Resource Center Industry insights, news, and announcements

Articles sorted by actuality

Learn how Hawk helps clients ensure the effectiveness, accuracy, and compliance of systems in their AML model validation process.

Built-for-purpose AI technology helps banks identify suspicious activity in real-time, at scale via Anomaly Detection, Pattern Detection, False Positive Reduction, and pKYC use cases.

Instant payments can create headaches for fraud teams, as faster payments enable faster fraud. The good news is that AI can help.

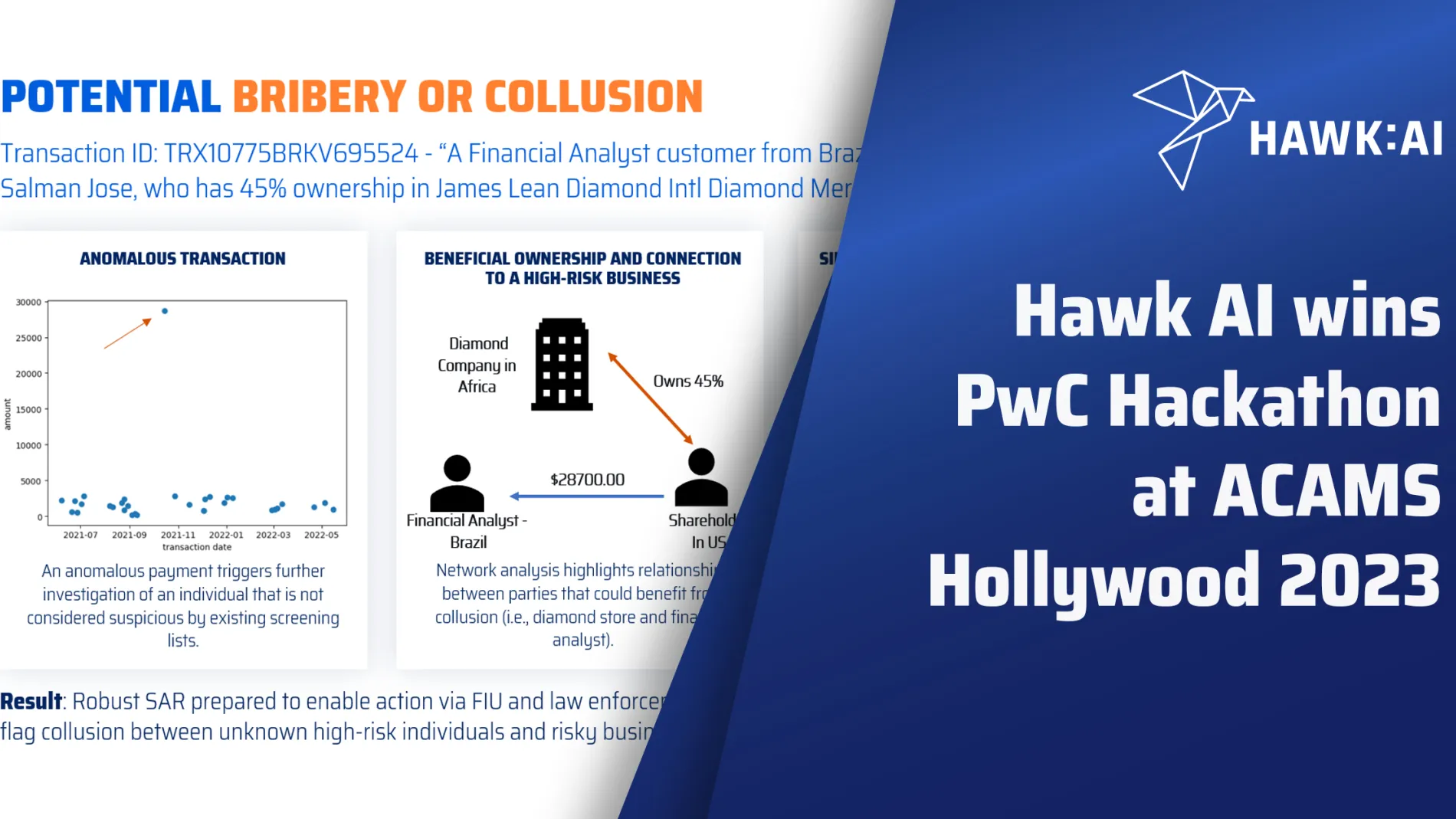

In May 2023, Hawk AI participated in the PwC Hackathon at ACAMS Hollywood.

The competition aimed to identify maximum suspicious transactions and/or new trends in the provided data and artfully present our findings. Based on our company vision of streamlining the process for frontline operators and enabling them to efficiently generate high-quality true positive Suspicious Activity Reports (SARs), our data science and product teams set on working through the supplied data sets to detect financial crime.

Building the AML compliance function of a financial services business right the first time will save time, money, and stress in the long run. Not only that, but proactive AML compliance can promote innovation and help bring new products to market more quickly. Viewing AML compliance as a business driver helps to set a foundation of sustainable growth and innovation.

Financial criminals are becoming increasingly sophisticated, and so are the tools needed to catch them. Trust and transparency are key to successful deployment. AI models that emphasize explainability and auditability act as virtual teammates that work in partnership with their human operators.

Banken generieren jeden Tag eine große Menge an Finanzdaten. Im Kampf gegen Finanzkriminalität können diese Informationen aktuell aufgrund von Datenschutzbedenken und fehlender Infrastruktur nicht institutionsübergreifend genutzt werden. Mit dem safeFBDC (safe Financial Big Data Cluster) soll sich das ändern.

Every day, banks and financial services generate an enormous amount of data – transactions, and customer information, to name a few dimensions. With the volume consistently growing, the connections between different data points become increasingly fuzzy. This makes it harder to get valuable insights out of financial (and other) data and turn those insights into actions.

Money laundering is abnormal behavior, which should make it easy to spot. However, money launderers change their methods to avoid prosecution, which makes it difficult to detect financial crime. Emerging AI technology provides anti-money laundering teams with the anomaly detection power they need to catch and fight financial crime.

In regular HAWKademy sessions, we learn from one another interactively and collaboratively. The latest session focussed on what Test-Driven Development (TDD) means in actual practice.

World-class organizations are built by world-class teams, which is why HAWK AI focuses on attracting top talent from across the globe. But how do you make talent even better? Of course, by sharing with, and learning from, the other talented team members!

Wie steht es um die Geldwäschebekämpfung in Deutschland? Unser CEO, Tobias Schweiger, liefert spannende Einblicke – und zeigt, warum neue Technologien der Schlüssel zum Erfolg sind.