Analytics Studio Fast AI development, without the governance burden

Streamline how you build, optimize, and govern AI models for AML and fraud, managing the entire AI lifecycle from a single, integrated environment within Hawk.

Product Differentiators Take control of your AI lifecycle

Create and retrain models with speed, transparency, and regulatory confidence. Address risks quickly with a solution designed for regulated financial crime and compliance programs

Automate the most time-consuming parts of the AI lifecycle without compromising control or oversight. Respond faster while keeping humans in the loop

Tailor models to your data and real FinCrime risks, without relying on scarce data science or IT resources, with financial crime typology templates and copilot guidance

Approve, defend, and audit models with confidence. Explainability, documentation, versioning, and performance evidence are built into every stage of the AI lifecycle

Automated AI Pipeline & Governance Develop expert models with speed

Streamline your AI lifecycle for fast, regulator-ready model development and optimization within Hawk's integrated environment, including:

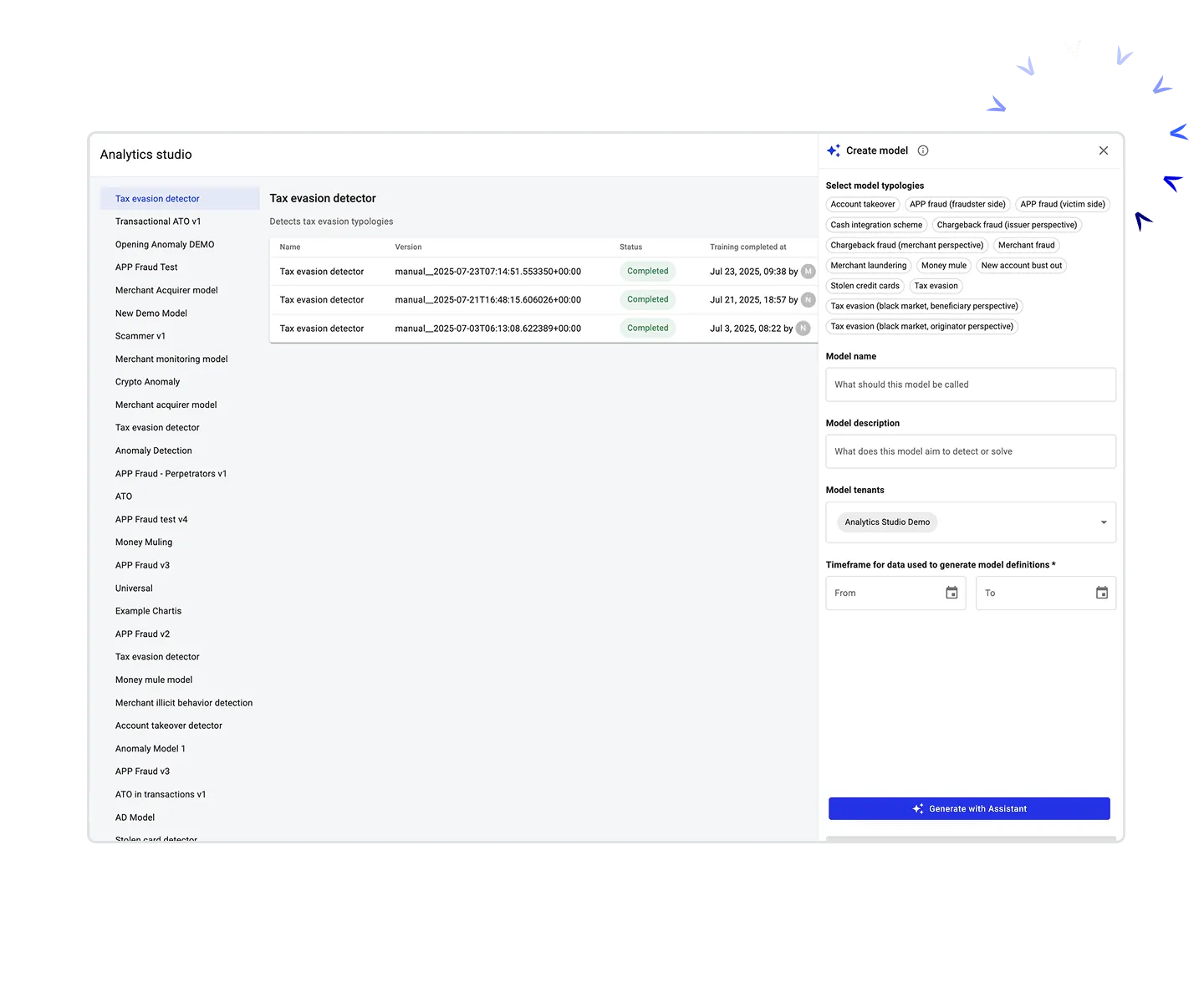

- FinCrime-specific typology templates and expert model frameworks designed specifically for AML and fraud teams

