SAR / CTR Filing Integrated reporting, faster filing

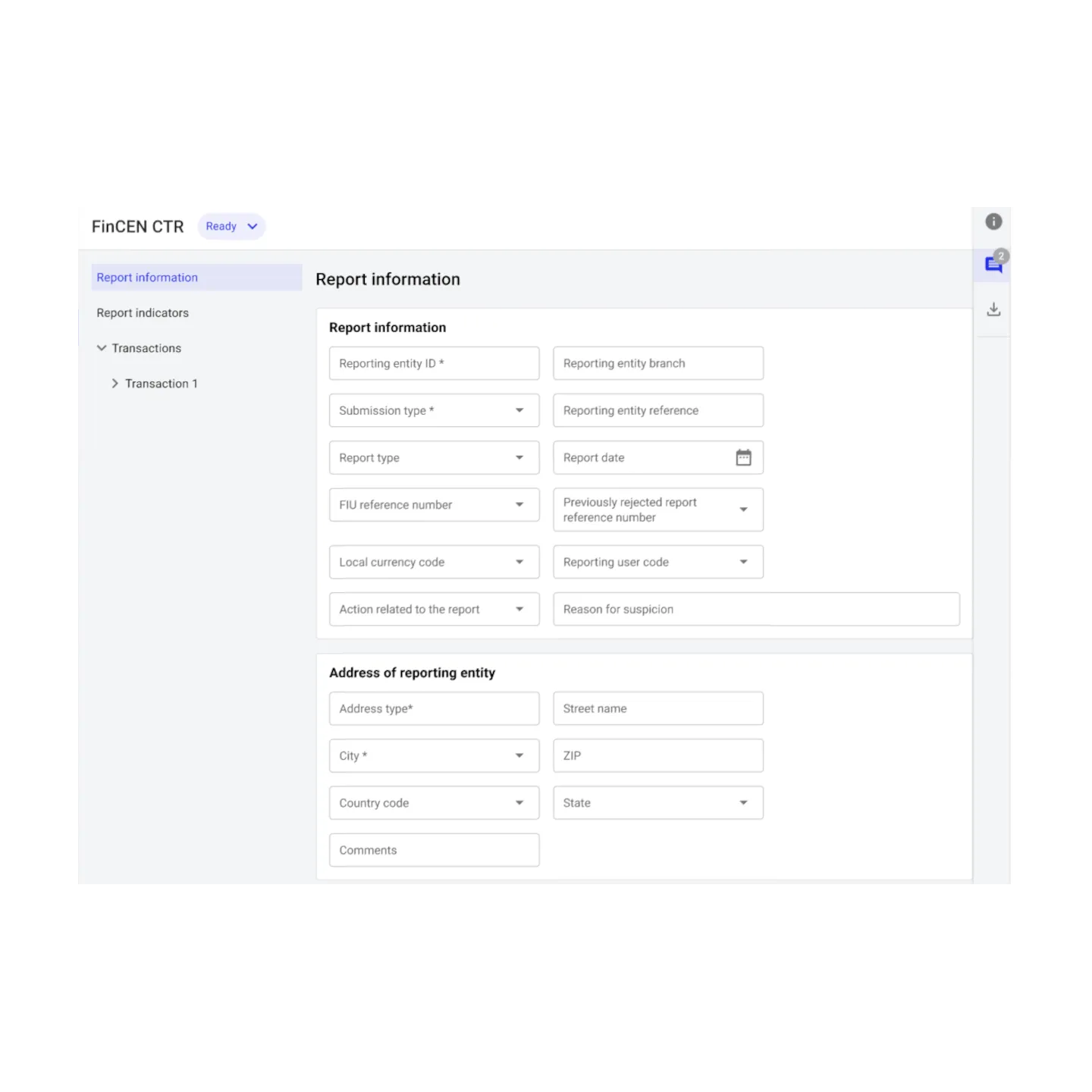

Prepare suspicious activity reports (SARs) and currency transaction reports (CTRs) for filing directly from the Hawk platform.

Product Highlights Streamline preparation, filing with speed and accuracy

Reduce manual effort by generating, filling in, and submitting regulatory reports from the Hawk AML solution

Submit higher quality filings with missing data warnings, built-in field validation, and 4-eyes approval before report filing

Ensure on-time submissions by tracking progress of all regulatory reports from one space; easily find past filings

Efficient SAR Automation File reports with confidence

Gain complete visibility into your organization’s reporting activities, ensuring efficient, on-time filing and monitoring made simple post-filing.

- Direct integration with Hawk’s transaction monitoring

- Coverage across multiple jurisdictions

- Unified report tracking and status management

- Missing data warnings and built-in field validation

- 4-eyes report review

- Bulk report download and submission

- Direct filing with FinCEN

- Full, automated audit trail

- 90-day review and continuing SAR mechanisms

The Hawk Difference Discover how Hawk raises the bar for automated SAR and CTR filing

The Traditional Way

- Manually open report templates in a separate filing portal or external government website

- Copy customer, account, and transaction details from several systems field by field

- Use an excel or shared document to track filing deadlines and 90-day reviews

- Manually route approvals and rely on managers to catch typos and report issues

- Rework and resubmit rejected reports, often starting from scratch

The Hawk Way

- Investigate suspicious activity and initiate a SAR from one system

- Review pre-filled forms, manually adding context only where missing

- Get automated reminders of report filing deadlines and continuing SAR needs

- Automatically validate that all necessary fields are filled and match expected format

- Route approvals through a built-in workflow management system

- Easily extract for GoAML filing or submit directly to FinCEN with just a few clicks

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have