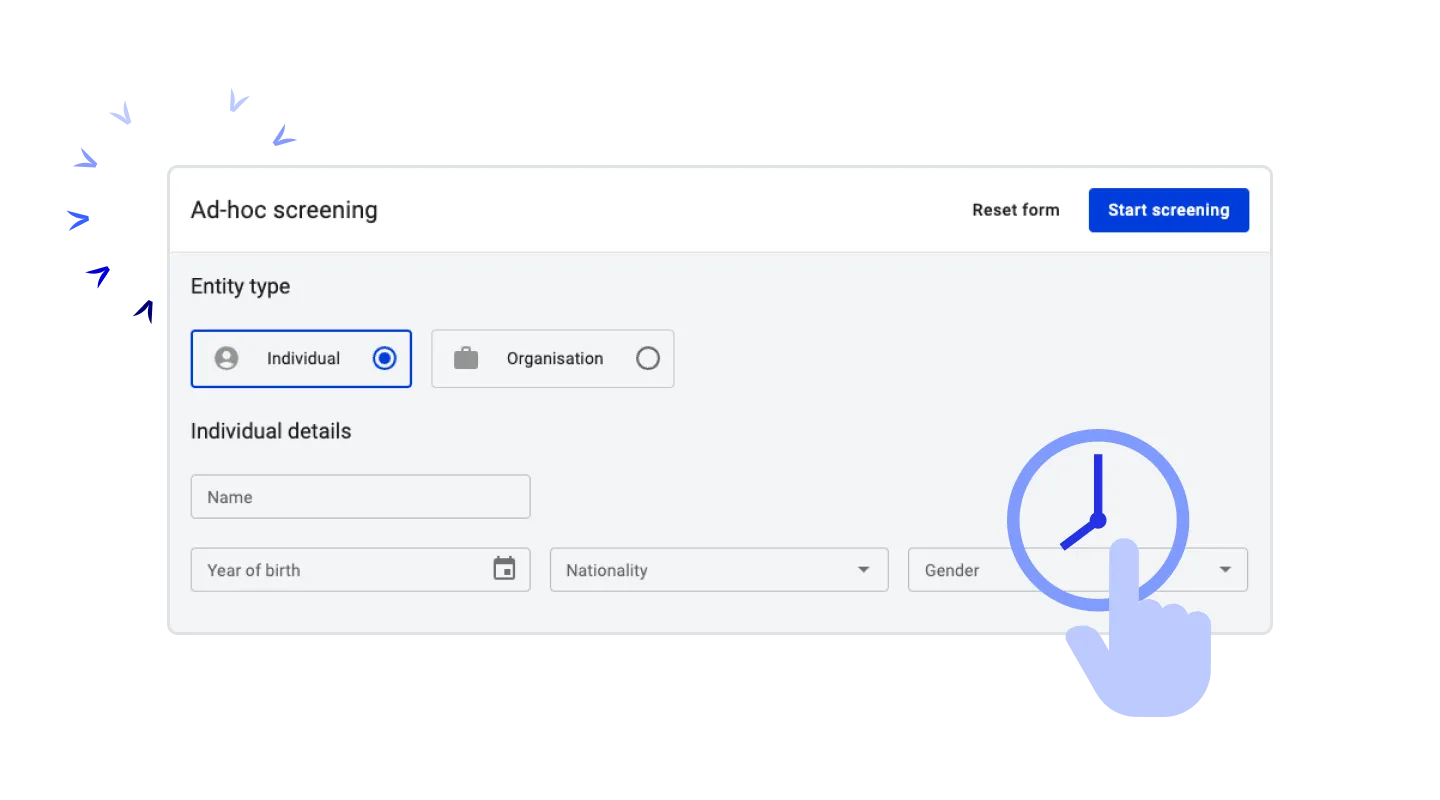

- Batch API, real-time API and on-demand screening

- Coverage for individuals and organizations

- Integration with common sanctions, PEP/RCA, and adverse media watchlists

- Self-serve fuzzy matching configuration and tuning

- Click-of-a-button hit dispositioning

- Confirmed screening results reflected in Customer Risk Rating

The Hawk Difference Discover how Hawk raises the bar for efficient customer screening

The Traditional Way

- Long backlogs and analyst fatigue due to high false positives

- Generic algorithms, not purpose-built around screening use cases

- Hardcoded, IT/external support-managed list integrations

- One-size-fits-all approach that doesn’t reflect local regulations

- Outdated user interface with fragmented information and high friction

- Too frequent or too infrequent screenings

The Hawk Way

- Low false positives thanks to past decision recall

- Proprietary fuzzy matching algorithm with granular rule-specific tuning settings

- Flexible list management

- Multi-tenant structure that supports regional regulations

- Simplified, unified view of relevant risks so you can review and close an alert in just three clicks

- Screening as data changes to capture risks early

Awards & Recognition Leading the industry forward

Learn how Hawk's AI-fueled technology is driving the future of AML & CFT, according to software analysts and industry experts.

Forrester Wave Hawk Named a Strong Performer in Anti-Money Laundering Solutions Evaluation

Hawk has been recognized as a Strong Performer by Forrester in its new report “The Forrester Wave™: Anti-Money-Laundering Solutions, Q2 2025”. In the report, Forrester stated; “Hawk’s innovation is ahead of the competition.”

Support business growth at every stage

Manage risk effortlessly across the customer lifecycle

Customer Onboarding

Verify new individual and corporates against global sanctions, Politically Exposed Persons (PEPs), and adverse media lists at account opening.

Routine Screening

Continuously monitor your customer base with scheduled, time-based reviews.

Ad Hoc Screening

Conduct targeted checks when needed, in response to new applications, specific requests, or changes in customer risk profile.

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Articles & Resources The latest from Hawk

Learn how Generative AI can help Financial Institutions detect sanctions violations, money laundering, and fraud, aid investigations, and improve QA processes.

Discover how Hawk's AML & Screening technology has enabled Ratepay to stay compliant while managing a wide range of customer risk profiles.

Hawk is the only supplier from 22 profiled companies to receive the XCelent Advanced Technology 2024 award.

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have