Where Banks Are Using AI in Financial Crime & Compliance Today

Banks are embracing AI - that is the number one finding of our latest research with Chartis. 91% of the compliance and risk leaders that we surveyed said that their institution encourages AI use, while 70% said that AI was being tested or piloted in their organization.

The report, AI in Financial Crime and Compliance: Charting the Path from Pilot to Maturity, provides insight into current and future use of AI in banks' FCC function.

→ Download the Banking Edition here

→ Download the Payment & FinTech Edition here

How AI is used across financial crime & compliance

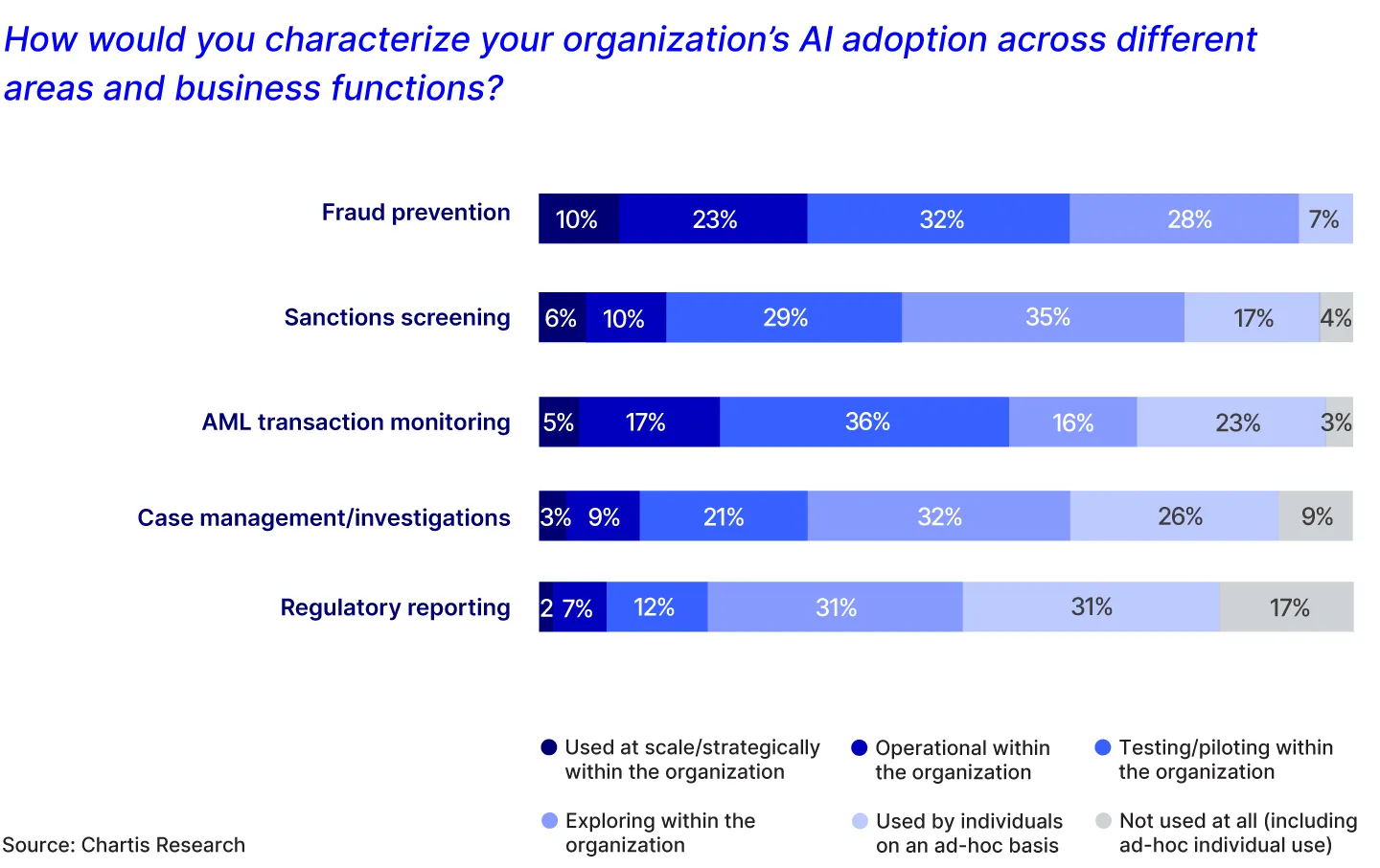

When compliance and risk leaders ranked their current AI usage across five different areas of FCC, fraud prevention emerged as the clear frontrunner:

- 33% are using AI at scale or operationally in fraud prevention

- 32% are testing or piloting AI in fraud prevention

- 28% are exploring AI for fraud prevention

- 0% of banks reported no AI usage in anti-fraud programs

AML transaction monitoring follows as the second most mature area, with 22% reporting operational or at-scale deployment. Sanctions screening stands at 16%, while case management and investigations trail at 12%.

