Fraud Prevention Stronger AI defenses, deeper trust

Protect your institution and customers from the fraud tsunami with AI-powered, real-time prevention from Hawk. Increase precision to minimize losses without increasing customer friction.

fraud prevention solution Stop fraud, without stopping legitimate customers

While attackers use adversarial AI to outsmart defenses, your fraud prevention systems struggle — burdened by rigid detection, high costs, and false positives that frustrate customers and strain teams.

Future-proof your defenses with AI that intervenes before fraud takes flight.

Hawk’s AI-native fraud prevention software protects revenue and customer trust by detecting both known threats and anomalies — all while cutting false positives.

Self-serve rules pair with AI precision, giving your team the agility to outpace flash fraud and stop threats in real-time (150 ms average).

The Hawk Difference Discover how Hawk raises the bar for efficient fraud prevention

The Traditional Way

- Ineffective, generic AI fraud typology models

- Reliance on external support to manage rules, delaying response time to fraud attacks

- Fragmented coverage with a separate fee for each payment type

- Offline or lab model simulation that relies on stale data

- Disjointed systems that force teams to juggle multiple tools

- Outdated user interface and black-box AI that slows down case review

The Hawk Way

- Day one defense models for personalized protection at speed

- Agile self-serve rule management and optimization

- No extra fees per rail or seat; get full access and protection across payment rails

- Production-grade sandbox with live data for faster, more reliable testing

- Consolidated fraud solution with common tools, like check image analytics, pre-integrated

- Sleek interface and unified case management with contextual AI explanations that cut review time and customer friction

Product Suite Real-time fraud detection that protects your customers from the get-go

Transaction Fraud

Monitor transaction behavior to detect fraudulent patterns across all channels and payment methods

Check Fraud

Stop fraud before checks clear with AI-driven image forensics and cross-channel check fraud protection

Scams & Mules

Monitor transactions in real-time to spot scammers, flag mules, and shield victims

Alert & Case Management

Get a holistic view of your alerts and maximize efficiency with a unified case manager

