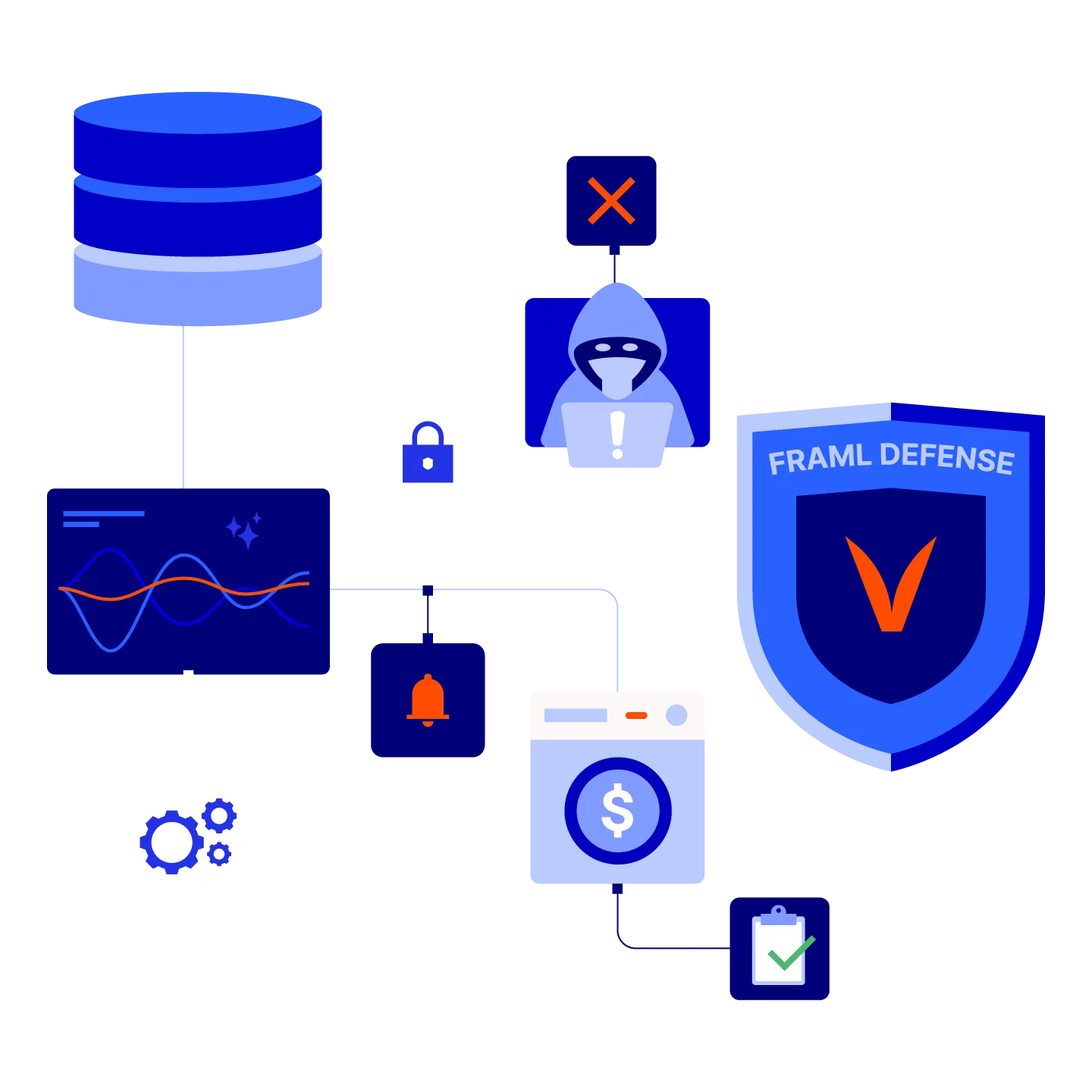

FRAML Combat financial crime with a streamlined FRAML platform

Financial crime & compliance made simple with Hawk

Less complexity, more efficiency, full protection

Detect and block suspicious transactions in true real-time (200 ms)

