How Agentic AI Will Transform Financial Crime & Compliance

76% of compliance and risk leaders expect agentic AI to have a positive impact on financial crime and compliance effectiveness over the next two to three years. And 33% believe it will lead to a major shift in how work is done.

This data comes from our new report with Chartis.

AI in Financial Crime and Compliance: Charting the Path from Pilot to Maturity provides comprehensive data on current and future use of AI in financial crime and compliance programs.

→ Download the Banking Edition here

→ Download the Payment & FinTech Edition here

How Compliance & Risk Leaders Feel About Agentic AI

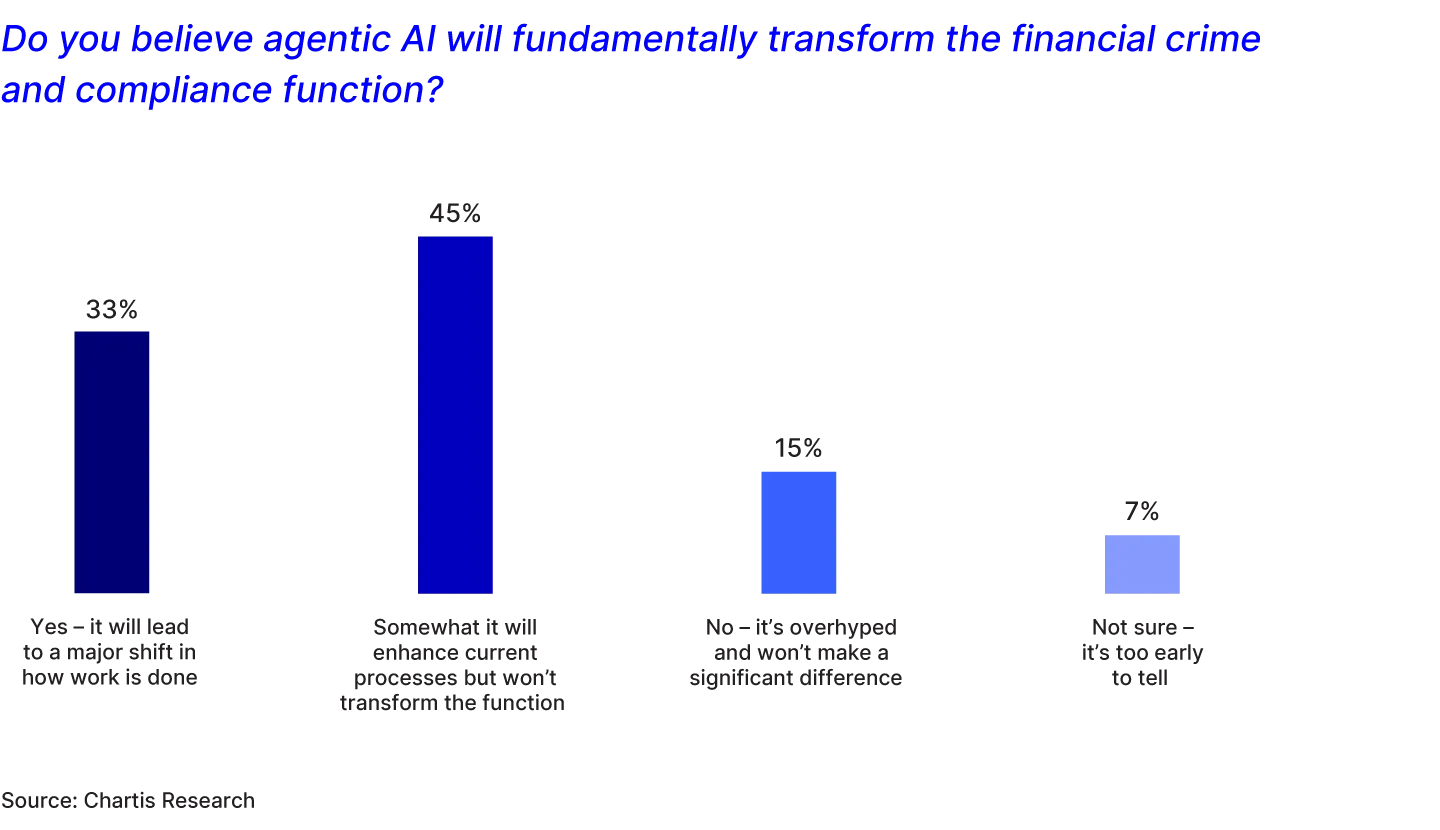

We asked compliance and risk leaders at banks globally about the impact agentic AI will have on their FCC operations. Their responses revealed strong optimism:

- 33% believe it will lead to a major shift in how compliance and risk work is done