Stop known fraud threat vectors with AI precision

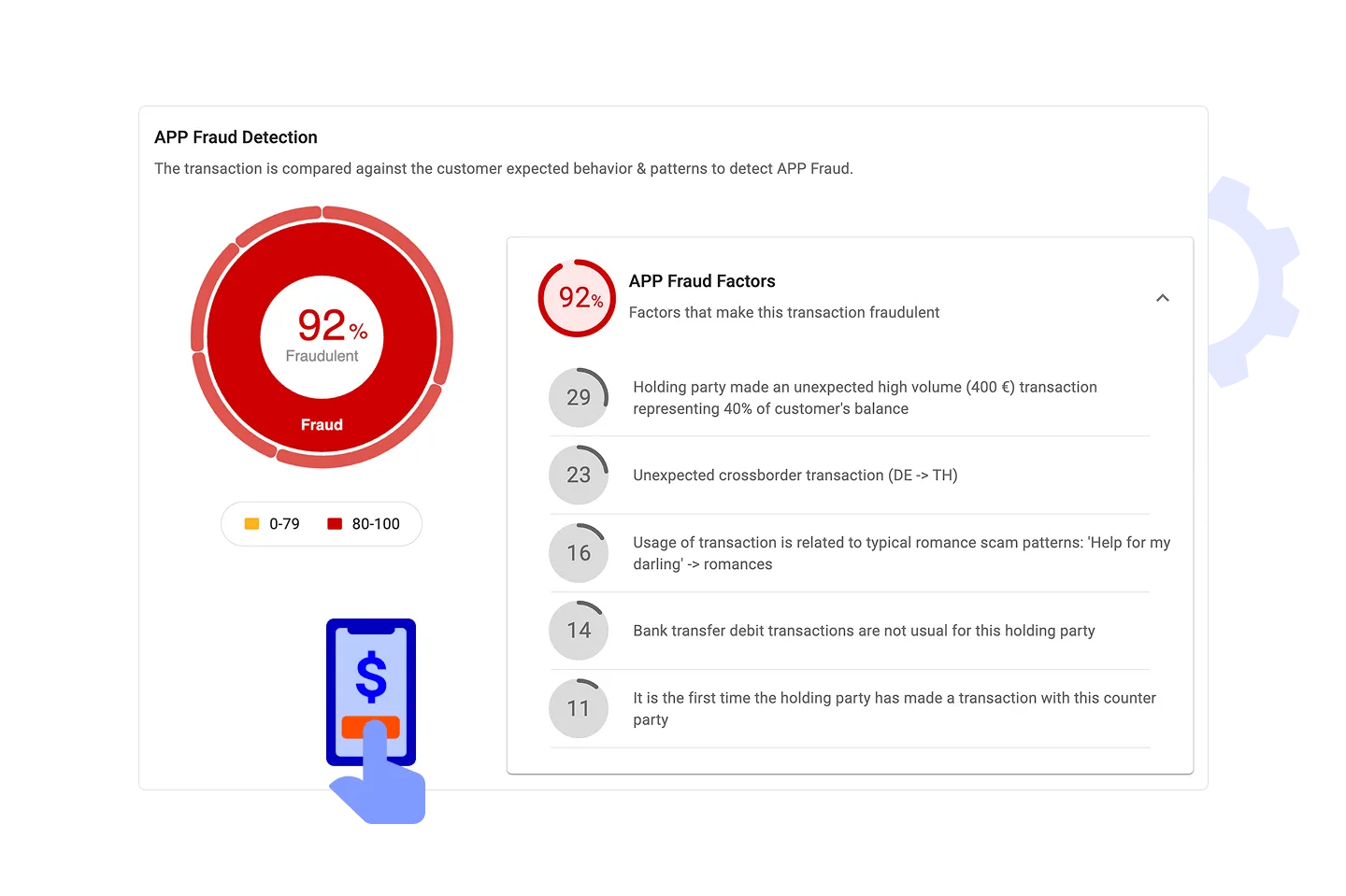

Authorized Push Payment

Prevent victims from sending payments to scammers, based on behavioral signals

- Real-time monitoring of payee relationships and transactional flow to identify potential coercion or scams