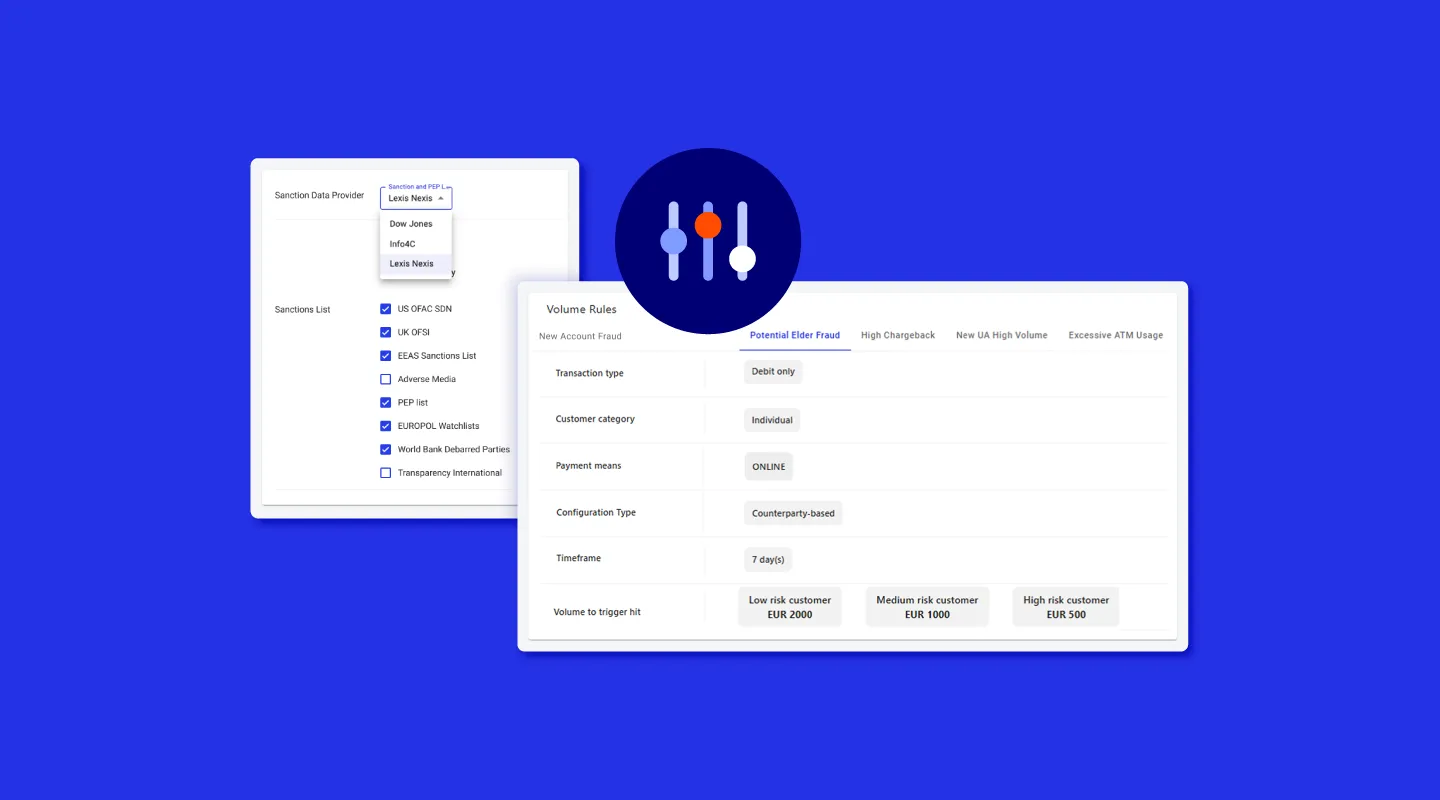

Optimize rule coverage with self-serve rule configuration and sandbox testing

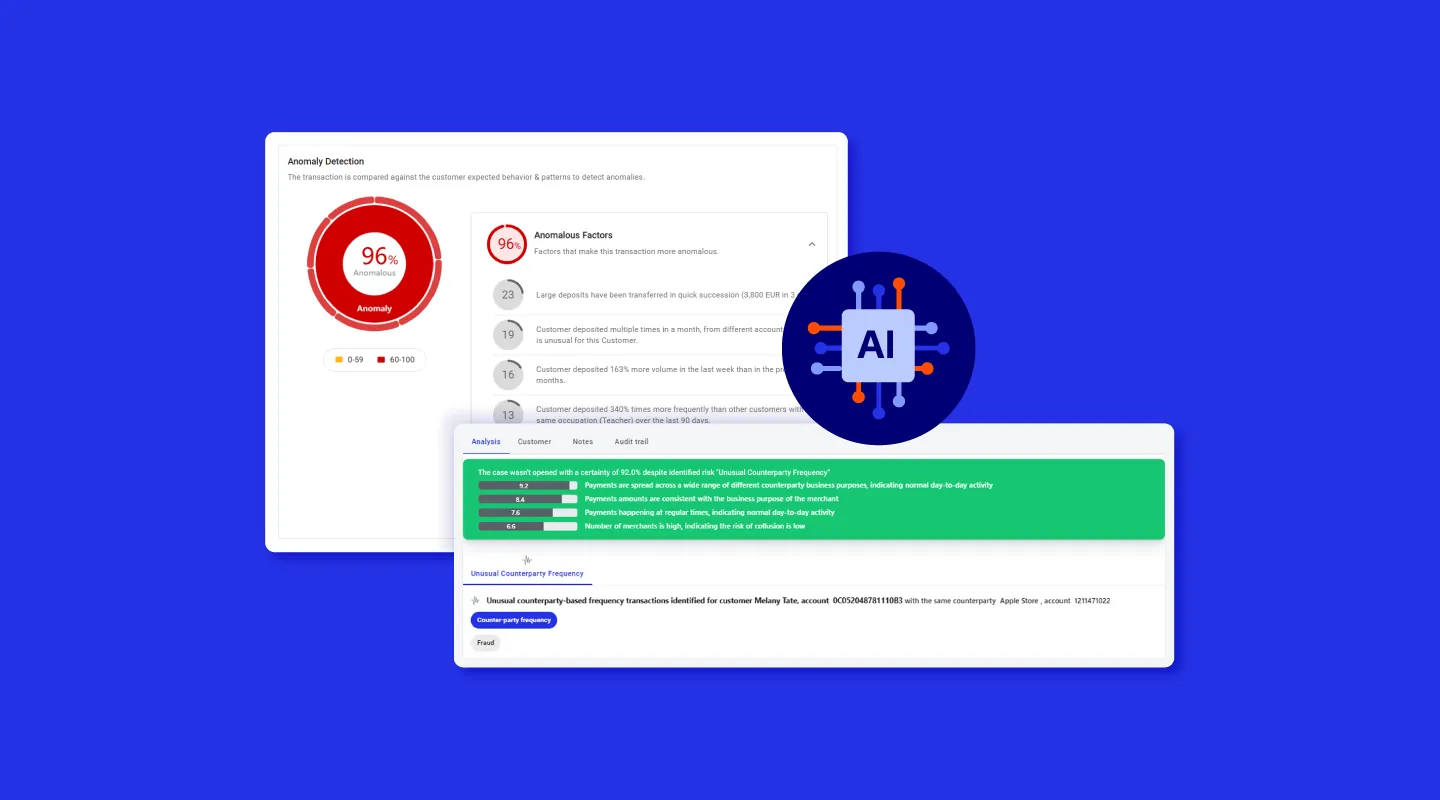

Sharpen threat detection and slash false positives with well-governed AI

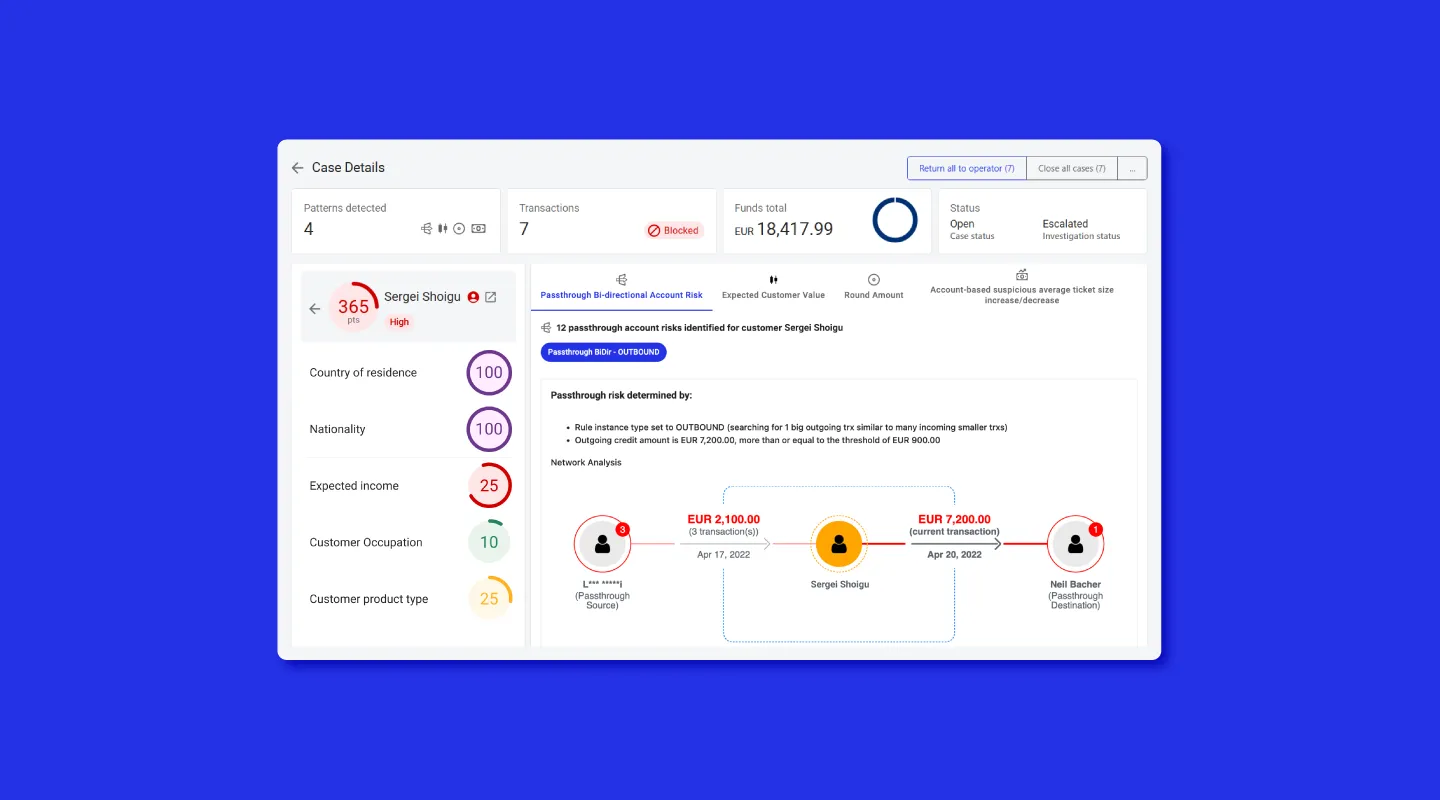

Streamline investigations with unified insights and clear AI explanations

Address risks at speed

Misleading vendor “real-time” claims and reliance on external support for list and rule management delay your regulatory response and let fraudulent transactions through.

With Hawk, you can stop fraud fast and stay compliant, pinpointing suspicious transactions in true real-time (200ms). Hawk give you control, allowing you to optimize rule coverage with self-serve rule configuration and sandbox testing.

Strengthen defenses without adding complexity