- 45% believe it will enhance current compliance processes

- 15% believe it’s overhyped and won’t make a significant difference

- Overall, 78% expect agentic AI to make a positive impact

Investment in Agentic AI Set to Grow

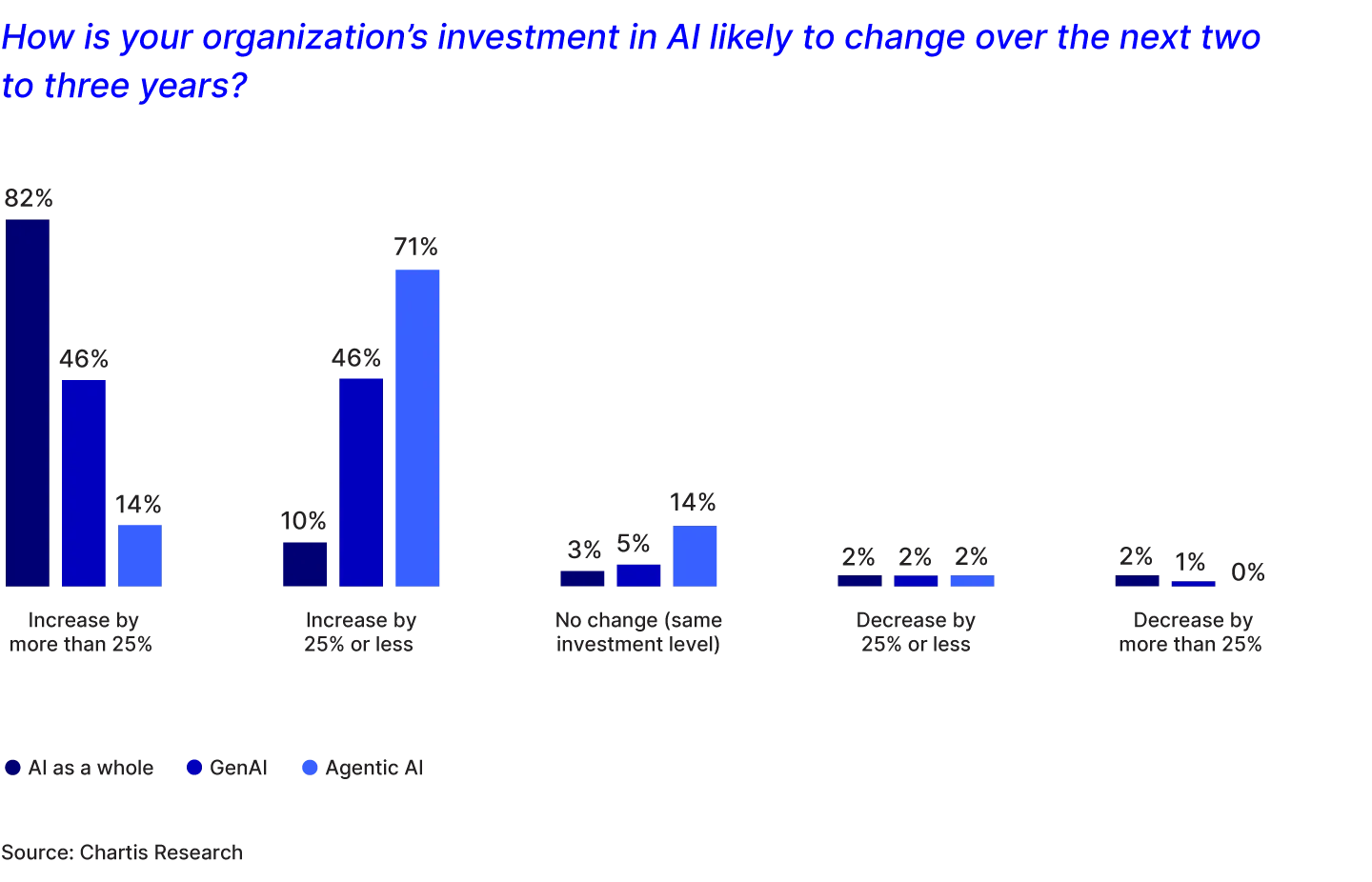

Compliance and risk leaders are backing their optimism with budget commitments. When asked about investment expectations over the next two to three years, the trend is decisively upward:

- 71% expect increases of up to 25% in agentic AI

- 14% predict larger jumps of more than 25%

- Only 2% anticipate any decrease in agentic AI investment

How Agentic AI Is Changing the FCC Workforce

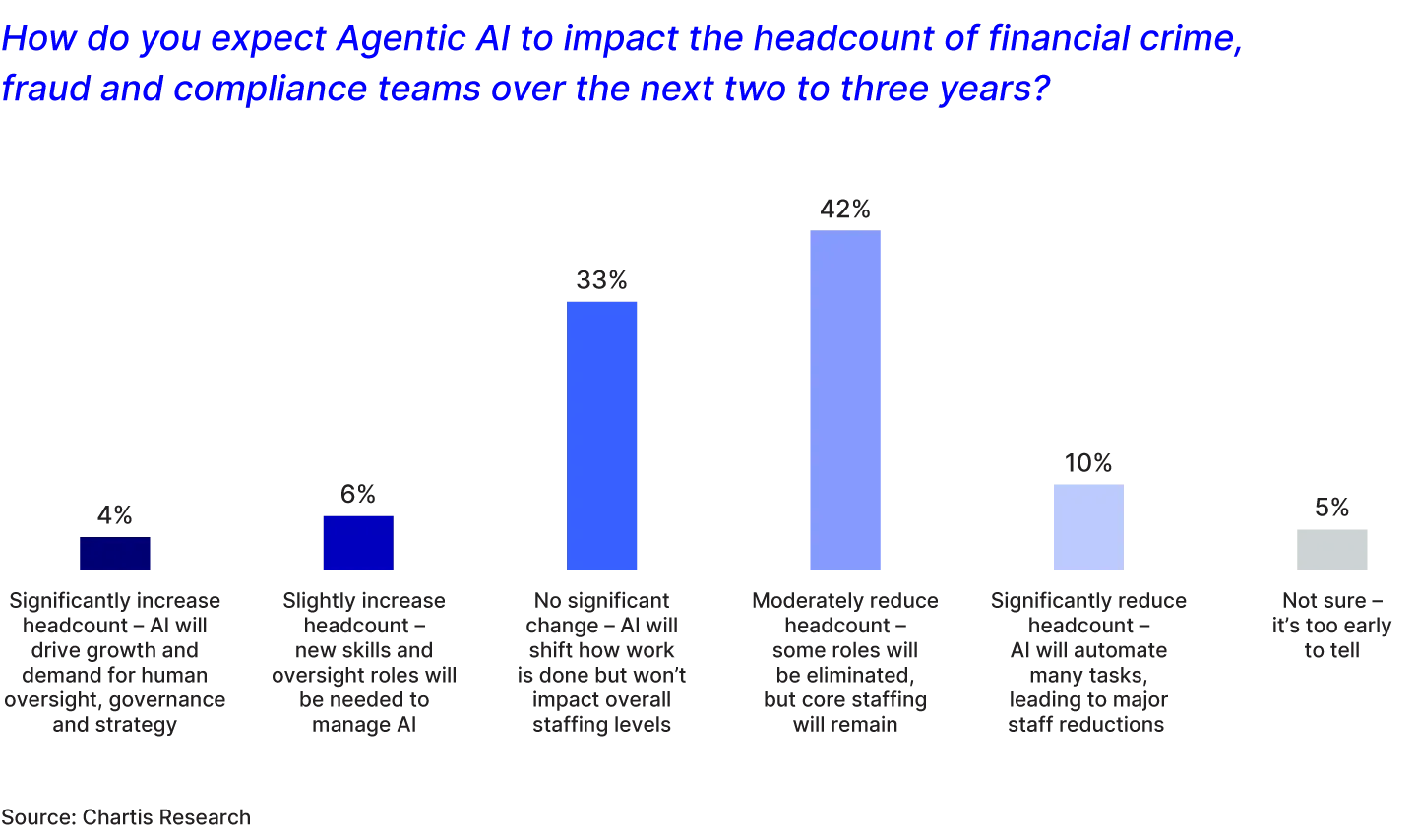

When asked about the expected impact of agentic AI on compliance and fraud teams over the next two to three years, FCC leaders envision a transformation in how teams operate rather than simple headcount reduction:

- 42% say it will moderately reduce headcount – some roles will be eliminated, but core staffing will remain

- 33% say no significant change – AI will shift how work is done but won’t impact overall staffing levels

- 10% say it will significantly reduce headcount – AI will automate many tasks, leading to major staff reductions

- 6% say it will slightly increase headcount – new skills and oversight roles will be needed to manage AI

- 5% say they are not sure – it’s too early to tell

- 4% say it will significantly increase headcount – AI will drive growth and demand for human oversight, governance and strategy

These results reflect the opportunity for compliance teams to move away from repetitive, time-consuming tasks and toward more strategic, analytical work. With the right reskilling and redeployment strategies, financial institutions can strengthen their FCC function while ensuring human expertise is central to decision-making.