- Self-service, co-pilot guided model creation

- Automated AI model pipeline generation and training

- Model performance dashboards and alert samples

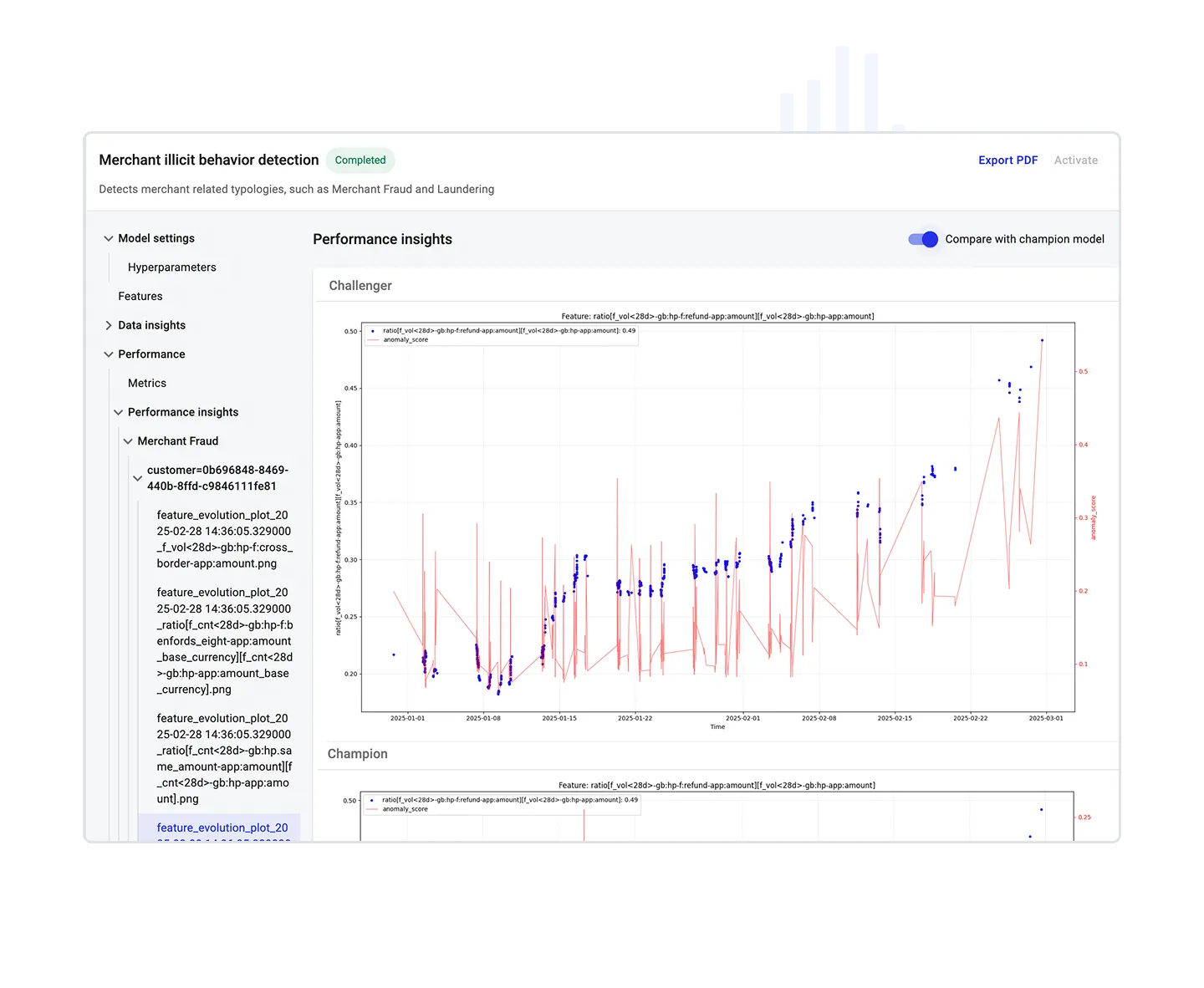

- Continuous model improvement with side-by-side version analysis

- Built-in explainability

Automated model documentation with exportable governance artifacts

Streamline development step-by-step

Analytics Studio supports every stage of the AI lifecycle—so you can move from model creation to regulator-ready deployment with confidence at every step.

Define what risk you want to detect quickly:

- Start with financial crime-specific model templates based on known AML and fraud typologies

- Use guided self-service and GenAI-assisted interaction to shape model objectives

- Select relevant data and configure the model framework without writing code

Conduct initial training and regularly retrain and iterate on models:

- Reduce manual data preparation and technical overhead

- Automatically generate the AI model pipeline and (re)train models using available production data