AI maturity varies significantly across FCC, with regulatory reporting lagging furthest behind. Only 9% of banks actively use AI in regulatory reporting, while 17% do not use it at all. This represents the highest rate of non-adoption across all FCC areas.

At the same time, regulatory reporting shows the highest level of informal AI use: 31% of institutions we surveyed said individuals use AI on an ad hoc basis.

Which AI techniques different FCC functions use

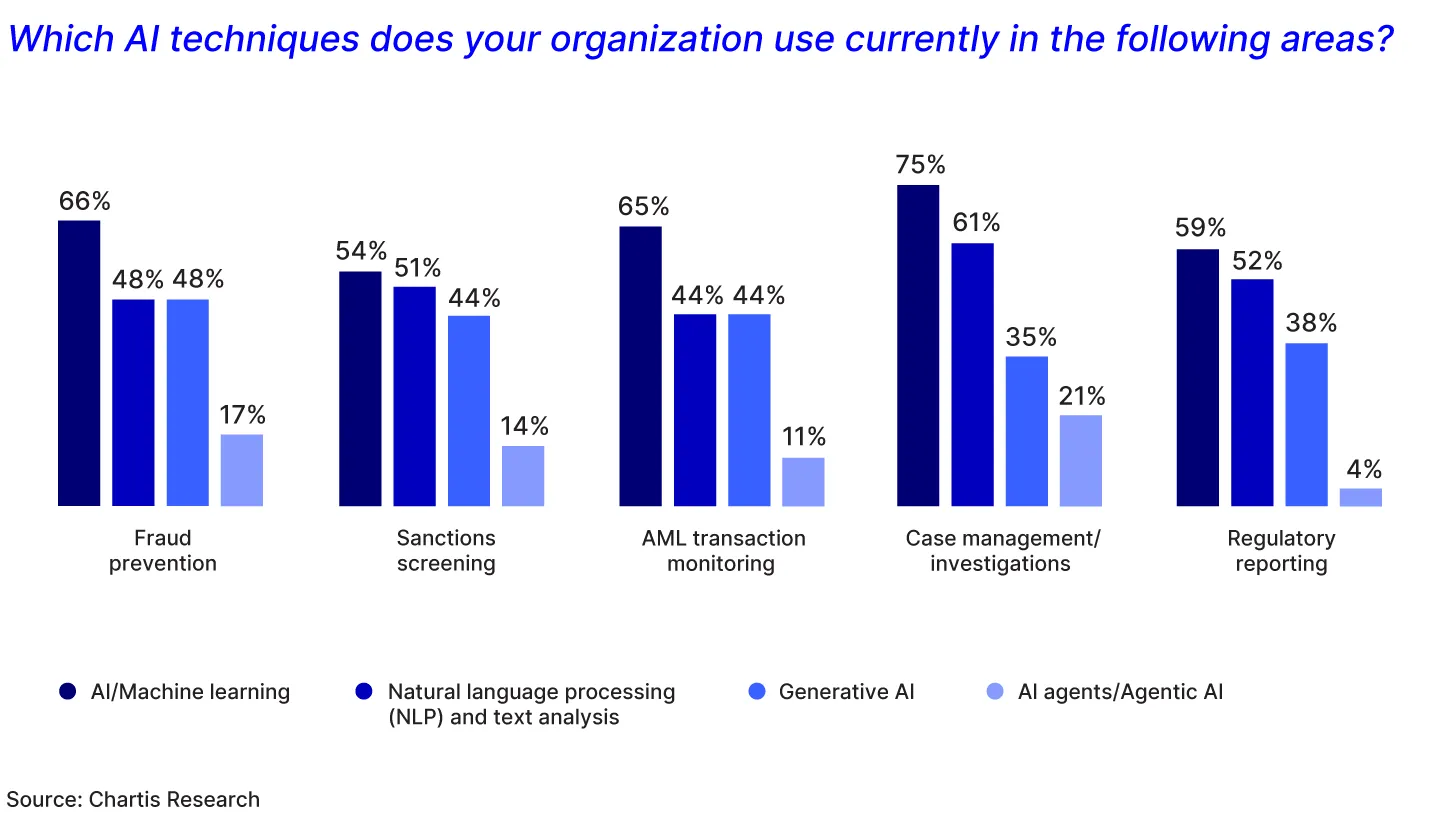

Machine learning (ML) remains the foundation technology across the FCC function:

- 75% use machine learning in case management and investigations

- 66% apply machine learning to fraud prevention

- 65% deploy it for AML transaction monitoring

Natural language processing ranks second, with strong adoption in case management and investigations (61%) and regulatory reporting (52%).