Use Cases for Agentic AI In FCC

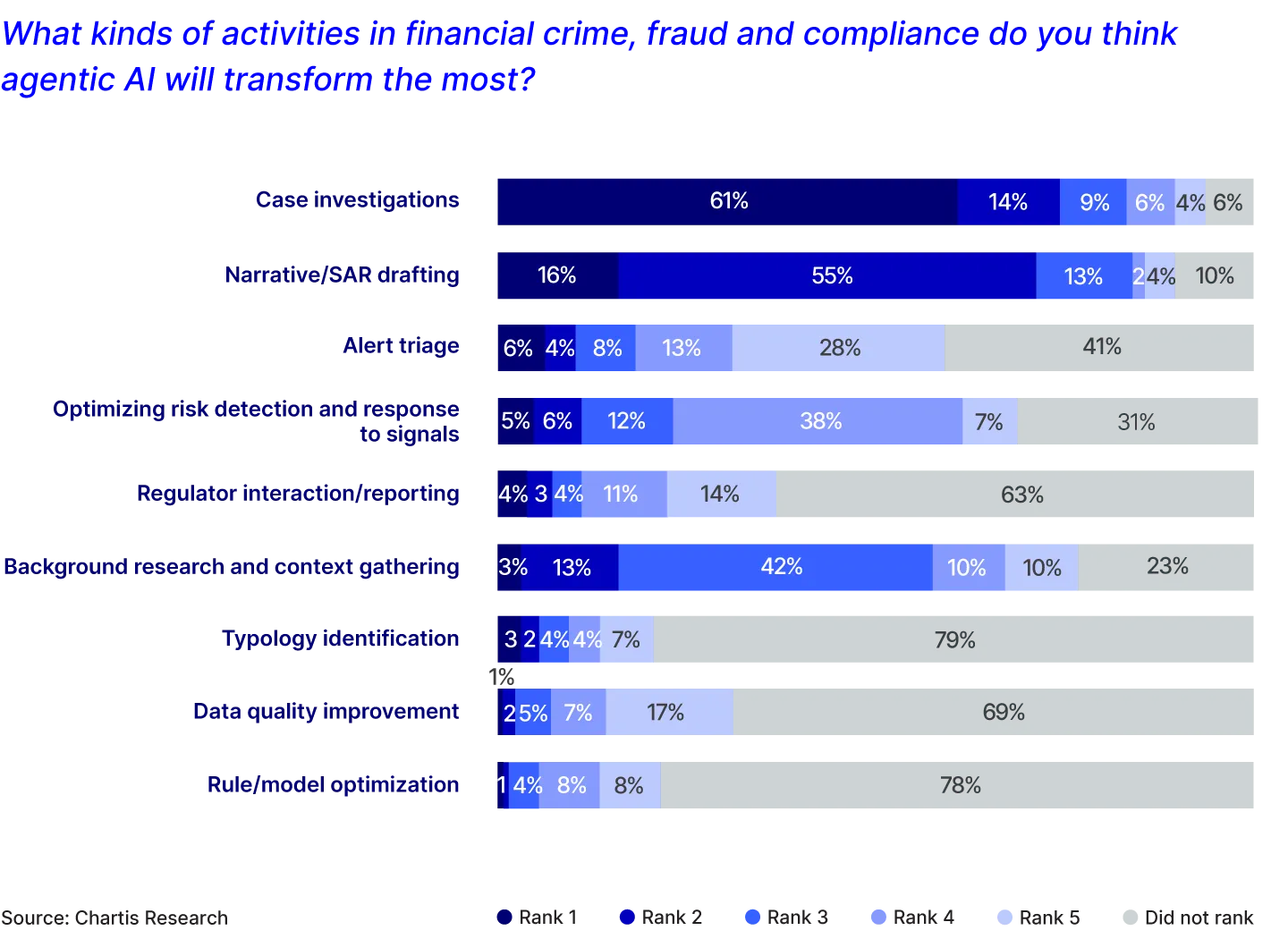

The compliance and risk leaders were also asked about the specific activities where they believe agentic AI will have the greatest impact. Case investigations took the top position:

- 61% ranked case investigations as the first area where agentic AI will drive transformation

- 55% ranked narrative and SAR drafting second

- 42% ranked background research and context gathering third

These responses reveal a strategic focus on applying agentic AI to the most resource-intensive and complex aspects of investigative work. Case investigations, which require synthesizing multiple data sources and applying nuanced judgment, represent both the greatest challenge and the greatest opportunity for AI agents to improve efficiency.

AML Use Cases for Agentic AI

If you’re considering how to integrate agentic AI into your AML program, our latest whitepaper is your essential guide. It covers key applications and strategic considerations, including:

- Technology Segmentation: Agentic vs. GenAI vs. Traditional AI - roles, trade-offs, and when to use each type of AI

- Transforming Investigations: How to use agentic for data collection, case summarization, typology ID and SAR drafting

- Enhancing System Accuracy: Agentic's role in threshold tuning, rule/model recommendations, drift detection, and simulation

- And much more...

Download Our Reports

→ Get our Agentic Whitepaper here

→ Read the Banking Edition here

→ Read the Payment & FinTech Edition here