- Behavioral analysis to detect deviations from typical patterns

- Contextual risk scoring that assesses the recipient's history and risk profile

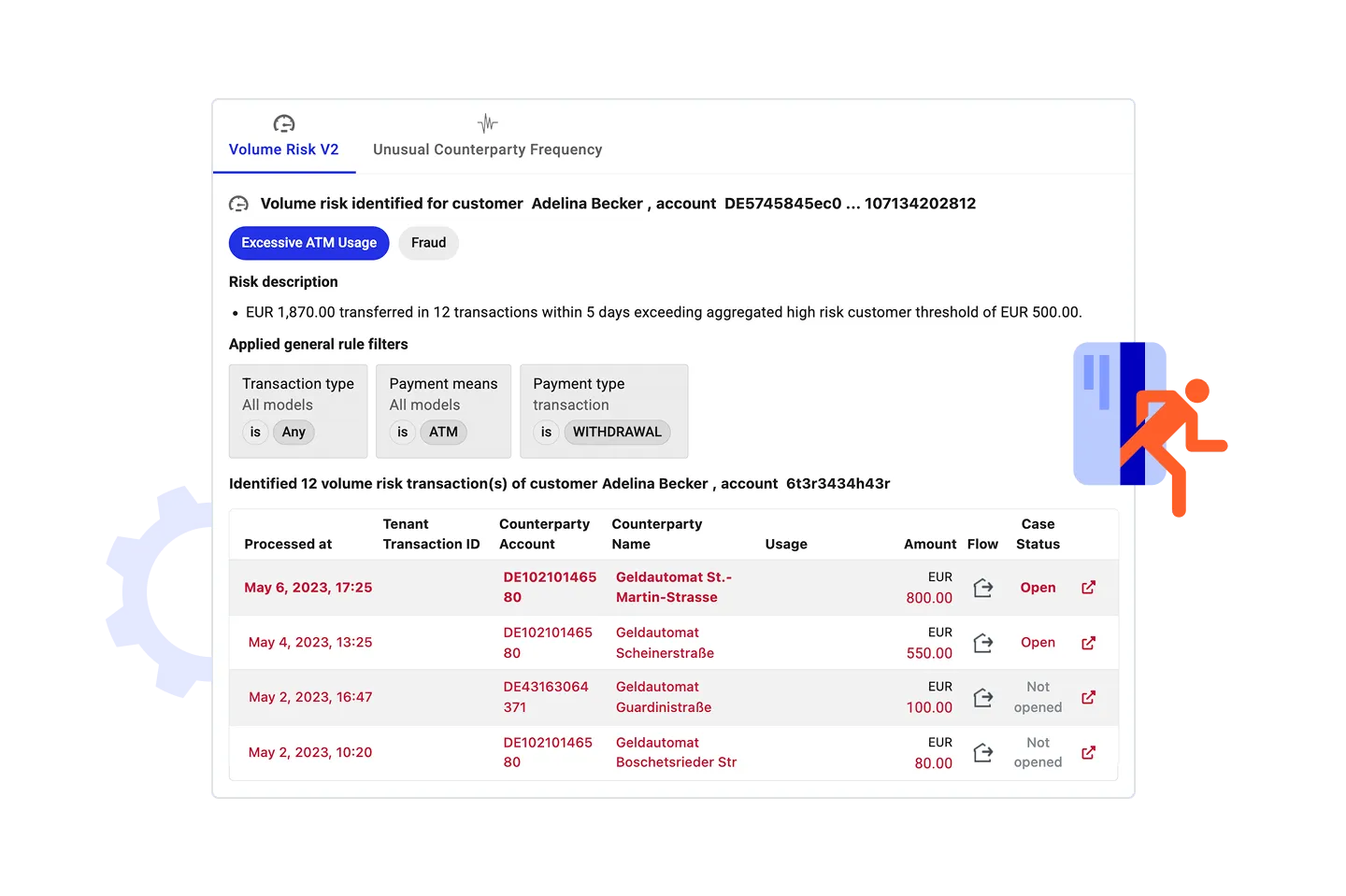

Account Bust Out

Stop fraudsters from maxing out credit and cashing out, leaving your institution counting the losses

- Continuous monitoring of credit lines and account usage for rapid, uncharacteristic spikes in activity

- Behavioral biometrics to flag sudden changes in user login patterns and device usage