Although generative AI is still emerging, 48% of banks already apply it to fraud prevention, with sanctions screening and AML monitoring close behind at 44% each.

Agentic AI is still in its early stages, but it is already gaining traction in case management and investigations, with 21% of banks reporting active deployment.

Banks expect strong impact from AI technologies

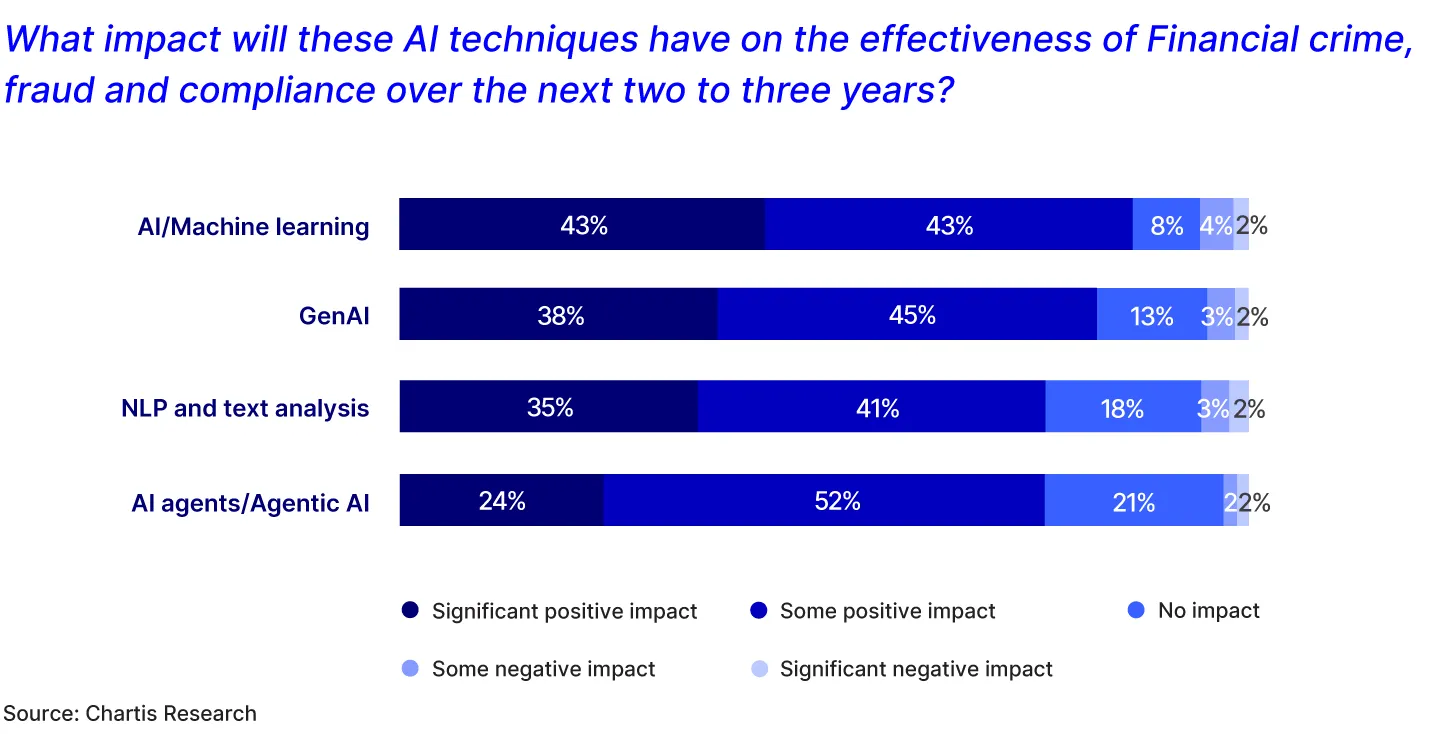

Compliance and risk leaders are optimistic about the future of AI in FCC.

86% expect machine learning to have a positive impact on financial crime, fraud and compliance over the next 2-3 years. Expectations for generative AI are similarly high, with 83% predicting positive outcomes.

Agentic AI, the technology at the earliest point in its adoption curve, is also expected to deliver a positive impact with 76% of respondents expressing optimism for the value it will bring.

→ Read the full Banking Edition here

→ Read the full Payment & FinTech Edition here