Financial Regulator Attitudes to AI: Are They Changing?

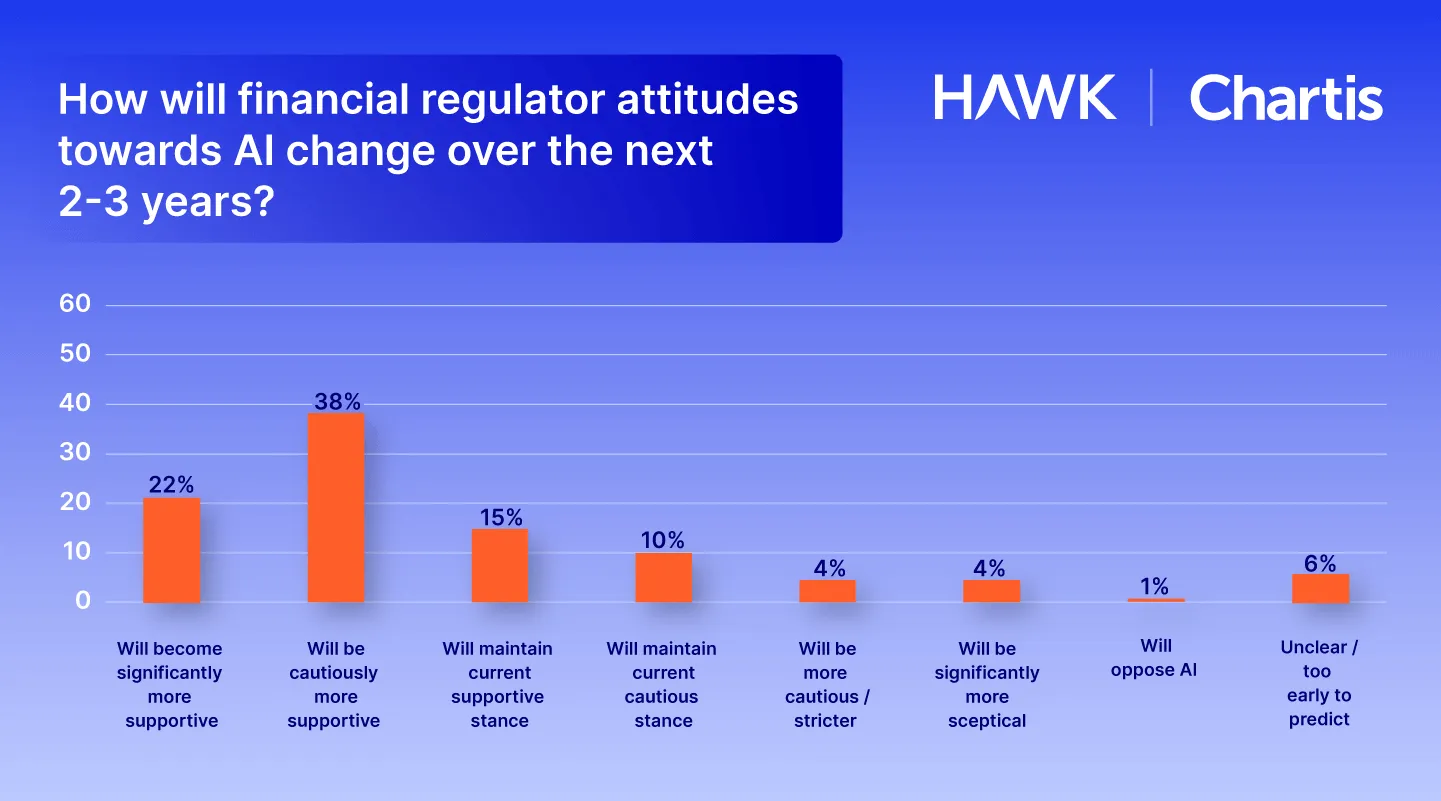

Our recent report with Chartis reveals that 60% of banking leaders expect regulators to become more supportive of AI over the next two to three years. And an additional 15% expect regulators to maintain their current supportive stance.

The report, AI in Financial Crime and Compliance: Charting the Path from Pilot to Maturity, provides comprehensive data on current and future use of AI in FCC efforts.

→ Download the Banking Edition here

→ Download the Payment & FinTech Edition here

Banks Expect Regulators to Support AI

We asked compliance and risk leaders at banks globally how they think the regulatory landscape for AI will change over the next two to three years. Their responses revealed optimism:

- 38% said regulators will be cautiously more supportive — gradually more accepting, but with safeguards

- 22% said regulators will become significantly more supportive — actively promoting and encouraging adoption

Regional Differences in AI Regulation Expectations

Breaking down responses by region reveals interesting geographic differences in optimism about regulator support for AI.

Optimism is highest in Latin America, where 30% expect regulators to become significantly more supportive. North America follows closely behind at 25%.

A Key Barrier to AI Adoption in Financial Crime

How banking leaders feel about regulatory support is important for two reasons:

First, regulatory concerns remain a barrier to adoption of AI in financial crime and compliance. When asked about the main business challenges preventing their institution from introducing more AI into anti-financial crime programs, 73% of respondents ranked "regulatory concerns or lack of clarity on regulator expectations" as either their first or second concern.

Regulatory concerns actually increase during adoption. 37% of respondents said that regulatory concerns had increased during the early stages of AI adoption, even as other concerns, such as insufficient AI expertise or lack of stakeholder alignment, had diminished. This highlights why banks need transparent AI regulation policies.

Explainable AI: The Bridge Between Innovation and Regulation

As banking leaders anticipate more supportive AI regulation, the need for transparent, auditable AI systems becomes critical. This is where explainable AI bridges the gap between innovation and AI compliance.

Hawk's explainable AI provides banks and payment firms with the transparency, accountability, and auditability needed to safely realize the benefits of AI in AML while meeting regulatory requirements.

Hawk provides clear, natural language explanations for every AI-driven decision, such as why a transaction was flagged as suspicious or why a case was closed. This detailed reasoning creates a complete audit trail, allowing compliance teams to easily justify their actions (or inaction) during regulatory reviews and audits.

With 73% of banking leaders citing regulatory concerns as a top barrier to AI adoption, explainable AI isn't just another feature. It's the foundation for confident and compliant AI use that satisfies both internal stakeholders and external regulators.

→ Download the Banking Edition here

→ Download the Payment & FinTech Edition here