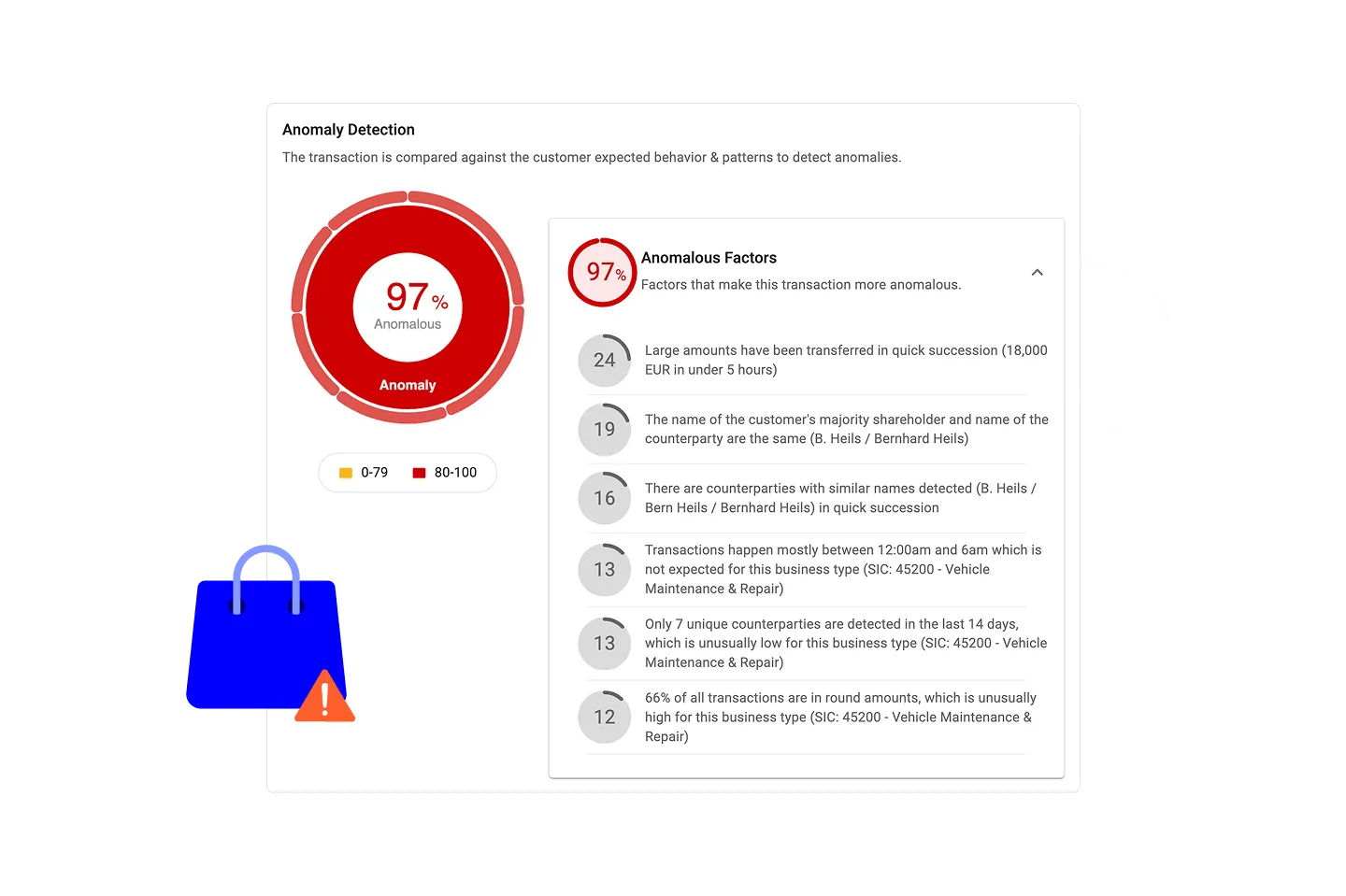

Merchant Fraud

Identify fake merchants through behavioral comparison with peer merchants

- Real-time transaction monitoring to identify unusual transactions

- AI model that dynamically assesses a merchant's chargeback rate and transaction history