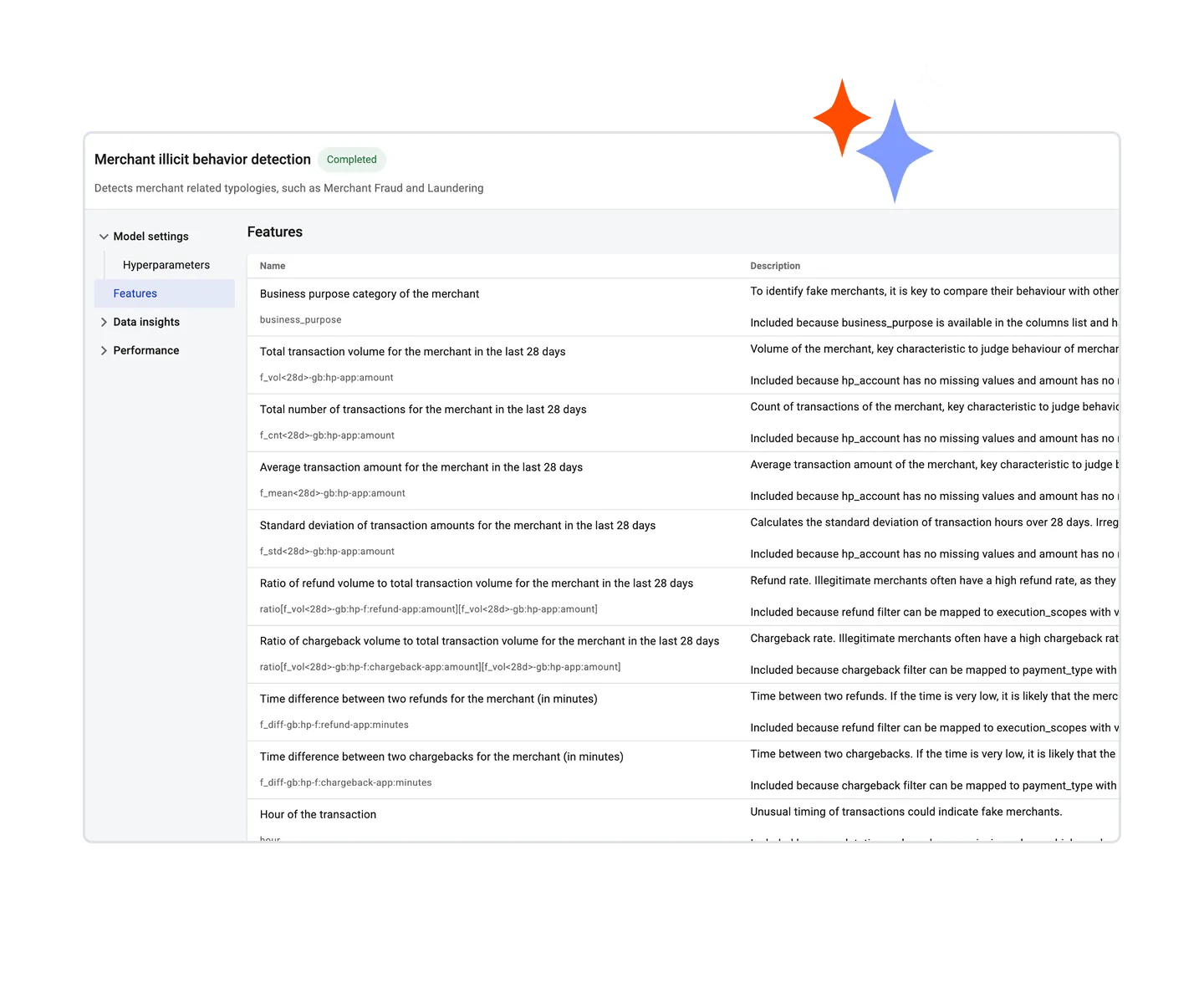

- Get visibility into model architecture, features, and the time since last retraining, auto-documenting models as they’re developed

Make confident, informed decisions about model performance and next steps:

- Understand underlying risk typologies, features, and model behavior with built-in explainability

- Review performance through dashboards, visual metrics, and alert samples

- Compare model versions side by side to identify improvements or degradation

Support governance, audits, and regulatory reviews with ease:

- Automatically generate model documentation, version history, and performance evidence

- Export explainability and governance artifacts as needed

- Share clear, regulator-ready documentation with governance teams, auditors, and examiners

The Hawk Difference Discover how Hawk raises the bar for integrated AI lifecycle management

The Traditional Way

- Heavy reliance on IT and data science resources to create or update even simple models

- Models built on generic assumptions rather than specialized AML and fraud risk typologies

- Slow, manual data preparation and significant technical overhead to generate model pipelines

- "Black box" AI models lacking the transparent explainability required by regulators

- Manual, fragmented documentation and version history that creates a heavy burden during audits and examinations

Limited visibility into performance, making it difficult to know whether retraining is impactful

The Hawk Way

- Self-service, no-code development empowering faster, more efficient model development and retraining