High alert volumes with poor risk prioritization and fragmented insights overwhelm analysts and slow investigations.

Sharpen threat detection and slash false positives with AI models, built by Hawk experts for you; Model explanations are so easy to understand that it improves investigator clarity.

Streamline operations

Say goodbye to outdated, cumbersome platforms that hinder team productivity with excessive clicks and confusing navigation.

Hawk unifies insights and eliminates duplication, so you can move faster and focus on the real risks. Reduce maintenance and accelerate investigations with a single, consolidated system.

In numbers: the Hawk impact

3 - 5 X

Increase in risk detection using AI

70%

Average false positive reduction

One Solution for All Your Financial Crime Needs

✔️ Direct integration with core banking platforms CSI, FIS, Fiserv, and Jack Henry

✔️ Dynamic customer profiling and risk rating for better prioritization and decision-making

✔️ Real-time screening of customers and transactions for high-risk individuals, including Politically Exposed Persons and those subject to sanctions

✔️ AI-driven AML monitoring with precision rules to detect suspicious activities.

✔️ Detection and protection across the customer lifecycle, from account takeover to transaction fraud.

✔️ Unified investigations that eliminate data silos and inefficient case handling

✔️ Direct FinCEN SAR & CTR e-filing

Discover the FRAML Results Your Peers Are Achieving

$1M | $5M | >53% |

| In expected savings within 5 years according to 77% of respondents | Savings of 50% of surveyed institutions who've already converged | Of organizations increased operational efficiencies and lowered total cost of ownership |

Unify Your Financial Crime Management

For effortless control over AML, fraud, and compliance risks.