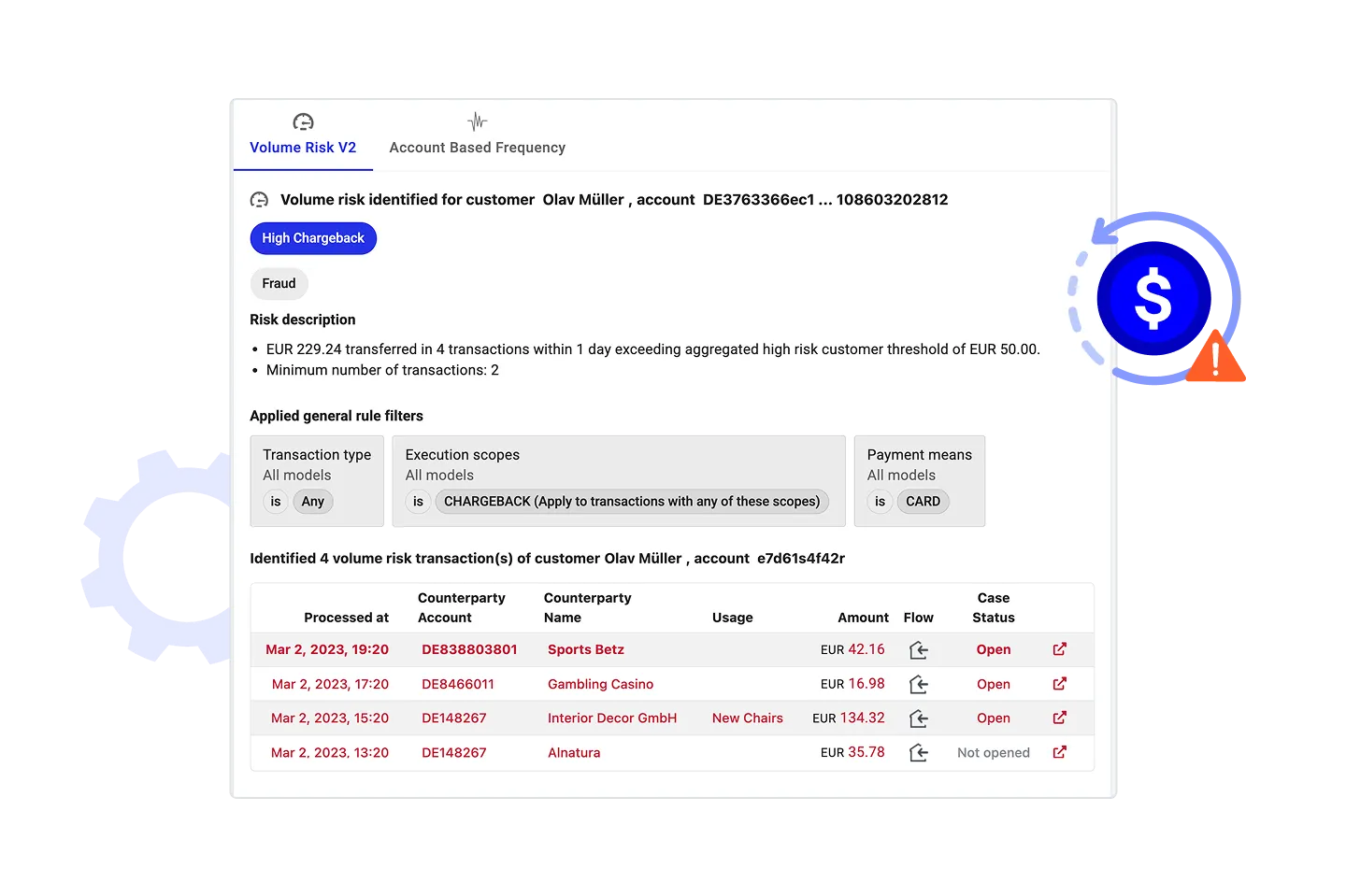

Chargeback Fraud

Cut losses from friendly fraud with ease by pinpointing clients with a pattern of false claims

- Automated analysis of chargeback history to identify repeat offenders or suspicious patterns