- Financial crime-native templates allowing expert models built around real-world risks

- Automated model pipeline generation using available production data to reduce manual effort

- Built-in explainability providing clear visibility into model behavior and underlying risk features

- Regulator-ready model documentation automatically generated with version history and performance evidence

Easy ongoing model retraining with side-by-side version comparison and alert sampling

Agentic AI: A Practical Guide for Anti-Financial Crime and Compliance Leaders

How is agentic AI changing the way that financial crime and compliance teams work? Our latest whitepaper provides you with 50 pages of insight on the best use cases for agentic AI, covering:

- Improving investigations

- Enhancing system accuracy

- Optimizing workflows

Articles & Resources The latest from Hawk

Learn how Hawk helps clients ensure the effectiveness, accuracy, and compliance of systems in their AML model validation process.

Read about AI-enabled compliance in the new industry report by Hawk and Chartis.

Learn how the EU AI Act could impact banking AML and fraud processes, and how technology can address its requirements.

Request a demo Take full control of your AI lifecycle

Request a demo with one of our product experts and find out if Hawk meets your business needs.

During the personalized demo, you'll learn how Hawk helps your team:

- Accelerate creation and deployment of regulator-ready AI models

- Reduce technical burden and dependence on data science resources

- Support regulatory reviews through explainability, documentation, and version history