How Much Are Banks Saving with AI in Financial Crime & Compliance?

Our recent research with Chartis finds that AI is driving meaningful cost reductions in financial crime and compliance, with further gains expected in the next 12 months.

The report, AI in Financial Crime and Compliance: Charting the Path from Pilot to Maturity, provides comprehensive data on current and future use of AI across the FCC function.

→ Download the Banking Edition here

→ Download the Payment & FinTech Edition here

Banks Are Reducing Compliance Costs With AI

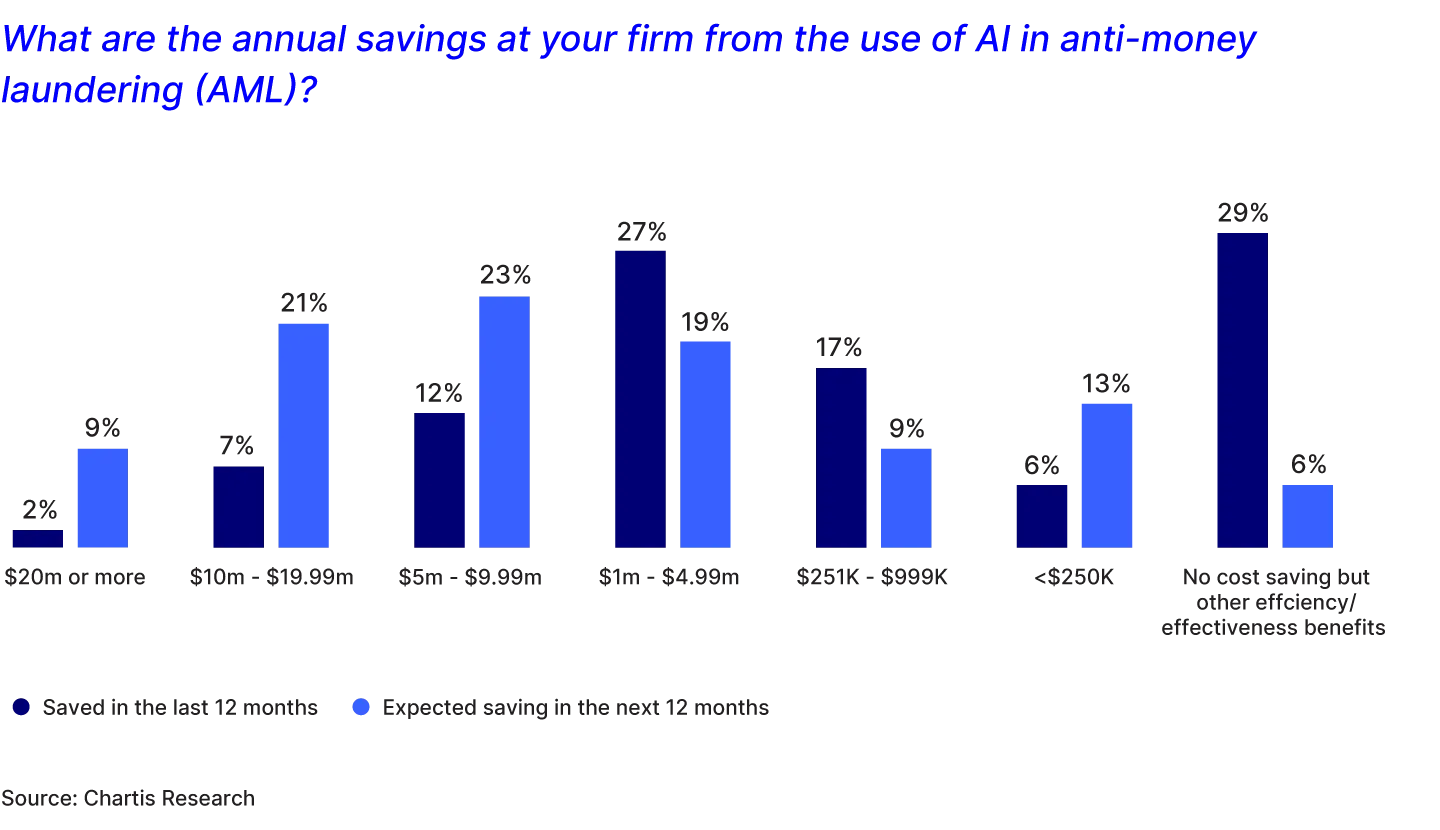

We asked compliance and risk leaders at banks globally how much their institution saved using AI in financial crime and compliance during the past twelve months:

- 27% saved between $1 million and $4.99 million

- 12% saved between $5 million and $9.99 million

- 7% saved between $10 million and $19.99 million

- 2% saved $20 million or more

- 17% saved between $251,000 and $999,000

- 6% saved less than $250,000

- 29% reported no direct cost savings but achieved other efficiency benefits

Banks Expect Major Compliance Savings in 2026 from AI

Looking ahead, compliance and risk leaders anticipate even more substantial cost reductions as their AI implementations mature:

- 21% expect to save between $10 million and $19.99 million

- 23% expect to save between $5 million and $9.99 million

- 9% expect to save $20 million or more

- 19% expect to save between $1 million and $4.99 million

- 9% expect to save between $251,000 and $999,000

- 13% expect to save less than $250,000

- Just 6% expect no cost savings (down from 29% in 2025)

From AI Pilots to Proven ROI

Hawk's AI-powered AML and fraud solutions help banks realize cost savings in compliance and risk detection by dramatically reducing false positive alerts and streamlining investigation workflows. With explainable AI at its core, Hawk delivers both the cost efficiencies and the regulatory transparency that modern compliance programs require.

Learn more about Hawk’s AI solutions here.