- Cross-channel monitoring to build a holistic picture of customer risk

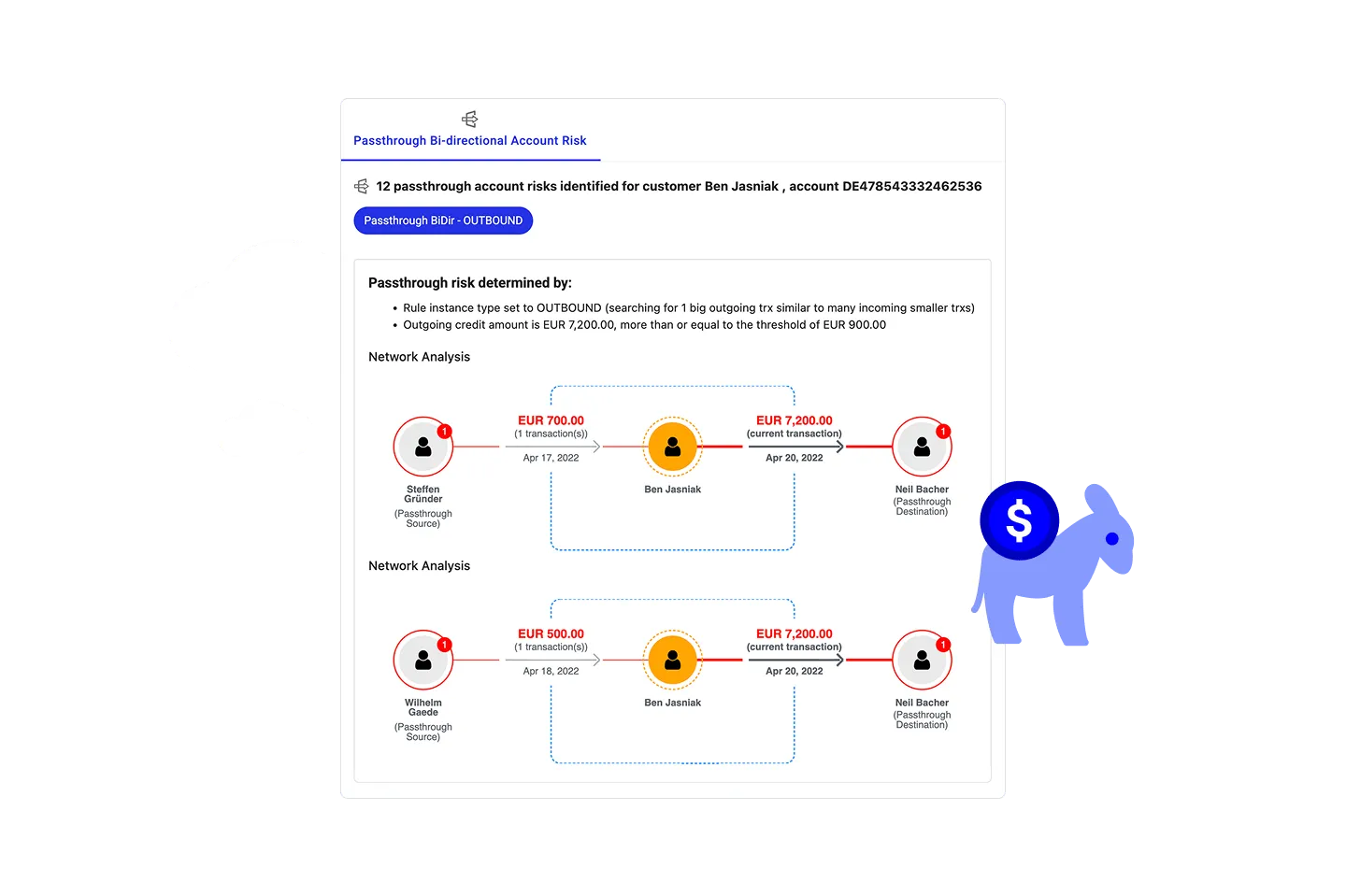

Money Mules

Stop mules, witting and unwitting, from moving dirty money through your accounts

- Behavioral analytics to flag accounts with high volumes of incoming funds from disparate sources

- AI analytics to identify skimming or commissions on mule activities

Hawk's AI Day One Defense Models: How to get tailored fraud prevention AI models quickly

Hawk's Day One Defense Models are AI typology blueprints fine-tuned to the specific needs of each financial institution, to deliver hyper-personalization, fast deployment, and high accuracy.

Milestones & Recognition Leading the Industry Forward

Learn how Hawk's AI-fueled technology is driving the future of AML & CFT, according to customers and industry experts.

Hawk Named “Technology Standout” in New Celent Anti-Fraud Solutions Report

Bundesbank Strengthens Fraud Prevention with Hawk Technology

Hawk Named A Category Leader in Chartis Enterprise and Payment Fraud Report

Industry-specific protection, instant results

Neutralize your threats with personalized prevention, using AI models built with deep domain expertise.

Banking Fraud prevention for the modern banking sector

Defend your institution, cull losses, and drive operational efficiencies. Hawk’s cross-rail, cross-channel fraud platform slashes customer friction and frees your teams to catch more fraudsters.

Payments Real-time fraud detection that adapts to your needs

Safeguard your transactions and your revenue with real-time fraud detection built to keep pace with high-speed, cross-border payments.

FinTech Flexible fraud prevention for the FinTech industry

Accelerate growth and build trust with a flexible, API-driven solution that scales as fast as you do.

Neobanks Scalable fraud solution built for rapid growth

Stop fraud rings and account takeovers without compromising on seamless user experience.

Articles & Resources The latest from Hawk

Read about the missteps to avoid when employing AI in your fraud prevention system, like underusing internal data, relying on generic models, or ignoring explainability.

Banks and credit unions are seeing significant return on investment from the convergence of fraud and AML, while also benefitting from better risk visibility and numerous other advantages. Find out more in Celent's report.

Learn about the top drivers of change in fraud and AML compliance, according to the latest FRAML report released by Celent and Hawk

Related Solutions Explore Hawk's Fraud suite

Request a demo Stop 2X more threats with 50% less effort with Hawk

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the demo process you'll touch on Hawk's:

- API infrastructure and data integration capabilities

- Modular design and flexible multi-tenant set up

- No-code rule builder, AI feature library, and model explanations

- Any further questions you may have